Costco 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.warehouse closing costs was $8,609, of which $7,833 related to future lease obligations. This compares to a re-

serve for warehouse closing costs of $11,845 at September 1, 2002, of which $10,395 related to future lease

obligations.

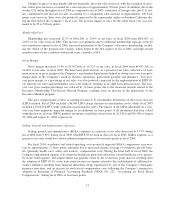

Interest Expense

Interest expense totaled $36,920 in fiscal 2003, compared to $29,096 in fiscal 2002. Interest expense in fis-

cal 2003 includes interest on the 3

1

⁄

2

% Zero Coupon Notes, 7

1

⁄

8

%and5

1

⁄

2

% Senior Notes and on balances out-

standing under the Company’s bank credit facilities and promissory notes. The increase is primarily related to the

reduction in interest capitalized related to warehouse construction, as the overall cost of projects under con-

struction was lower than in fiscal 2002. The increase was also attributed to the Company’s issuance of $300,000

5

1

⁄

2

% Senior Notes in March 2002, which were simultaneously swapped to a floating interest rate. This increase

was partially offset by an interest rate reduction in the Company’s $300,000 7

1

⁄

8

% Senior Notes, resulting from

interest rate swap agreements entered into effective November 13, 2001, converting the interest rate from fixed to

floating, and to the fact that the Company had little interest expense related to borrowings under its commercial

paper program in fiscal 2003.

Interest Income and Other

Interest income and other totaled $38,525 in fiscal 2003, compared to $35,745 in fiscal 2002. The increase

primarily reflects greater interest earned on higher cash and cash equivalents balances on hand throughout fiscal

2003, as compared to fiscal 2002, which was partially offset by an increase in the expense to record the minority

interest in earnings of foreign subsidiaries.

Provision for Income Taxes

The effective income tax rate on earnings was 37.75% in fiscal 2003 and 38.50% in fiscal 2002. The de-

crease in the effective income tax rate, year-over-year, is primarily attributable to lower statutory income tax

rates for foreign operations.

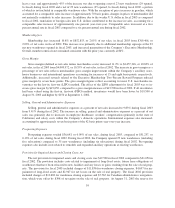

Liquidity and Capital Resources (dollars in thousands, except per share amounts)

Cash Flows

Cash flow generated from warehouse operations provides a significant source of liquidity. Net cash pro-

vided by operating activities totaled $2,098,783 in fiscal 2004 compared to $1,507,208 in fiscal 2003. The in-

crease of $591,575 is primarily a result of an increase in the change in receivables, other current assets, deferred

income and accrued and other current liabilities of $507,860, due primarily to the collection of an operating tax

receivable and increases in the workers’ compensation accrual, income taxes payable, executive membership

two-percent reward accrual and deferred membership income in fiscal 2004 compared to fiscal 2003. In addition,

the increase in net income of $161,393 contributed to the increase in cash provided by operating activities.

The primary investing activity continues to be the purchase of property and equipment and the construction

of facilities related to the Company’s warehouse expansion and remodel projects. Net cash used in investing

activities totaled $1,048,481 in fiscal 2004 compared to $790,588 in fiscal 2003, an increase of $257,893. The

increase in investing activities primarily relates to net purchases of short-term investments of $303,945 and the

purchase of the remaining 20% minority interest in Costco Wholesale UK Limited of $95,153, which was parti-

ally offset by a reduction in the acquisition of property and equipment and the construction of facilities for new

and remodeled warehouses of $105,045 (from $810,665 to $705,620) between fiscal 2003 and fiscal 2004, as

new warehouse openings decreased year-over-year from 29 (including five relocated warehouses) in fiscal 2003

to 20 in fiscal 2004.

Net cash provided by financing activities totaled $209,569 in fiscal 2004 compared to net cash used of

$1,428 in fiscal 2003. The increase of $210,997 primarily resulted from an increase in bank checks outstanding

of $243,890 and the increase in proceeds received from the exercise of stock options of $90,077, which were off-

set by the payment of cash dividends in fiscal 2004 of $92,137 and from the reduction in the issuance of long-

term debt of $59,424 in fiscal 2003 to no additional issuances of long-term debt in the current fiscal year.

17