Dell 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

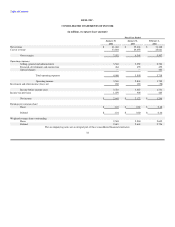

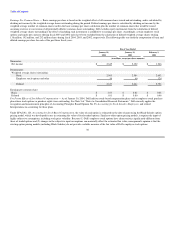

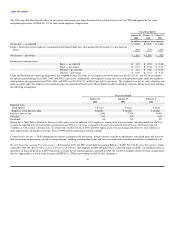

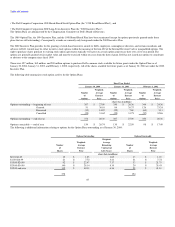

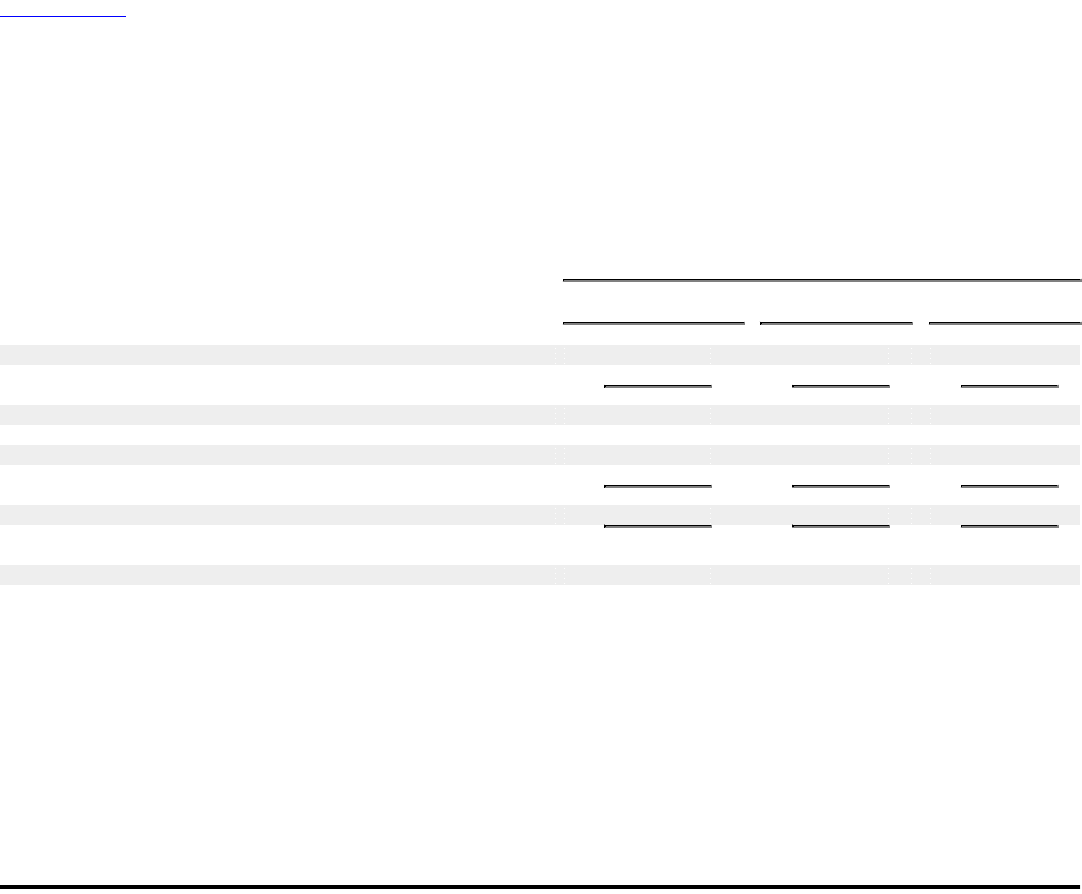

Earnings Per Common Share — Basic earnings per share is based on the weighted effect of all common shares issued and outstanding, and is calculated by

dividing net income by the weighted average shares outstanding during the period. Diluted earnings per share is calculated by dividing net income by the

weighted average number of common shares used in the basic earnings per share calculation plus the number of common shares that would be issued

assuming exercise or conversion of all potentially dilutive common shares outstanding. Dell excludes equity instruments from the calculation of diluted

weighted average shares outstanding if the effect of including such instruments is antidilutive to earnings per share. Accordingly, certain employee stock

options and equity put contracts (during fiscal 2003 and 2002 only) have been excluded from the calculation of diluted weighted average shares totaling

138 million, 192 million, and 232 million shares during fiscal 2004, 2003, and 2002, respectively. The following table sets forth the computation of basic and

diluted earnings per share for each of the past three fiscal years:

Fiscal Year Ended

January 30, January 31, February 1,

2004 2003 2002

(in millions, except per share amounts)

Numerator:

Net income $ 2,645 $ 2,122 $ 1,246

Denominator:

Weighted average shares outstanding:

Basic 2,565 2,584 2,602

Employee stock options and other 54 60 124

Diluted 2,619 2,644 2,726

Earnings per common share:

Basic $ 1.03 $ 0.82 $ 0.48

Diluted $ 1.01 $ 0.80 $ 0.46

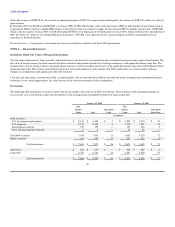

Pro Forma Effects of Stock-Based Compensation — As of January 30, 2004, Dell had four stock-based compensation plans and an employee stock purchase

plan where stock options or purchase rights were outstanding. See Note 5 of "Notes to Consolidated Financial Statements." Dell currently applies the

recognition and measurement principles of Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees, and related

Interpretations in accounting for those plans.

Under SFAS No. 123, Accounting for Stock-Based Compensation, the value of each option is estimated on the date of grant using the Black-Scholes option

pricing model, which was developed for use in estimating the value of freely traded options. Similar to other option pricing models, it requires the input of

highly subjective assumptions, including stock price volatility. Because (1) Dell's employee stock options have characteristics significantly different from

those of traded options and (2) changes in the subjective input assumptions can materially affect the estimated fair value, management's opinion is that the

existing option pricing models (including Black-Scholes) do not provide a reliable measure of the fair value of Dell's employee stock options.

38