Costco 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

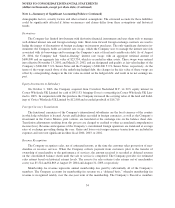

Note 3—Debt (Continued)

the Company entered into interest rate swap agreements converting the interest to a floating rate indexed to LI-

BOR. As of August 29, 2004, the Company was in compliance with all restrictive covenants.

In October 2000, the Company’s wholly-owned Japanese subsidiary issued 2.070% promissory notes in the

aggregate amount of approximately $32,004, through a private placement. Interest is payable annually and

principal is due on October 23, 2007.

In July 2001, the Company’s wholly-owned Japanese subsidiary issued 1.187% promissory notes in the ag-

gregate amount of approximately $27,432, through a private placement. Interest is payable semi-annually and

principal is due on July 9, 2008.

In November 2002, the Company’s wholly-owned Japanese subsidiary issued promissory notes bearing

interest at 0.88% in the aggregate amount of approximately $27,432, through a private placement. Interest is

payable semi-annually and principal is due on November 7, 2009.

In April 2003, the Company’s wholly-owned Japanese subsidiary issued promissory notes bearing interest at

0.92% in the aggregate amount of approximately $36,576, through a private placement. Interest is payable semi-

annually and principal is due on April 26, 2010.

The Company guarantees all of the promissory notes issued by its wholly-owned Japanese subsidiary.

On August 19, 1997, the Company completed the sale of $900,000 principal amount at maturity Zero Cou-

pon Subordinated Notes (the “Notes”) due August 19, 2017. The Notes were priced with a yield to maturity of

3

1

⁄

2

%, resulting in gross proceeds to the Company of $449,640. The current Notes outstanding are convertible

into a maximum of 19,340,158 shares of Costco Common Stock shares at an initial conversion price of $22.00.

Holders of the Notes may require the Company to purchase the Notes (at the discounted issue price plus accrued

interest to date of purchase) on August 19, 2007, or 2012. The Company, at its option, may redeem the Notes (at

the discounted issue price plus accrued interest to date of redemption) any time on or after August 19, 2002. As

of August 29, 2004, $48,352 in principal amount of the Zero Coupon Notes had been converted by note holders

to shares of Costco Common Stock.

In February 1996, the Company filed with the Securities and Exchange Commission a shelf registration

statement for $500,000 of senior debt securities. On October 23, 2001, an additional $100,000 in debt securities

was registered, bringing the total amount of debt registered under the shelf registration to $600,000. The

$300,000 of 5

1

⁄

2

% Senior Notes issued in March 2002 reduced the amount of registered securities available for

future issuance to $300,000.

At August 29, 2004, the fair value of the 7

1

⁄

8

% Senior Notes, and the 5

1

⁄

2

% Senior Notes, based on market

quotes, was approximately $311,250 and $316,950, respectively. The Senior Notes are not redeemable prior to

maturity. The fair value of the 3

1

⁄

2

% Zero Coupon Subordinated Notes at August 29, 2004, based on market

quotes, was approximately $822,607. The fair value of other long-term debt approximates carrying value.

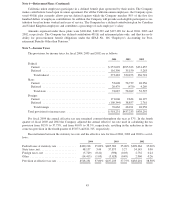

Maturities of long-term debt during the next five fiscal years and thereafter are as follows:

2005 ............................................................ $ 305,594

2006 ............................................................ 879

2007 ............................................................ 322,305

2008 ............................................................ 61,467

2009 ............................................................ 450

Thereafter ....................................................... 608,645

Total ....................................................... $1,299,340

42