Costco 2004 Annual Report Download - page 35

Download and view the complete annual report

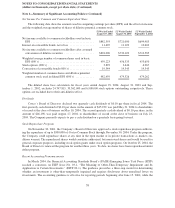

Please find page 35 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1—Summary of Significant Accounting Policies (Continued)

The Company provides for estimated inventory losses between physical inventory counts on the basis of a

standard percentage of sales. This provision is adjusted periodically to reflect the actual shrinkage results of the

physical inventory counts, which generally occur in the second and fourth quarters of the Company’s fiscal year.

Property and Equipment

Property and equipment are stated at cost. Depreciation and amortization expenses are computed using the

straight-line method for financial reporting purposes. Buildings are generally depreciated over twenty-five to

thirty-five years; equipment and fixtures are depreciated over three to ten years; leasehold improvements are

amortized over the initial term of the lease or the useful lives of the assets. The Company capitalizes certain costs

related to the acquisition and development of software and amortizes those costs using the straight-line method

over their estimated useful lives, which range from three to five years.

Interest costs incurred on property and equipment during the construction period are capitalized. The

amount of interest costs capitalized was $4,155 in fiscal 2004, $3,272 in fiscal 2003, and $13,480 in fiscal 2002.

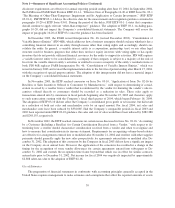

Impairment of Long-Lived Assets

The Company periodically evaluates the realizability of long-lived assets for impairment when management

makes the decision to relocate or close a warehouse or when events or changes in circumstances occur, which

may indicate the carrying amount of the asset may not be recoverable. The Company evaluates the carrying value

of the asset by comparing the estimated future undiscounted cash flows generated from the use of the asset and

its eventual disposition with the asset’s reported net carrying value. The Company recorded a pre-tax, non-cash

charge of $2,592, $4,697 and $0 in fiscal 2004, 2003 and 2002, respectively, reflecting its estimate of impairment

relating to real property. The charge reflects the difference between the carrying value and fair value, which was

based on estimated market valuations for those assets whose carrying value is not currently anticipated to be re-

coverable through future cash flows.

Goodwill

Goodwill, net of accumulated amortization, resulting from certain business combinations is included in

other assets, and totaled $65,721 at August 29, 2004 and $46,549 at August 31, 2003. The increase in goodwill

was due to the Company increasing its ownership in Costco Wholesale UK Limited from 80% to 100% in the

first quarter of fiscal 2004. The Company follows Statement of Financial Accounting Standards (SFAS) No. 142,

“Accounting for Goodwill and Other Intangibles,” which specifies that goodwill and some intangible assets

should no longer be amortized, but instead will be subject to periodic impairment testing. Accordingly, the Com-

pany reviews previously reported goodwill for impairment on an annual basis, or more frequently if circum-

stances dictate. No impairment of goodwill has been incurred to date.

Accounts Payable

The Company’s banking system provides for the daily replenishment of major bank accounts as checks are

presented. Accordingly, included in accounts payable at August 29, 2004 and August 31, 2003 are $438,025 and

$216,980, respectively, representing the excess of outstanding checks over cash on deposit at the banks on which

the checks were drawn.

Insurance/Self Insurance Liabilities

The Company uses a combination of insurance and self-insurance mechanisms to provide for the potential

liabilities for workers’ compensation, general liability, property insurance, director and officers’ liability, vehicle

liability and employee health care benefits. Liabilities associated with the risks that are retained by the Company

are not discounted and are estimated, in part, by considering historical claims experience and outside expertise,

33