Costco 2004 Annual Report Download - page 42

Download and view the complete annual report

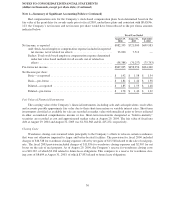

Please find page 42 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 1—Summary of Significant Accounting Policies (Continued)

and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates.

Reclassifications

Certain reclassifications have been made to prior fiscal years to conform with the presentation adopted in

the current fiscal year.

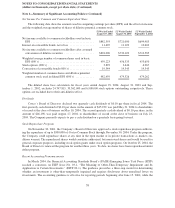

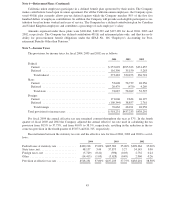

Note 2—Comprehensive Income

Comprehensive income is net income, plus certain other items that are recorded directly to stockholders’

equity. Comprehensive income was $976,517 for fiscal 2004 and $800,745 for fiscal 2003. Foreign currency

translation adjustments and unrealized gains and losses on short-term investments are the components applied to

net income to calculate the Company’s comprehensive income and totaled $94,264 and ($140), respectively, for

fiscal 2004 and $79,745, which related only to foreign currency translation adjustments in fiscal 2003.

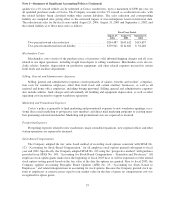

Note 3—Debt

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in thousands of US dollars)

The Company has in place a $500,000 commercial paper program supported by a $300,000 bank credit fa-

cility with a group of ten banks, of which $150,000 expired on November 9, 2004 and $150,000 expires on No-

vember 15, 2005. At August 29, 2004 and August 31, 2003, no amounts were outstanding under the commercial

paper program and no amounts were outstanding under the credit facility. The Company presently does not plan

to renew the $150,000 portion of the credit facility that expired on November 9, 2004.

A wholly-owned Canadian subsidiary has a $152,000 commercial paper program supported by a $46,000

bank credit facility with a Canadian bank that is guaranteed by the parent company and expires in March 2005.

At August 29, 2004 and August 31, 2003, no amounts were outstanding under the Canadian commercial paper

program or the bank credit facility.

The Company has agreed to limit the combined amount outstanding under the U.S. and Canadian commer-

cial paper programs to the combined amounts of the supporting bank credit facilities, which are $346,000 at

August 29, 2004, decreased to $196,000 on November 9, 2004.

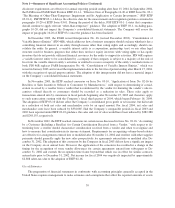

The Company’s wholly-owned Japanese subsidiary has a short-term $27,400 bank line of credit that origi-

nally expired in November 2004. Subsequent to the Company’s fiscal year end, the bank line of credit was ex-

tended through February 10, 2005. At August 29, 2004 and August 31, 2003, no amounts were outstanding under

the line of credit.

The Company’s Korean subsidiary has a short-term $10,400 bank line of credit, which expires in January

2005. At August 29, 2004, no amounts were outstanding under the line of credit.

The Company’s wholly-owned United Kingdom subsidiary has a $108,000 bank revolving credit facility

expiring in February 2007 and a $63,000 bank overdraft facility renewable on a quarterly basis in March. At

August 29, 2004, $21,595 was outstanding under the revolving credit facility with an applicable interest rate of

5.285% and no amounts were outstanding under the bank overdraft facility. At August 31, 2003, $47,421 was

outstanding under the revolving credit facility with an applicable interest rate of 4.413% and no amounts were

outstanding under the bank overdraft facility.

40