Costco 2004 Annual Report Download - page 24

Download and view the complete annual report

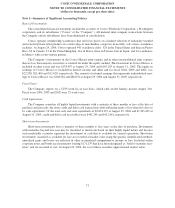

Please find page 24 of the 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.whether an investment is other-than-temporarily impaired and requires disclosures about unrealized losses on

investments. The accounting guidance is effective for reporting periods beginning after June 15, 2004, while the

disclosure requirements are effective for annual reporting periods ending after June 15, 2004. In September 2004,

the FASB issued FASB Staff Position EITF 03-1-1, “Effective Date of Paragraphs 10-20 of EITF Issue No. 03-1

‘The Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments,” (FSP EITF

03-01-1). FSP EITF 03-1-1 delays the effective date for the measurement and recognition guidance contained in

paragraphs 10-20 of EITF Issue 03-01. During the period of the delay, FSP EITF 03-1-1 states that companies

should continue to apply relevant “other-than-temporary” guidance. The adoption of EITF 03-1, excluding para-

graphs 10-20, did not impact the Company’s consolidated financial statements. The Company will assess the

impact of paragraphs 10-20 of EITF 03-1 once the guidance has been finalized.

In December 2003, the FASB issued Interpretation No. 46 (revised December 2003), “Consolidation of

Variable Interest Entities” (FIN 46R), which addresses how a business enterprise should evaluate whether it has a

controlling financial interest in an entity through means other than voting rights and accordingly should con-

solidate the entity. In general, a variable interest entity is a corporation, partnership, trust, or any other legal

structure used for business purposes that either does not have equity investors with voting rights or has equity

investors that do not provide sufficient financial resources for the entity to support its activities. FIN 46R requires

a variable interest entity to be consolidated by a company if that company is subject to a majority of the risk of

loss from the variable interest entity’s activities or entitled to receive a majority of the entity’s residual returns or

both. FIN 46R replaces FASB Interpretation No. 46, “Consolidation of Variable Interest Entities,” which was

issued in January 2003 and revised the implementation date to the first fiscal period ending after March 15, 2004,

with the exception of special purpose entities. The adoption of this interpretation did not have a material impact

on the Company’s consolidated financial statements.

In November 2003, the EITF reached consensus on Issue No. 03-10, “Application of Issue No. 02-16 by

Resellers to Sales Incentives Offered to Consumers by Manufacturers,” with respect to determining if consid-

eration received by a reseller from a vendor that is reimbursed by the vendor for honoring the vendor’s sale in-

centives offered directly to consumers should be recorded as a reduction in sales. These rules apply to

transactions entered into by consumers in fiscal periods beginning after November 25, 2003 and, therefore, apply

to such transactions starting with the Company’s fiscal third quarter of 2004, which began February 16, 2004.

The adoption of EITF 03-10 did not affect the Company’s consolidated gross profit or net income, but did result

in a reduction of both net sales and merchandise costs by an equal amount. For fiscal 2004, net sales and

merchandise costs have been reduced by $334,065. Had the Company’s comparable periods in fiscal 2003 and

2002 been reported under EITF 03-10 guidance, the sales and cost of sales would have been reduced by $282,288

and $248,155, respectively.

In November 2002, the EITF reached consensus on certain issues discussed in Issue No. 02-16, “Accounting

by a Customer (Including a Reseller) for Certain Consideration Received from a Vendor,” with respect to de-

termining how a reseller should characterize consideration received from a vendor and when to recognize and

how to measure that consideration in its income statement. Requirements for recognizing volume-based rebates

are effective for arrangements entered into or modified after November 21, 2002 and resellers with other supplier

payments should generally apply the new rules prospectively for agreements entered into or modified after De-

cember 31, 2002. The adoption of this consensus by the Company in fiscal 2003 did not have a significant impact

on the Company on an annual basis, but resulted in a change in the timing for the recognition of some vendor al-

lowances for certain agreements entered into subsequent to December 31, 2002 and extends the recognition time

frame beyond that which was in effect for similar contracts entered into prior to December 31, 2002. Net income

for fiscal 2004 was negatively impacted by approximately $2,808 (after-tax) due to the adoption of EITF 02-16.

Quantitative and Qualitative Disclosures About Market Risk

The Company is exposed to financial market risk resulting from changes in interest and foreign currency

rates. As a policy, the Company does not engage in speculative or leveraged transactions, nor hold or issue

financial instruments for trading purposes.

22