Costco 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YEAR ENDED AUGUST 29, 2004

Annual

Report

2004

2004

Annual

Report

2004

Table of contents

-

Page 1

Annual Report 2004 2004 YEAR ENDED AUGUST 29, 2004 -

Page 2

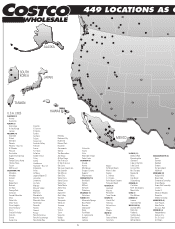

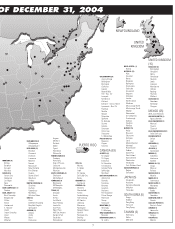

... Japan (five locations), as well as 25 warehouses in Mexico through a 50%-owned joint venture. CONTENTS Financial Highlights ...Letter to Shareholders ...Map of Warehouse Locations ...Number of Warehouses/Ancillary Businesses ...Market for Costco Common Stock ...Dividend Policy ...Ten Year Operating... -

Page 3

... 600 32,000 0 2000 2001 2002 2003 2004 At Fiscal Year End 31,621 0 2000 2001 2003 2002 Fiscal Year 2004 2000 2001 2002 2003 Fiscal Year 2004 631 602 325 313 0 Comparable Sales Growth 18 12% 11% 10% 10% 17 Membership Gold Star Members 5.0 Business Members 4.810 4.8 16 15 14.984 15.018 14.597... -

Page 4

... goal of increasing shareholder value is accomplished by conscientiously living our mission statement and code of ethics each and every day...To bring the highest quality goods and services to market at the lowest possible prices...and to obey the law, take care of our members, take care of our... -

Page 5

..., North Carolina. Our infill buildings were opened in Commerce Township, Michigan; Chantilly and Leesburg, Virginia; Citrus Heights, Turlock and Poway, California; South Ogden, Utah; Coeur d'Alene, Idaho; Vancouver, Washington; Lewisville, Texas; Enfield, Connecticut and Lake in the Hills, Illinois... -

Page 6

...saving money on the basics, our members can choose from a wide variety of value-priced luxury items, whether found while treasurehunting the aisles or in special-order kiosks or at our upscale road shows within our warehouses. As you may know, Costco is one of the largest dealers of fine diamonds in... -

Page 7

... discussing our plans for Costco's future with you at our Annual Meeting of Shareholders on January 27, 2005, in Bellevue, Washington. Thank you for your continued confidence and support. We wish you and yours a most joyous Holiday Season and a New Year abundant in success, good health and happiness... -

Page 8

... Tempe Costco Home Thomas Road Tucson NW Tucson CALIFORNIA (100) Alhambra Almaden Antioch Azusa Bakersfield Burbank Cal Expo Canoga Park Carlsbad Carmel Mountain Chico Chino Hills Chula Vista Citrus Heights City of Industry Clovis Coachella Valley Concord Corona Culver City Danville El Camino El... -

Page 9

... Salem Tigard Warrenton Wilsonville PENNSYLVANIA (6) PUERTO RICO Bayamon Caguas Carolina CANADA (63) ALBERTA (8) Cranberry Harrisburg King of Prussia Lancaster Montgomeryville Robinson SOUTH CAROLINA (2) UTAH (6) Charleston Myrtle Beach TENNESSEE (3) Murray S. Ogden Orem St. George Salt Lake... -

Page 10

...in Mexico. These warehouses are not included in the number of warehouses open in any period because the joint venture is accounted for using the equity method and, therefore, its operations are not consolidated in the Company's financial statements. The Company's headquarters are located in Issaquah... -

Page 11

... basis. EQUITY COMPENSATION PLANS Information related to the Company's equity compensation plans is incorporated herein by reference to the Proxy Statement. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the end of the Company's fiscal year. 9 -

Page 12

... (dollars in millions, except per share data) WAREHOUSES IN OPERATIONS Beginning of year ...Openings ...Closings ...End of year ...OPERATING RESULTS Revenue Net Sales ...Membership fees and other ...Total revenue ...Operating expenses Merchandise costs ...Selling, general and administrative... -

Page 13

2000 292 25 (4) 313 1999 278 21 (7) 292 1998 261 18 (1) 278 1997 252 17 (8) 261 1996 240 20 (8) 252 1995 221 24 (5) 240 $31,621 543 32,164 28,322 2,756 42 7 31,127 1,037 (39) 54 - 1,052 421 631 - 631 - - $631 100.0% 1.7 101.7 89.6 8.7 0.1 - 98.4 3.3 (0.1) 0.2 - 3.3 1.3 2.0 - 2.0 - - 2.0% $26... -

Page 14

... sales of 10% and the opening of 20 new warehouses; Membership fees for fiscal 2004 increased 12.7% to $961,280 representing new member sign ups at new warehouses opened during the fiscal year, increasing penetration of the Company's Executive Membership program, and continued strong member... -

Page 15

...'s fiscal 2004 third quarter. EITF 03-10, which primarily impacts the Company's vendor coupon programs, reduces net sales and merchandise costs by an equal amount and does not affect the Company's consolidated gross margin or net income. Had EITF 03-10 been in effect for the comparable periods... -

Page 16

... sign-ups at the 20 new warehouses opened in fiscal 2004; increased penetration of the Company's Executive membership, including the rollout of the program into Canada, which began in the first quarter of fiscal 2004; and high overall member renewal rates consistent with recent years, currently... -

Page 17

...or 0.09% of net sales, during fiscal 2003. This reduction was due to fewer warehouse openings. During fiscal 2004, the Company opened 20 new warehouses compared to 29 new warehouses (including 5 relocations) during fiscal 2003. Pre-opening expenses also include costs related to remodels and expanded... -

Page 18

... of net sales, in fiscal 2002. This increase was primarily due to additional membership sign-ups at the 23 net new warehouses opened in fiscal 2003, and increased penetration of the Company's Executive Membership. Overall, member renewal rates remained consistent with the prior year, currently at 86... -

Page 19

... relates to net purchases of short-term investments of $303,945 and the purchase of the remaining 20% minority interest in Costco Wholesale UK Limited of $95,153, which was partially offset by a reduction in the acquisition of property and equipment and the construction of facilities for new... -

Page 20

... open merchandise purchase orders at fiscal year end, including those supported by letters of credit. (5) The amounts presented above as purchase obligations include an analysis of all known contracts with the exception of minor outsourced services negotiated at the individual warehouse level... -

Page 21

... Kingdom and Asia, along with other international markets. At present, the Company is planning to open two additional warehouses in the U.K and one additional warehouse in both the Taiwan and Japan markets during fiscal 2005. Costco and its Mexico-based joint venture partner, Controladora Comercial... -

Page 22

... Company's financial statements requires that management make estimates and judgments that affect the financial position and results of operations. Management continues to review its accounting policies and evaluate its estimates, including those related to revenue recognition, merchandise inventory... -

Page 23

... sheets until the sale or service is completed. The Company provides for estimated sales returns based on historical returns levels. Merchandise Inventories Merchandise inventories are valued at the lower of cost or market as determined primarily by the retail method of accounting and are stated... -

Page 24

... In general, a variable interest entity is a corporation, partnership, trust, or any other legal structure used for business purposes that either does not have equity investors with voting rights or has equity investors that do not provide sufficient financial resources for the entity to support its... -

Page 25

.... At the end of fiscal year 2005, Section 404 of the Sarbanes-Oxley Act will require management of the Company to provide in its annual report an assessment of the effectiveness of the Company's internal controls over financial reporting and the Company's independent public accounting firm will be... -

Page 26

... caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles... -

Page 27

... caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles... -

Page 28

... financial statements, during the fiscal year ended August 31, 2003, the Company adopted Emerging Issues Task Force Issue No. 02-16, "Accounting by a Customer (Including a Reseller) for Certain Consideration Received from a Vendor," based on the specific transition guidance. Seattle, Washington... -

Page 29

... STOCKHOLDERS' EQUITY CURRENT LIABILITIES Short-term borrowings ...$ 21,595 $ 47,421 Accounts payable ...3,600,200 3,131,320 Accrued salaries and benefits ...904,209 734,261 Accrued sales and other taxes ...223,009 207,392 Deferred membership income ...453,881 401,357 Current portion long-term debt... -

Page 30

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (dollars in thousands, except per share data) 52 Weeks Ended August 29, 2004 52 Weeks Ended August 31, 2003 52 Weeks Ended September 1, 2002 REVENUE Net sales ...Membership fees ...Total revenue ...OPERATING EXPENSES Merchandise costs ... -

Page 31

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY AND COMPREHENSIVE INCOME For the 52 weeks ended August 29, 2004, the 52 weeks ended August 31, 2003 and the 52 weeks ended September 1, 2002 (in thousands) Common Stock Shares... ...Stock options exercised including income tax... -

Page 32

... benefit from exercise of stock options ...22,712 12,348 27,171 Change in receivables, other current assets, deferred income, accrued and other current liabilities ...740,027 232,167 129,883 Increase in merchandise inventories ...(256,438) (162,759) (380,158) Increase in accounts payable ...211,990... -

Page 33

... date of purchase. Investments with maturities beyond one year may be classified as short-term based on their highly liquid nature and because such marketable securities represent the investment of cash that is available for current operations. Short-term investments classified as available for sale... -

Page 34

... to an aging of accounts. Vendor Rebates and Allowances Periodic payments from vendors in the form of volume rebates or other purchase discounts that are evidenced by signed agreements are reflected in the carrying value of the inventory when earned or as the Company progresses towards earning the... -

Page 35

... the physical inventory counts, which generally occur in the second and fourth quarters of the Company's fiscal year. Property and Equipment Property and equipment are stated at cost. Depreciation and amortization expenses are computed using the straight-line method for financial reporting purposes... -

Page 36

.... Membership fee revenue represents annual membership fees paid by substantially all of the Company's members. The Company accounts for membership fee revenue on a "deferred basis," whereby membership fee revenue is recognized ratably over the one-year term of the membership. The Company's Executive... -

Page 37

... support warehouse operations. Marketing and Promotional Expenses Costco's policy is generally to limit marketing and promotional expenses to new warehouse openings, occasional direct mail marketing to prospective new members and direct mail marketing programs to existing members promoting selected... -

Page 38

... TO CONSOLIDATED FINANCIAL STATEMENTS (dollars in thousands, except per share data) (Continued) Note 1-Summary of Significant Accounting Policies (Continued) Had compensation costs for the Company's stock-based compensation plans been determined based on the fair value at the grant dates for awards... -

Page 39

...year end. The Company believes that the incorrect reporting of deferred taxes of Costco Mexico has not materially impacted its consolidated results of operations, financial position or cash flows. Accordingly, these amounts have not been adjusted in the accompanying consolidated financial statements... -

Page 40

... 30, 2004. Under the program, the Company could repurchase shares at any time in the open market or in private transactions as market conditions warrant. The repurchased shares would constitute authorized, but non-issued shares and would be used for general corporate purposes, including stock option... -

Page 41

... In general, a variable interest entity is a corporation, partnership, trust, or any other legal structure used for business purposes that either does not have equity investors with voting rights or has equity investors that do not provide sufficient financial resources for the entity to support its... -

Page 42

... TO CONSOLIDATED FINANCIAL STATEMENTS (dollars in thousands, except per share data) (Continued) Note 1-Summary of Significant Accounting Policies (Continued) and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of... -

Page 43

... notes due November 2009 ...0.92% Promissory notes due April 2010 ...3 1â„ 2% Zero Coupon convertible subordinated notes due August 2017 ...Notes payable secured by trust deeds on real estate ...Capital lease obligations and other ...Less current portion ...Total long-term debt ... $ 304,350... -

Page 44

..., $48,352 in principal amount of the Zero Coupon Notes had been converted by note holders to shares of Costco Common Stock. In February 1996, the Company filed with the Securities and Exchange Commission a shelf registration statement for $500,000 of senior debt securities. On October 23, 2001, an... -

Page 45

...one or more of the following options which the Company can exercise at the end of the initial lease term: (a) renewal of the lease for a defined number of years at the then fair market rental rate; (b) purchase of the property at the then fair market value; or (c) right of first refusal in the event... -

Page 46

.... Note 6-Retirement Plans The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have completed 90 days of employment. For all U.S. employees, with the exception of California union employees, the plan allows pre-tax deferral against which the Company matches 50% of... -

Page 47

... Company sponsored 401(k) plan currently allows pre-tax deferral against which the Company matches 50% of the first five hundred dollars of employee contributions. In addition, the Company will provide each eligible participant a contribution based on hours worked and years of service. The Company... -

Page 48

... as follows: August 29, 2004 August 31, 2003 Accrued liabilities and reserves ...Deferred membership fees ...Other ...Total deferred tax assets ...Property and equipment ...Merchandise inventories ...Other receivables ...Total deferred tax liabilities ...Net deferred tax liabilities ... $224,523 29... -

Page 49

... responsibility and exclude the Mexico joint-venture, as it is accounted for under the equity method and its operations are not consolidated in the Company's financial statements. United States Operations Canadian Operations Other International Operations Total Year Ended August 29, 2004 Total... -

Page 50

... of operations for fiscal 2004 and 2003. First Quarter 12 Weeks 52 Weeks Ended August 29, 2004 Second Third Fourth Quarter Quarter Quarter 12 Weeks 12 Weeks 16 Weeks Total 52 Weeks REVENUE Net sales ...Membership fees ...Total revenue ...OPERATING EXPENSES Merchandise costs ...Selling, general and... -

Page 51

Note 10-Quarterly Financial Data (Unaudited) (Continued) First Quarter 12 Weeks 52 Weeks Ended August 31, 2003 Second Third Fourth Quarter Quarter Quarter 12 Weeks 12 Weeks 16 Weeks Total 52 Weeks REVENUE Net sales ...Membership fees ...Total revenue ...OPERATING EXPENSES Merchandise costs ...... -

Page 52

... E. Burdick Senior Vice President, Information Systems Charles V. Burnett Senior Vice President, Pharmacy Roger A. Campbell Senior Vice President, General Manager- Southeast Region Richard C. Chavez Senior Vice President, Costco Wholesale Industries & Business Development Richard D. DiCerchio Senior... -

Page 53

..., Chief Executive Officer John Thelan Senior Vice President, Operations-Depots Thomas K. Walker Executive...Financial Accounting Controller Mitzi Hu GMM-Imports Ross Hunt Human Resources, Finance & IS- Canadian Division Arthur D. Jackson, Jr. Administration & Community Giving Harold E. Kaplan Corporate... -

Page 54

... Mario Omoss Operations-Texas Region John R. Osterhaus Photo, Optical, Hearing Aids, Gasoline & Costco Trading Steve Pappas Country Manager-Korea Shawn Parks Operations-Los Angeles Region Mike Parrott Corporate Purchasing & Other Businesses Mike Pollard E-commerce Operations & Marketing Steve Powers... -

Page 55

Annual Report 2004 2004 YEAR ENDED AUGUST 29, 2004 PRINTED ON RECYCLED PAPER -

Page 56

... INFORMATION A copy of Costco's annual report to the Securities and Exchange Commission on Form 10-K and quarterly reports on Form 10-Q will be provided to any shareholder upon written request directed to Investor Relations, Costco Wholesale Corporation, 999 Lake Drive, Issaquah, Washington...