Dell 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

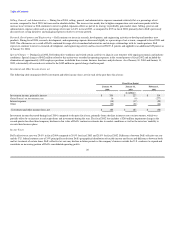

During calendar 2003, overall technology spending stabilized and corporate spending started to show signs of a recovery with the market producing positive

year-over-year unit growth for the past six consecutive quarters. This growth was partially fueled by an intensified competitive pricing environment during the

year and a shift in product mix towards lower-priced products and services. In addition, component costs continued to decline during fiscal 2004, but at a

more moderate pace than fiscal 2003. These factors contributed to a 7% year-over-year decline in average revenue per-unit sold for Dell during fiscal 2004.

Dell's general practice is to aggressively pass on declines in costs to its customers in order to enhance customer value while increasing market share.

Management expects that the competitive pricing environment will continue to be challenging and Dell will continue to adjust its pricing as necessary in

response to future competitive and economic conditions.

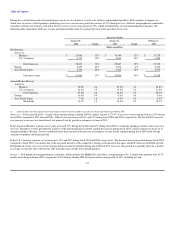

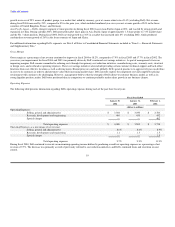

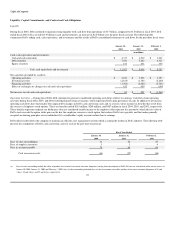

Results of Operations

Net Revenue

During fiscal 2004, Dell's strategy and execution translated to the No. 1 worldwide market share position for the calendar year. Dell produced net revenue of

$41.4 billion in fiscal 2004, compared to $35.4 billion in fiscal 2003, and $31.2 billion in fiscal 2002. The year-over-year increase in net revenue during fiscal

2004 and 2003 was driven by strong unit growth across all regions and product lines. Dell's fiscal 2004 growth continued to exceed market growth as

consolidated net unit shipments increased 26% year-over-year while industry growth for the calendar year was only 9% (excluding Dell). During fiscal 2003,

Dell produced net unit growth of 21%, while the industry declined 1% for the calendar year (excluding Dell). Dell's strong unit growth during fiscal 2004 was

partially offset by lower average selling prices, which can be primarily attributed to the increased competitive pricing environment and moderate declines in

component costs.

Dell continues to focus on extending its enterprise computing capabilities with an increase in product mix of enterprise systems to 22% of net revenue in fiscal

2004 from 20% in fiscal 2003. Net revenue for enterprise systems increased 31% year-over-year during fiscal 2004, led by servers and storage. Dell gained

1.8 share points in shipments of x86 servers (based on standard Intel architecture) and maintained its No. 2 share position at 23.4%, compared to 21.6% in

calendar 2002. Dell's revenue growth in storage of 58% during fiscal 2004 was supported by Dell's partnership with EMC Corporation and the Dell/ EMC

storage area networking products as well as Dell's PowerVault line of direct and network attached storage and tape.

During fiscal 2004, Dell's desktop products produced year-over-year net unit growth of 23%, as Dell maintained its No. 1 share position worldwide. In

addition, Dell held the No. 2 worldwide market share position in notebooks with net unit growth of 35%, compared to 20% in fiscal 2003, as customer trends

continue to shift more toward mobile computing. This unit growth was partially offset by a 13% year-over-year decline in average revenue per-unit sold,

resulting in net revenue growth of 18% in notebook products for the year in this highly competitive space.

17