Dell 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

was not material; however, the consolidation of DFS increased Dell's consolidated assets and liabilities by $588 million. CIT's equity ownership in the net

assets of DFS as of January 30, 2004 was $17 million, which is recorded as minority interest and included in other non-current liabilities on Dell's

consolidated statement of financial position. The consolidation has not altered the partnership agreement or risk sharing arrangement between Dell and CIT.

DFS sells, assigns, and transfers all rights to its financing receivables to CIT, subject to limited recourse and servicing provisions. The limited recourse

provision is fully funded by DFS through restricted cash escrow accounts which are included in other current assets on Dell's consolidated statement of

financial position as of January 30, 2004. CIT has no recourse or rights of return to Dell, except that end-user customers may return equipment pursuant to

Dell's standard return policy. DFS records transfers of financing receivables in accordance with the provisions of SFAS No. 140, Accounting for Transfers

and Servicing of Financial Assets and Extinguishment of Liabilities. A gain or loss is recorded in net revenue when a transfer of finance receivables qualifies

as a sale of financial assets under SFAS No. 140. These gains or losses were not material to Dell's consolidated statement of income during fiscal 2004.

Financing receivables that have not been transferred to CIT, due to the timing of completing the transaction, are included in accounts receivable, net, and were

not material as of January 30, 2004. Dell recognized revenue of $3.4 billion during fiscal 2004 for equipment sold to end-user customers that is financed by

CIT loans. For lease financing arrangements, where Dell typically sells the equipment to DFS and DFS enters into direct financing lease arrangements with

the customers, Dell recognized revenue $1.1 billion during fiscal 2004.

DFS maintains credit facilities with CIT which provide DFS with a funding capacity of up to $1.0 billion. As of January 30, 2004, outstanding advances under

these facilities totaled $159 million and are included in other current and non-current liabilities on Dell's consolidated statement of financial position.

Dell is dependent upon DFS to provide financing for a significant number of customers who elect to finance Dell products, and DFS is highly dependent upon

CIT to access the capital markets to provide funding for these transactions. If CIT is unable to access the capital markets, Dell would find alternative sources

for financing for its customers or self-finance these activities.

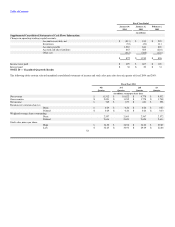

NOTE 7 — Commitments, Contingencies, and Certain Concentrations

Lease Commitments — Dell leases property and equipment, manufacturing facilities, and office space under non-cancelable leases. Certain of these leases

obligate Dell to pay taxes, maintenance, and repair costs. As of January 30, 2004, future minimum lease payments under these non-cancelable leases were as

follows: $53 million in fiscal 2005; $39 million in fiscal 2006; $30 million in fiscal 2007; $20 million in fiscal 2008; $20 million in fiscal 2009; and

$35 million thereafter.

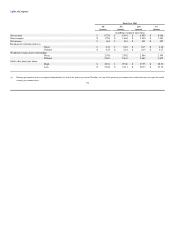

Dell historically maintained master lease facilities which provided the company with the ability to lease certain real property, buildings, and equipment to be

constructed or acquired. These leases have historically been accounted for as operating leases by Dell. During fiscal 2004, Dell paid $636 million to purchase

all of the assets covered by its master lease facilities. Accordingly, the assets formerly covered by these facilities are included in Dell's consolidated statement

of financial position and Dell has no remaining lease commitments under these master lease facilities as of January 30, 2004.

Rent expense under all leases totaled $76 million, $96 million, and $93 million for fiscal 2004, 2003, and 2002, respectively.

Restricted Cash — Pursuant to the joint venture agreement between DFS and CIT, DFS is required to maintain certain escrow cash accounts. Due to the

consolidation of DFS, $253 million in restricted cash is included in other current assets on Dell's consolidated statement of financial position as of January 30,

2004.

47