Costco 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

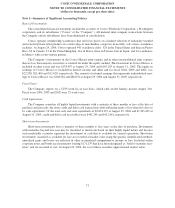

Note 1—Summary of Significant Accounting Policies (Continued)

qualify for a 2% reward (which can be redeemed at Costco warehouses), up to a maximum of $500 per year, on

all qualified purchases made at Costco. The Company accounts for this 2% reward as a reduction in sales, with

the related liability being classified within other current liabilities. The sales reduction and corresponding

liability are computed after giving effect to the estimated impact of non-redemptions based on historical data.

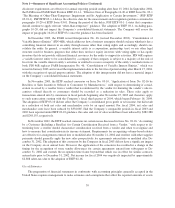

The reduction in sales for the fiscal years ended August 29, 2004, August 31, 2003 and September 1, 2002, and

the related liability as of those dates were as follows:

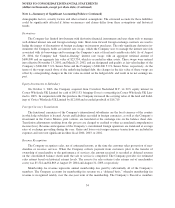

Fiscal Year Ended

August 29,

2004

August 31,

2003

September 1,

2002

Two-percent reward sales reduction ........................ $244,487 $169,612 $143,637

Two-percent unredeemed reward liability ................... $170,941 $114,681 $ 94,448

Merchandise Costs

Merchandise costs consist of the purchase price of inventory sold, inbound shipping charges and all costs

related to our depot operations, including freight from depots to selling warehouses. Merchandise costs also in-

clude salaries, benefits, depreciation on production equipment, and other related expenses incurred in certain

fresh foods and ancillary departments.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of salaries, benefits and workers’ compensa-

tion costs for warehouse employees, other than fresh foods and certain ancillary businesses, as well as all

regional and home office employees, including buying personnel. Selling, general and administrative expenses

also include utilities, bank charges and substantially all building and equipment depreciation, as well as other

operating costs incurred to support warehouse operations.

Marketing and Promotional Expenses

Costco’s policy is generally to limit marketing and promotional expenses to new warehouse openings, occa-

sional direct mail marketing to prospective new members and direct mail marketing programs to existing mem-

bers promoting selected merchandise. Marketing and promotional costs are expensed as incurred.

Preopening Expenses

Preopening expenses related to new warehouses, major remodels/expansions, new regional offices and other

startup operations are expensed as incurred.

Stock-Based Compensation

The Company adopted the fair value based method of recording stock options consistent with SFAS No.

123, “Accounting for Stock-Based Compensation,” for all employee stock options granted subsequent to fiscal

year end 2002. Specifically, the Company adopted SFAS No. 123 using the “prospective method” with guidance

provided from SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure.” All

employee stock option grants made since the beginning of fiscal 2003 have or will be expensed over the related

stock option vesting period based on the fair value at the date the options are granted. Prior to fiscal 2003, the

Company applied Accounting Principles Board Opinion (APB) No. 25, “Accounting for Stock Issued to

Employees,” and related interpretations in accounting for stock options. Because the Company granted stock op-

tions to employees at exercise prices equal to fair market value on the date of grant, no compensation cost was

recognized for option grants.

35