Dell 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

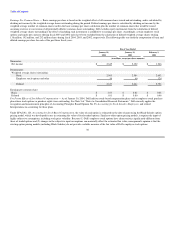

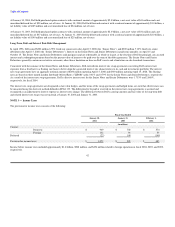

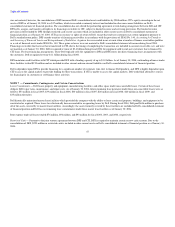

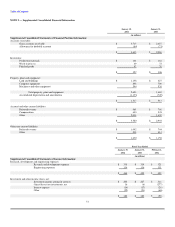

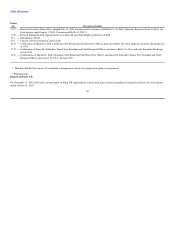

Aggregate Deferred Revenue and Warranty Liability — Revenue from extended warranty and service contracts, for which Dell is obligated to perform, is

recorded as deferred revenue and subsequently recognized over the term of the contract or when the service is completed. Dell records warranty liabilities at

the time of sale for the estimated costs that may be incurred under its basic limited warranty. Changes in Dell's aggregate deferred revenue and warranty

liability (basic and extended warranties) are presented in the following table:

Fiscal Year Ended

January 30, January 31,

2004 2003

(in millions)

Aggregate deferred revenue and warranty liability at beginning of period $ 2,042 $ 1,447

Revenue deferred and costs accrued for new warranties 2,547 2,137

Service obligations honored (983) (868)

Amortization of deferred revenue (912) (674)

Aggregate deferred revenue and warranty liability at end of period $ 2,694 $ 2,042

Current portion $ 1,333 $ 1,034

Non-current portion 1,361 1,008

Aggregate deferred revenue and warranty liability at end of period $ 2,694 $ 2,042

Legal Matters — Dell is subject to various legal proceedings and claims arising in the ordinary course of business. Dell's management does not expect that the

outcome in any of these legal proceedings, individually or collectively, will have a material adverse effect on Dell's financial condition, results of operations

or cash flows.

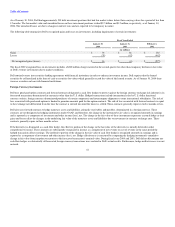

Certain Concentrations — All of Dell's foreign currency exchange and interest rate derivative instruments involve elements of market and credit risk in

excess of the amounts recognized in the consolidated financial statements. The counterparties to the financial instruments consist of a number of major

financial institutions. In addition to limiting the amount of agreements and contracts it enters into with any one party, Dell monitors its positions with and the

credit quality of the counterparties to these financial instruments. Dell does not anticipate nonperformance by any of the counterparties.

Dell's investments in debt securities are placed with high quality financial institutions and companies. Dell's investments in debt securities primarily have

maturities of less than five years. Management believes that no significant concentration of credit risk for investments exists for Dell.

Dell markets and sells its products and services to large corporate clients, governments, healthcare and education accounts, as well as small-to-medium

businesses and individuals. Dell's receivables from such parties are well diversified.

Dell purchases a number of components from single sources. In some cases, alternative sources of supply are not available. In other cases, Dell may establish

a working relationship with a single source if Dell believes it is advantageous due to performance, quality, support, delivery, capacity or price considerations.

If the supply of a critical single-source material or component were delayed or curtailed, Dell's ability to ship the related product in desired quantities and in a

timely manner could be adversely affected. Even where alternative sources of supply are available, qualification of the alternative suppliers and establishment

of reliable supplies could result in delays and a possible loss of sales, which may have an adverse effect on Dell's operating results.

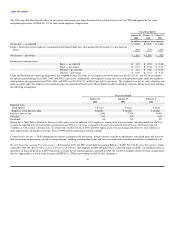

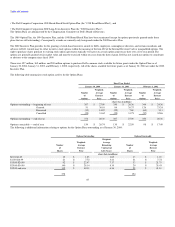

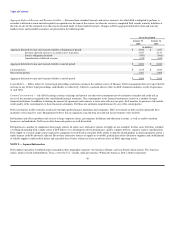

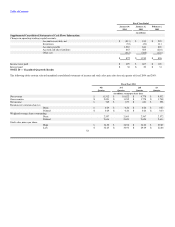

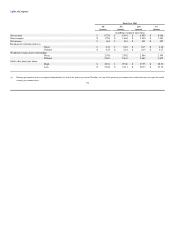

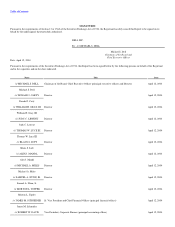

NOTE 8 — Segment Information

Dell conducts operations worldwide and is managed in three geographic segments: the Americas, Europe, and Asia Pacific-Japan regions. The Americas

region, which is based in Round Rock, Texas, covers the U.S., Canada, and Latin America. Within the Americas, Dell is further segmented

48