CVS 1998 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

CVS Corporation

four

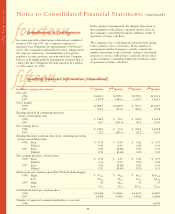

Strategic Restructuring Program

& Discontinued Operations

In November 1997, the Company completed the final phase

of its comprehensive strategic restructuring program, first

announced in October 1995 and subsequently refined in May

1996 and June 1997. The strategic restructuring program

included: (i) the sale of Marshalls, Kay-Bee Toys, Wilsons,

This End Up and Bob’s Stores, (ii) the spin-off of Footstar,

Inc., which included Meldisco, Footaction and Thom McAn

(the “Footstar Distribution”), (iii) the initial and secondary

public offerings of Linens ‘n Things and (iv) the elimination

of certain corporate overhead costs.

The strategic restructuring program was completed without

significant changes to the Board approved plan. As part of

completing this program, the Company recorded, as a

component of discontinued operations, an after-tax charge

of $20.7 million during the second quarter of 1997 and $148.1

million during the second quarter of 1996 to finalize original

liability estimates. The Company believes that the remaining

pre-tax reserve balance of $84.7 million at December 31,

1998 is adequate to cover the remaining liabilities associated

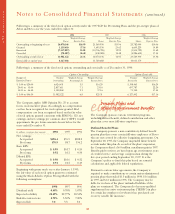

with this program. Following is a summary of the strategic

restructuring reserve:

Total Utilized

In millions Reserve to Date Transfer Balance

Loss on disposal $ 721.8 $ (710.6) $38.8 $50.0

Lease obligations 187.4 (124.6) (32.8) 30.0

Severance 58.6 (47.9) (6.0) 4.7

Other 174.2 (174.2) — —

$1,142.0 $(1,057.3) $ — $84.7

Following is a summary of discontinued operations by

reporting segment for the years ended December 31:

In millions 1997 1996

Net sales:

Footwear $ — $1,391.1

Apparel 348.3 526.4

Toys and Home Furnishings — 900.3

$ 348.3 $2,817.8

Operating (loss):

Footwear $ — $ (12.4)

Apparel — (171.3)

Toys and Home Furnishings — (49.7)

$ — $ (233.4)

As of December 31, 1998 and 1997, there were no assets or

liabilities of the discontinued operations reflected in the

accompanying consolidated balance sheets.

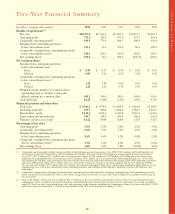

five

Borrowings and Credit

Agreements

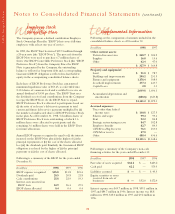

Following is a summary of the Company’s borrowings at

December 31:

In millions 1998 1997

Commercial paper $ 736.6 $450.0

ESOP note payable(1) 270.7 292.1

Uncommitted lines of credit 34.5 16.4

9.125% senior notes —19.2

Mortgage notes payable 16.1 17.1

Capital lease obligations and other 3.5 3.9

1,061.4 798.7

Less:

Short-term borrowings (771.1) (466.4)

Current portion of long-term debt (14.6) (41.9)

$ 275.7 $290.4

(1) See Note 9 for further information about the Company’s ESOP Plan.

The Company’s commercial paper program is supported by a

$670 million, five-year unsecured revolving credit facility,

which expires on May 30, 2002 and a $460 million, 364-day

unsecured revolving credit facility, which expires on June 26,

1999 (collectively, the “Credit Facilities”). The Credit Facilities

require the Company to pay a quarterly facility fee of 0.07%,

regardless of usage. The Company can also obtain up to $35.0

million of short-term financing through various uncommitted

lines of credit. The weighted average interest rate for short-term

borrowings was 5.7% as of December 31, 1998 and 1997.

The Company was not obligated under any formal or informal

compensating balance agreements.

During the second quarter of 1997, the Company extinguished

$865.7 million of the debt it absorbed as part of the CVS/Revco

Merger using cash on hand and commercial paper borrowings. As

a result, the Company recorded an extraordinary loss, net of

income taxes, of $17.1 million, which consisted of early

retirement premiums and the write-off of unamortized deferred

financing costs. On January 15, 1998, the Company redeemed the

remaining $19.2 million of 9.125% senior notes.

At December 31, 1998, the aggregate long-term debt maturing

during the next five years is as follows: $14.6 million in 1999,

$17.3 million in 2000, $21.6 million in 2001, $26.5 million in

2002, $32.3 million in 2003, $178.0 million in 2004 and thereafter.

Interest paid was approximately $70.7 million in 1998, $58.4

million in 1997 and $79.8 million in 1996.

Notes to Consolidated Financial Statements (continued)