Dell 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

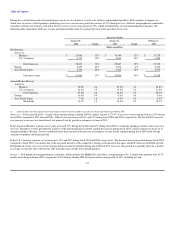

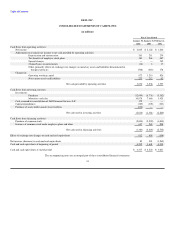

The year-over-year increase in days of sales outstanding during fiscal 2004 was primarily due to stronger revenues during January 2004, than compared to the

prior year. Dell defers the cost of revenue associated with in-transit customer shipments until they are delivered and revenue is recognized. These deferred

costs are included in Dell's reported days of sales outstanding because management believes it illustrates a more conservative and accurate presentation of

Dell's days of sales outstanding and cash conversion cycle. These deferred costs are recorded in other current assets in Dell's consolidated statement of

financial position and totaled $387 million, $423 million, and $367 million as of January 30, 2004, January 31, 2003, and February 1, 2002, respectively.

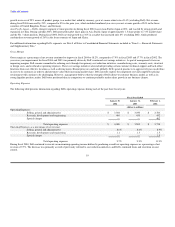

Investing Activities — Cash used in investing activities during fiscal 2004 was $2.8 billion, as compared to $1.4 billion in fiscal 2003 and $2.3 billion in fiscal

2002. Cash used in investing activities principally consists of net purchases of investments and capital expenditures for property, plant, and equipment. The

increase in fiscal 2004, when compared to fiscal 2003, was primarily due to the increase in purchases of investments, net of maturities and sales, as Dell

continues to invest its cash provided by operating activities. In addition, during fiscal 2004 Dell purchased $636 million in assets that were held in master

lease facilities and previously classified as operating leases. The decrease in cash used in investing activities from fiscal 2002 to 2003 was primarily due to an

increase of maturities and sales on investments during fiscal 2003 and timing of reinvesting cash provided by operations.

Financing Activities — Cash used in financing activities during fiscal 2004 was $1.4 billion, as compared to $2.0 billion in fiscal 2003 and $2.7 billion in

fiscal 2002. Financing activities primarily consist of the repurchase of Dell common stock, partially offset by the issuance of common stock under employee

stock option plans. The decrease in cash used during fiscal 2004, compared to fiscal 2003, was primarily due to an increase in the number of shares issued

under employee plans and an increase in the weighted average exercise price of stock options exercised. In addition, the aggregate value of common stock

repurchased by Dell declined during fiscal 2004, which was primarily due to a respective decrease in the weighted average share price of common stock

repurchased by Dell. The decrease in cash used during fiscal 2003, compared to fiscal 2002, was mainly due to the settlement of put obligations at the

beginning of the fourth quarter of fiscal 2003.

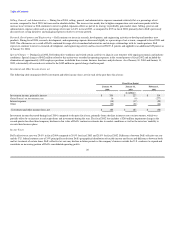

Dell has historically generated annual cash flows from operating activities in amounts greater than net income, driven mainly by its efficient cash conversion

cycle metrics. Management currently believes that Dell's fiscal 2005 cash flows from operations will continue to exceed net income and will be more than

sufficient to support Dell's operations and capital requirements. Dell currently anticipates that it will continue to utilize its strong liquidity and cash flows from

operations to repurchase its common stock, invest in systems and processes, invest in the growth of its enterprise products, and make a limited number of

strategic equity investments.

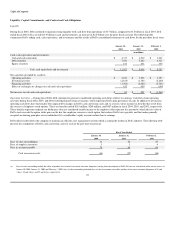

Capital Commitments

Share Repurchase Program — Dell has a share repurchase program that authorizes the purchase of up to 1.25 billion shares of common stock to manage the

dilution resulting from shares issued under Dell's employee stock plans. As of the end of fiscal 2004, Dell had cumulatively repurchased 1.1 billion shares for

an aggregate cost of approximately $14 billion. During fiscal 2004, Dell repurchased 63 million shares of common stock for an aggregate cost of $2.0 billion.

Through the fourth quarter of fiscal 2003, Dell previously utilized equity instrument contracts to facilitate its repurchase of common stock. All remaining put

and call contracts were settled in full during the fourth quarter of fiscal 2003. Dell now effects its share repurchases entirely through open market transactions

and expects to continue to repurchase shares of common stock through a systematic program of open market purchases that will return cash to stockholders

and mitigate dilution. For the first quarter of fiscal 2005, Dell expects to spend approximately $1.1 billion repurchasing shares. Dell evaluates its share

repurchase program quarterly and expects share repurchases during fiscal 2005 to increase compared to fiscal 2004.

23