CVS 1998 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

CVS Corporation

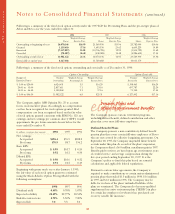

Financial instruments ~ The Company’s financial

instruments include cash and cash equivalents, accounts

receivable, accounts payable, accrued expenses and

short-term borrowings. Due to the short-term nature of

these instruments, the Company’s carrying value

approximates fair value. The Company also utilizes letters

of credit to guarantee certain foreign purchases. As of

December 31, 1998 and 1997, approximately $62.4 million

and $58.2 million, respectively, was outstanding under

letters of credit.

Property and equipment ~ Depreciation of property and

equipment is computed on a straight-line basis, generally

over the estimated useful lives of the asset or, when

applicable, the term of the lease, whichever is shorter.

Estimated useful lives generally range from 10 to 40 years for

buildings and improvements, 3 to 10 years for fixtures and

equipment, and 3 to 10 years for leasehold improvements.

Maintenance and repair costs are charged directly to expense

as incurred. Major renewals or replacements that

substantially extend the useful life of an asset are

capitalized and depreciated.

Impairment of long-lived assets ~ The Company

primarily groups and evaluates assets at an individual store

level, which is the lowest level at which individual cash flows

can be identified. When evaluating assets for potential

impairment, the Company considers historical performance

and estimated undiscounted future cash flows. If the

carrying amount of the related assets exceed the expected

future cash flows, the Company considers the assets to be

impaired and records an impairment loss.

Deferred charges and other assets ~ Deferred charges

and other assets primarily include beneficial leasehold costs,

which are amortized on a straight-line basis over the shorter

of 15 years or the remaining life of the leasehold acquired,

and reorganization goodwill, which is amortized on a

straight-line basis over 20 years. The reorganization goodwill

is the value of Revco D.S., Inc., in excess of identifiable

assets, as determined during its 1992 reorganization under

Chapter 11 of the United States Bankruptcy Code. See Note

11 for further information about reorganization goodwill.

Goodwill ~ Goodwill, which represents the excess of the

purchase price over the fair value of net assets acquired, is

amortized on a straight-line basis generally over periods of

40 years. Accumulated amortization was $85.6 million and

$65.6 million at December 31, 1998 and 1997, respectively.

The Company evaluates goodwill for impairment whenever

events or circumstances indicate that the carrying amount

may not be recoverable. If the carrying amount of the

goodwill exceeds the expected undiscounted future cash

flows, the Company records an impairment loss.

one

Notes to Consolidated Financial Statements

Significant Accounting Policies

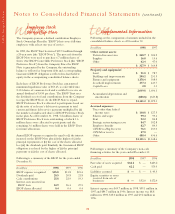

Description of business ~ CVS Corporation (“CVS” or

the “Company”) is principally in the retail drugstore

business. As of December 31, 1998, the Company operated

4,122 retail drugstores, located in 24 Northeast, Mid-

Atlantic, Southeast and Midwest states and the District of

Columbia. See Note 12 for further information about the

Company’s business segments.

Basis of presentation ~ The consolidated financial

statements include the accounts of the Company and its

wholly-owned subsidiaries. All material intercompany

balances and transactions have been eliminated. As a result

of the Company’s strategic restructuring program, the

results of operations of the former Footwear, Apparel, and

Toys and Home Furnishings segments have been classified

as discontinued operations in the accompanying

consolidated statements of operations. See Note 4 for

further information about the Company’s strategic

restructuring program and discontinued operations.

Stock split ~ On May 13, 1998, the Company’s

shareholders approved an increase in the number of

authorized common shares from 300 million to one billion.

Also on that date, the Board of Directors authorized a two-

for-one common stock split, which was effected by the

issuance of one additional share of common stock for each

share of common stock outstanding. These shares were

distributed on June 15, 1998 to shareholders of record as

of May 25, 1998. All share and per share amounts presented

herein have been restated to reflect the effect of the

stock split.

Cash and cash equivalents ~ Cash and cash equivalents

consist of cash and temporary investments with maturities of

three months or less when purchased.

Accounts receivable ~ Accounts receivable are stated net

of an allowance for uncollectible accounts of $39.8 million

and $39.2 million as of December 31, 1998 and 1997,

respectively. The balance primarily includes trade receivables

due from managed care organizations, pharmacy benefit

management companies, insurance companies,

governmental agencies and vendors.

Inventories ~ Inventories are stated at the lower of cost or

market using the first-in, first-out method.