CVS 1998 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

TO OUR SHAREHOLDERS

VS reached new heights in 1998 by virtually

every measure, including customers served,

prescriptions filled, stores operated, sales and

earnings generated, and return to shareholders.

We are particularly proud that we achieved excel-

lent financial results and maintained our focus

during a year of tremendous activity for CVS, as

we successfully integrated our acquisitions of

Revco D.S., Inc. and Arbor Drugs, Inc.

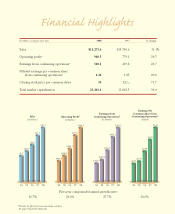

Record Sales and Earnings Lead to

Dramatic Growth in Shareholder Value

Our commitment to serving our customers

has led to results that are at the forefront of our

industry. Total sales in 1998 reached a record

$15.3 billion, an increase of 11.1% from the $13.7

billion reported in 1997. On a comparable store

basis, sales rose a healthy 10.8%, with pharmacy

same store sales climbing 16.5%.

Operating profit, before the effect of non-

recurring charges, advanced a robust 20.7% to

$940.5 million in 1998, driven by higher compa-

rable store sales and a continued expansion in our

operating margin. Gross margin management

continues to be a challenge in today’s managed

care environment. We continue to take a firm

position with third party payors to ensure accept-

able levels of reimbursement, and we are proac-

tively working with our managed care partners to

align incentives to lower costs and improve care.

We are pleased to report that there are signs that

the pressure on our pharmacy margin is begin-

ning to ease.

Cost control has always been a key priority

for CVS and 1998 was no exception. Our invest-

ments in technology, as well as synergy savings

from the acquisitions and the leveraging of our

exceptionally strong sales growth, have enabled

us to decrease our total selling, general and

administrative expense (SG&A) as a percent of

sales by approximately 300 basis points over the

last five years. Currently at 20.9%, our goal is to

reduce our total SG&A as a percent of sales to

less than 20% over the next two years. We cur-

rently have two major initiatives under way,

which we believe will enable us to lower costs

and improve inventory turns as well as in-stock

positions. Our Rx Delivery and Merchandise

Transaction System initiatives will help us con-

tinue to enhance our competitive cost structure.

Earnings from continuing operations,

excluding the effect of non-recurring items,

increased 21.7% in 1998 to $510.1 million, or

$1.26 per diluted share, from $419.2 million, or

$1.05 per diluted share, in 1997. With these

results, CVS generated a five-year compounded

annual earnings growth rate from continuing

operations of nearly 28%.

With a debt to total capital ratio of 25.4% at

year-end, our balance sheet continues to

improve. As such, Standard and Poor’s recently

upgraded our credit ratings, which will result in

real economic savings. Our financial strength in

large part reflects our aggressive capital manage-

ment program. We build our capital investment

plans to take advantage of the opportunities we

believe offer the greatest potential returns. With

the substantial 1998 investments surrounding the

Revco and Arbor acquisitions behind us, we

expect to generate significant free cash flow in

C

C