Costco 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

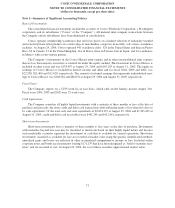

Note 1—Summary of Significant Accounting Policies (Continued)

Interest Income and Other

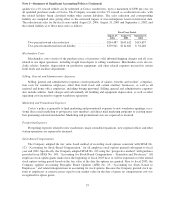

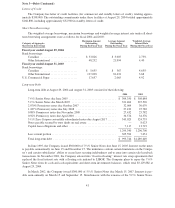

Interest income and other includes:

Fiscal Year Ended

August 29,

2004

August 31,

2003

September 1,

2002

Interest income ......................................... $31,537 $21,200 $16,005

Minority interest/earnings of affiliates and other ............... 20,090 17,325 19,740

Total ............................................. $51,627 $38,525 $35,745

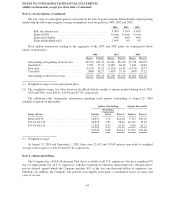

The Company recently determined that its joint venture Costco Mexico had incorrectly reported to the

Company the amount of deferred taxes recorded by Costco Mexico under SFAS No. 109, “Accounting for

Income Taxes.” As a result, the Company overstated its share in the equity in earnings of Costco Mexico

(reported in interest income and other) in fiscal years 2004, 2003 and 2002 by approximately $1,000, $1,000 and

$6,000, respectively – representing less than 1% of the Company’s income before income taxes in each of these

years. The cumulative balance sheet effect (reflected in other assets), over the past 12 fiscal years, has been to

overstate the Company’s investment in Costco Mexico by approximately $24,000, or less than .16% of total

assets at fiscal 2004 year end. The Company believes that the incorrect reporting of deferred taxes of Costco

Mexico has not materially impacted its consolidated results of operations, financial position or cash flows.

Accordingly, these amounts have not been adjusted in the accompanying consolidated financial statements.

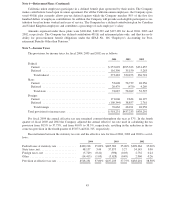

Income Taxes

The Company accounts for income taxes under the provisions of SFAS No. 109, “Accounting for Income

Taxes.” That standard requires companies to account for deferred income taxes using the asset and liability

method.

Under the asset and liability method of SFAS No. 109, deferred tax assets and liabilities are recognized for

the future tax consequences attributed to differences between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases and tax credits and loss carry-forwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which

those temporary differences and carry-forwards are expected to be recovered or settled. The effect on deferred

tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment

date. A valuation allowance is established when necessary to reduce deferred tax assets to amounts expected to

be realized.

37