CVS 1998 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

1998 Financial Report

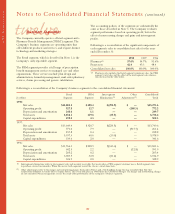

Following is a summary of the significant components of

the Company’s deferred tax assets and liabilities as of

December 31:

In millions 1998 1997

Deferred tax assets:

Employee benefits $ 84.5 $119.0

Other assets 185.5 253.8

Total deferred tax assets $270.0 $372.8

Deferred tax liabilities:

Property and equipment $(44.0) $(27.0)

Inventories (1.6) (29.9)

Other liabilities —(10.7)

Total deferred tax liabilites (45.6) (67.6)

Net deferred tax assets $224.4 $305.2

Based on historical pre-tax earnings, the Company believes

it is more likely than not that the deferred tax assets will be

realized.

As of December 31, 1998, the Company had federal net

operating loss carryforwards (“NOLs”) of $3.7 million that

are attributable to Revco for periods prior to its emergence

from Chapter 11. The benefits realized from these NOLs

should reduce reorganization goodwill. Accordingly, the tax

benefit of such NOLs utilized during the three years ended

December 31, 1998, $7.2 million, $69.4 million and $15.3

million for 1998, 1997 and 1996, respectively, has not been

included in the computation of the Company’s income tax

provision, but instead has been reflected as reductions of

reorganization goodwill.

On October 12, 1996, the Company completed the Footstar

Distribution which is believed to be tax-free to the Co

mpany

and its shareholders based on a legal opinion provided by

outside counsel. However, since opinions of counsel are not

binding on the Internal Revenue Service or the courts, it

could ultimately be determined that the Footstar Distribution

does not qualify as a tax-free distribution. If such occurred,

the Company would be required to recognize a capital gain

for tax purposes equal to the difference between the fair

market value of the shares of Footstar stock distributed and

the Company’s basis in such shares. The Company, however,

believes the likelihood of the Footstar Distribution not

qualifying as a tax-free distribution to be remote.

eleven

Income Taxes

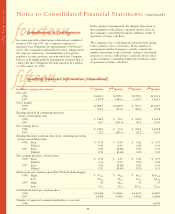

Deferred income taxes reflect the net tax effects of the

temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the

amounts used for income tax purposes.

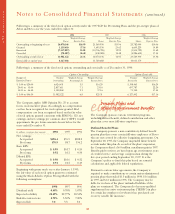

The Company’s income tax (provision) benefit for continuing

operations for the years ended December 31 consisted of the

following:

In millions Federal State Total

1998:

Current $(197.3) $(41.4) $(238.7)

Deferred (51.2) (25.0) (76.2)

$(248.5) $(66.4) $(314.9)

1997:

Current $(182.5) $(68.5) $(251.0)

Deferred 82.1 28.1 110.2

$(100.4) $(40.4) $(140.8)

1996:

Current $(195.6) $(54.9) $(250.5)

Deferred (17.7) (2.8) (20.5)

$(213.3) $(57.7) $(271.0)

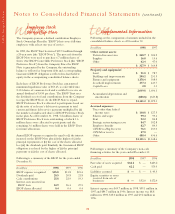

Following is a reconciliation of the statutory income tax rate

to the Company’s effective tax rate for the years ended

December 31:

1998 1997 1996

Statutory income tax rate 35.0% 35.0% 35.0%

State income taxes, net of

federal tax benefit 5.8 6.6 5.5

Goodwill and other 1.2 1.4 1.6

Effective tax rate before

merger-related costs 42.0 43.0 42.1

Merger-related costs(1) 2.3 21.8 —

Effective tax rate 44.3% 64.8% 42.1%

(1) Includes state tax effect.

Income taxes paid (refunded) were $102.6 million, $258.9

million and $(33.8) million during the years ended

December 31, 1998, 1997 and 1996, respectively.