Dell 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

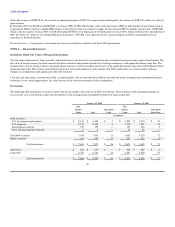

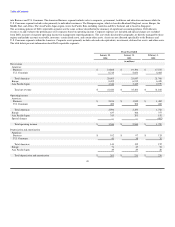

Employee Stock Purchase Plan — Dell has an employee stock purchase plan that qualifies under Section 423 of the Internal Revenue Code and permits

substantially all employees to purchase shares of Dell's common stock. Participating employees may purchase common stock through payroll deductions at

the end of each participation period at a purchase price equal to 85% of the lower of the fair market value of the common stock at the beginning or the end of

the participation period. Common stock reserved for future employee purchases under the plan aggregated 25 million shares at January 30, 2004, 29 million

shares at January 31, 2003, and 33 million shares at February 1, 2002. Common stock issued under this plan totaled 4 million shares in fiscal 2004, 4 million

shares in fiscal 2003, and 6 million shares in fiscal 2002.

Restricted Stock Grants — During fiscal 2004, 2003, and 2002, Dell granted 0.6 million shares, 0.3 million shares, and 2.1 million shares, respectively, of

restricted stock. The weighted average fair value of restricted stock granted in fiscal 2004, 2003, and 2002 was $27.92, $25.43, and $24.15, respectively. For

substantially all restricted stock grants, at the date of grant, the recipient has all rights of a stockholder, subject to certain restrictions on transferability and a

risk of forfeiture. Restricted shares typically vest over a seven-year period beginning on the date of grant. Dell records unearned compensation in

stockholders' equity equal to the market value of the restricted shares on the date of grant and charges the unearned compensation to expense over the vesting

period.

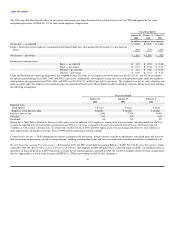

401(k) Plan — Dell has a defined contribution retirement plan that complies with Section 401(k) of the Internal Revenue Code. Substantially all employees in

the U.S. are eligible to participate in the plan. Dell matches 100% of each participant's voluntary contributions, subject to a maximum contribution of 3% of

the participant's compensation. Dell's contributions during fiscal 2004, 2003, and 2002 were $42 million, $38 million, and $40 million, respectively. Dell's

contributions are invested proportionate to each participant's voluntary contributions in the investment options provided under the plan. Investment options

include Dell stock, but neither participant nor Dell contributions are required to be invested in Dell stock.

NOTE 6 — Dell Financial Services

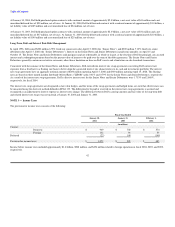

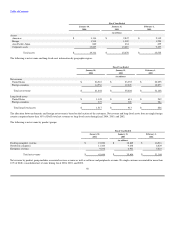

Dell is currently a partner in DFS, a joint venture with CIT. The joint venture allows Dell to provide its customers with various financing alternatives while

CIT provides the financing for the transaction between DFS and the customer. In general, DFS facilitates customer financing transactions through either loan

or lease financing. For customers who desire loan financing, Dell sells equipment directly to customers who, in turn, enter into loans with CIT to finance their

purchases. For customers who desire lease financing, Dell usually sells the equipment to DFS, and DFS enters into direct financing lease arrangements with

the customers.

Dell currently owns a 70% equity interest in DFS. In accordance with the partnership agreement between Dell and CIT, losses generated by DFS are fully

allocated to CIT. Net income generated by DFS is allocated 70% to Dell and 30% to CIT, after CIT has recovered any cumulative losses. If DFS is terminated

with a cumulative deficit, Dell is not obligated to fund any losses, including any potential losses on receivables transferred to CIT. Although Dell has a 70%

equity interest in DFS, prior to the third quarter of fiscal 2004 the investment was accounted for under the equity method because the company historically

could not, and currently does not, exercise control over DFS.

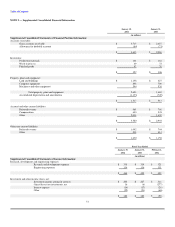

In January 2003, the FASB issued FIN 46, Consolidation of Variable Interest Entities. FIN 46 provides that if an entity is the primary beneficiary of a VIE,

the assets, liabilities, and results of operations of the VIE should be consolidated in the entity's financial statements. Based on the guidance in FIN 46, Dell

concluded that DFS is a VIE and Dell is the primary beneficiary of DFS's expected cash flows. Accordingly, Dell began consolidating DFS's financial results

at the beginning of the third quarter of fiscal 2004. The consolidation of DFS had no impact on Dell's net income or earnings per share during fiscal 2004

because Dell has historically been recording its 70% equity interest in DFS under the equity method. The impact to any individual line item on Dell's

consolidated statement of income

46