Costco 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.least a year, and approximately 45% of the increase was due to opening a net of 23 new warehouses (29 opened,

6 closed) during fiscal 2003 and a net of 29 new warehouses (35 opened, 6 closed) during fiscal 2002, a portion

of which is not included in comparable warehouse sales. With the exception of price increases in gasoline, which

accounted for a comparable sales increase of approximately 70 basis points, changes in prices of merchandise did

not materially contribute to sales increases. In addition, due to the weaker U.S. dollar in fiscal 2003 as compared

to fiscal 2002, translation of foreign sales into U.S. dollars contributed to the increase in sales, accounting for a

comparable sales increase of approximately one percent year-over-year. Comparable sales increased at a five

percent annual rate in fiscal 2003 compared to a six percent annual rate during fiscal 2002.

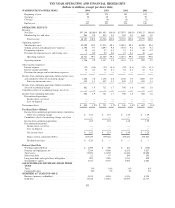

Membership fees

Membership fees increased 10.8% to $852,853, or 2.05% of net sales, in fiscal 2003 from $769,406, or

2.03% of net sales, in fiscal 2002. This increase was primarily due to additional membership sign-ups at the 23

net new warehouses opened in fiscal 2003, and increased penetration of the Company’s Executive Membership.

Overall, member renewal rates remained consistent with the prior year, currently at 86%.

Gross Margin

Gross margin (defined as net sales minus merchandise costs) increased 11.2% to $4,457,316, or 10.69% of

net sales, in fiscal 2003 from $4,009,972, or 10.55% of net sales, in fiscal 2002. The increase in gross margin as a

percentage of net sales reflects merchandise gross margin improvement within the Company’s ancillary ware-

house businesses and international operations accounting for increases of 15 and eight basis points, respectively.

Additionally, increased rewards related to the Executive Membership Two-Percent Reward Program reduced

gross margin by seven basis points. The gross margin figures reflect accounting for most U.S. merchandise in-

ventories on the last-in, first-out (LIFO) method. The effect of the LIFO adjustment for fiscal 2003 was to in-

crease gross margin by $19,650, compared to a gross margin increase of $13,500 in fiscal 2002. If all inventories

had been valued using the first-in, first-out (FIFO) method, inventories would have been lower by $19,500 at

August 31, 2003 and higher by $150 at September 1, 2002.

Selling, General and Administrative Expenses

Selling, general and administrative expenses as a percent of net sales increased to 9.83% during fiscal 2003

from 9.41% during fiscal 2002. The increase in selling, general and administrative expenses as a percent of net

sales was primarily due to increases in employee healthcare, workers’ compensation (primarily in the state of

California) and salary costs within the Company’s domestic operations. International expenses also increased,

accounting for approximately seven basis points of the 42 basis points year-over-year increase.

Preopening Expenses

Preopening expenses totaled $36,643, or 0.09% of net sales, during fiscal 2003, compared to $51,257, or

0.13% of net sales, during fiscal 2002. During fiscal 2003, the Company opened 29 new warehouses (including

five relocations) compared to 35 new warehouses (including six relocations) during fiscal 2002. Pre-opening

expenses also include costs related to remodels and expanded ancillary operations at existing warehouses.

Provision for Impaired Assets and Closing Costs, net

The net provision for impaired assets and closing costs was $19,500 in fiscal 2003 compared to $21,050 in

fiscal 2002. The provision includes costs related to impairment of long-lived assets, future lease obligations of

warehouses that have been relocated to new facilities and any losses or gains resulting from the sale of real prop-

erty. The provision for fiscal 2003 included charges of $11,836 for warehouse closing expenses, $4,697 for im-

pairment of long-lived assets and $2,967 for net losses on the sale of real property. The fiscal 2002 provision

included charges of $13,683 for warehouse closing expenses and $7,765 for Canadian administrative reorganiza-

tion, which were offset by $398 of net gains on the sale of real property. At August 31, 2003 the reserve for

16