Costco 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividends

Costco’s Board of Directors declared two quarterly cash dividends of $0.10 per share in fiscal 2004. The

first quarterly cash dividend of $0.10 per share, in the amount of $45,939, was paid May 31, 2004 to shareholders

of record at the close of business on May 10, 2004. The second quarterly cash dividend of $0.10 per share, in the

amount of $46,198, was paid August 27, 2004, to shareholders of record at the close of business on July 23,

2004.

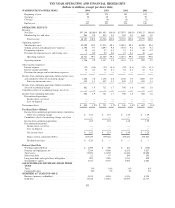

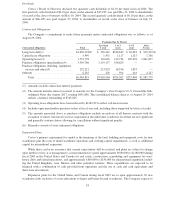

Contractual Obligations

The Company’s commitment to make future payments under contractual obligations was as follows, as of

August 29, 2004.

Payments Due by Period

Contractual obligations Total

Less than

1year

1to3

years

4to5

years

After

5 years

Long-term debt(1) .................... $1,656,393(2) $ 339,441 $336,632 $ 62,081 $ 918,239(2)

Capital lease obligations ............... 5,449 1,451 1,117 1,115 1,766

Operating leases(3) ................... 1,574,778 110,616 212,734 190,401 1,061,027

Purchase obligations (merchandise)(4) .... 3,509,786 3,153,157 356,629 — —

Purchase obligations (building, equipment,

services and other)(5) ................ 232,212 213,823 16,556 1,833 —

Other(6) ............................ 6,235 476 594 418 4,747

Total ........................... $6,984,853 $3,818,964 $924,262 $255,848 $1,985,779

(1) Amounts include contractual interest payments.

(2) The amount includes interest accreted to maturity for the Company’s Zero Coupon 3

1

⁄

2

% Convertible Sub-

ordinated Notes due August 2017, totaling $851,648. The consolidated balance sheet as of August 29, 2004

reflects a balance outstanding of $543,025.

(3) Operating lease obligations have been reduced by $148,339 to reflect sub-lease income.

(4) Includes open merchandise purchase orders at fiscal year end, including those supported by letters of credit.

(5) The amounts presented above as purchase obligations include an analysis of all known contracts with the

exception of minor outsourced services negotiated at the individual warehouse level that are not significant

and generally contain clauses allowing for cancellation without significant penalty.

(6) Primarily consists of asset retirement obligations.

Expansion Plans

Costco’s primary requirement for capital is the financing of the land, building and equipment costs for new

warehouses plus the costs of initial warehouse operations and working capital requirements, as well as additional

capital for international expansion.

While there can be no assurance that current expectations will be realized, and plans are subject to change

upon further review, it is management’s current intention to spend approximately $900,000 to $1,000,000 during

fiscal 2005 in the United States and Canada for real estate, construction, remodeling and equipment for ware-

house clubs and related operations; and approximately $100,000 to $150,000 for international expansion, includ-

ing the United Kingdom, Asia, Mexico and other potential ventures. These expenditures are expected to be

financed with a combination of cash provided from operations and the use of cash and cash equivalents and

short-term investments.

Expansion plans for the United States and Canada during fiscal 2005 are to open approximately 30 new

warehouse clubs inclusive of seven relocations to larger and better-located warehouses. The Company expects to

18