Costco 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

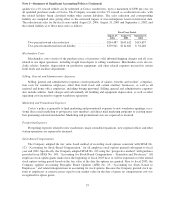

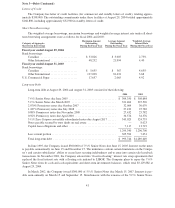

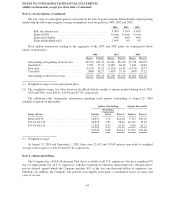

Note 6—Retirement Plans (Continued)

California union employees participate in a defined benefit plan sponsored by their union. The Company

makes contributions based upon its union agreement. For all the California union employees, the Company spon-

sored 401(k) plan currently allows pre-tax deferral against which the Company matches 50% of the first five

hundred dollars of employee contributions. In addition, the Company will provide each eligible participant a con-

tribution based on hours worked and years of service. The Company has a defined contribution plan for Canadian

and United Kingdom employees and contributes a percentage of each employee’s salary.

Amounts expensed under these plans were $169,664, $149,392 and $127,189 for fiscal 2004, 2003 and

2002, respectively. The Company has defined contribution 401(k) and retirement plans only, and thus has no li-

ability for post-retirement benefit obligations under the SFAS No. 106 “Employer’s Accounting for Post-

retirement Benefits Other than Pensions.”

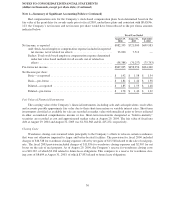

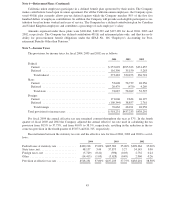

Note 7—Income Taxes

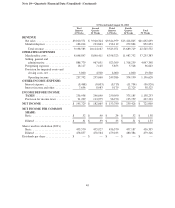

The provisions for income taxes for fiscal 2004, 2003 and 2002 are as follows:

2004 2003 2002

Federal:

Current ............................................. $257,092 $295,323 $331,455

Deferred ............................................ 116,390 35,150 5,263

Total federal ....................................... 373,482 330,473 336,718

State:

Current ............................................. 53,608 58,739 48,256

Deferred ............................................ 20,479 (470) 4,269

Total state ......................................... 74,087 58,269 52,525

Foreign:

Current ............................................. 171,006 9,634 46,197

Deferred ............................................ (100,344) 38,857 2,761

Total foreign ....................................... 70,662 48,491 48,958

Total provision for income taxes ........................... $518,231 $437,233 $438,201

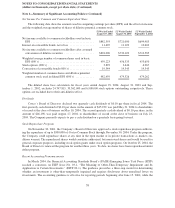

For fiscal 2004 the annual effective tax rate remained constant throughout the year at 37%. In the fourth

quarter of fiscal 2003 and 2002 the Company adjusted the annual effective tax rate used in calculating the tax

provision from 38.5% to 37.75%, and from 40.0% to 38.5%, respectively, resulting in the reduction in the in-

come tax provision in the fourth quarter of $5,873 and $11,315, respectively.

Reconciliation between the statutory tax rate and the effective rate for fiscal 2004, 2003 and 2002 is as fol-

lows:

2004 2003 2002

Federal taxes at statutory rate ............. $490,218 35.00% $405,382 35.00% $398,364 35.00%

State taxes, net ......................... 48,157 3.44 37,875 3.27 34,145 3.00

Foreign taxes, net ...................... (5,729) (0.41) (396) (0.03) 2,732 0.24

Other ................................ (14,415) (1.03) (5,628) (0.49) 2,960 0.26

Provision at effective tax rate ............. $518,231 37.00% $437,233 37.75% $438,201 38.50%

45