Costco 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 1—Summary of Significant Accounting Policies (Continued)

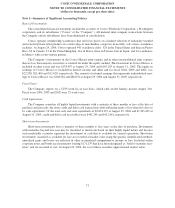

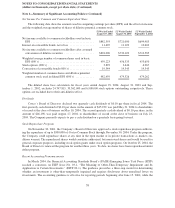

Short-term investments at August 29, 2004 were as follows:

Cost

Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

U.S. government and agency securities ...................... $ 46,060 $102 $(107) $ 46,055

Money market mutual funds .............................. 25,112 — — 25,112

Corporate notes and bonds ............................... 216,271 95 (149) 216,217

Asset backed securities .................................. 13,283 16 (115) 13,184

Mortgage backed securities ............................... 6,161 18 — 6,179

Total short-term investments .......................... $306,887 $231 $(371) $306,747

Receivables, net

Receivables consist primarily of vendor rebates and promotional allowances, receivables from government

tax authorities and other miscellaneous amounts due to the Company, and are net of an allowance for doubtful

accounts of $1,139 at August 29, 2004 and $1,529 at August 31, 2003. Management determines the allowance for

doubtful accounts based on known troubled accounts and historical experience applied to an aging of accounts.

Vendor Rebates and Allowances

Periodic payments from vendors in the form of volume rebates or other purchase discounts that are evi-

denced by signed agreements are reflected in the carrying value of the inventory when earned or as the Company

progresses towards earning the rebate or discount and as a component of cost of sales as the merchandise is sold.

Other consideration received from vendors is generally recorded as a reduction of merchandise costs upon com-

pletion of contractual milestones, terms of the related agreement, or by other systematic and rational approach.

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market as determined primarily by the retail in-

ventory method, and are stated using the last-in, first-out (LIFO) method for substantially all U.S. merchandise

inventories. Merchandise inventories for all foreign operations are primarily valued by the retail method of ac-

counting, and are stated using the first-in, first-out (FIFO) method. The Company believes the LIFO method

more fairly presents the results of operations by more closely matching current costs with current revenues. The

Company records an adjustment each quarter if necessary, for the expected annual effect of inflation and these

estimates are adjusted to actual results determined at year-end. The Company considers in its calculation of the

LIFO cost the estimated net realizable value of inventory in those inventory pools where deflation exists and re-

cords a write down of inventory where estimated net realizable value is less than LIFO inventory. The LIFO in-

ventory adjustment for the fourth quarter of fiscal 2004 decreased gross margin by $590 as compared to an

increase of $14,650 in the fourth quarter of fiscal 2003. If all merchandise inventories had been valued using the

FIFO method, inventories would have been lower by $13,410 and $19,500 at August 29, 2004 at August 31,

2003, respectively.

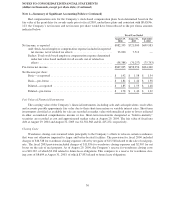

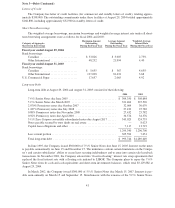

August 29,

2004

August 31,

2003

Merchandise inventories consist of:

United States (primarily LIFO) ........................ $2,903,551 $2,668,342

Foreign (FIFO) .................................... 740,034 671,086

Total ........................................ $3,643,585 $3,339,428

32