CVS 1998 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1998 Financial Report

29

three will require cash outlays of which $269.3 million had been

incurred as of December 31, 1998. The remaining cash

outlays primarily include noncancelable lease commitments

and severance. The Company also recorded a $75.0 million

charge to cost of goods sold during the second quarter of

1997 to reflect markdowns on noncompatible Revco

merchandise (the “Revco Inventory Markdown”).

Merger transaction costs included in the above charges

primarily relate to fees for investment bankers, attorneys,

accountants, financial printing and other related charges.

Restructuring activities primarily relate to the consolidation

of administrative functions. These actions resulted in the

reduction of approximately 200 Arbor employees and 1,000

Revco employees, all of which had occurred as of December

31, 1998. Noncancelable lease obligations and duplicate facil-

ities primarily include noncancelable lease commitments and

shutdown costs. These costs did not provide future benefit

to the retained stores or corporate facilities.

In accordance with EITF 94-3 and SFAS No. 121, the

Company also recorded a $31.0 million charge to operating

expenses during the first quarter of 1997 for certain costs

associated with the restructuring of Big B (the “Big B

Charge”). This charge included accrued liabilities related to

certain exit plans for identified stores and duplicate

corporate facilities, such as the cancellation of lease

agreements and the write-down of unutilized fixed assets.

Asset write-offs included in this charge totaled $5.1 million.

The balance of the charge, $25.9 million, will require cash

outlays of which $10.0 million had been incurred as of

December 31, 1998. The remaining cash outlays primarily

include noncancelable lease commitments. These exit plans

did not provide future benefit to the retained stores or

corporate facilities.

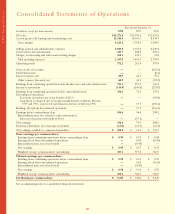

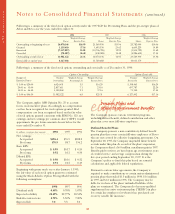

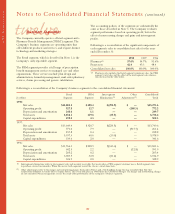

Following is a summary of the significant components of the above charges:

CVS/Arbor Charge CVS/Revco and Big B Charges

Total 1998 Utilized Balance at Total 1997 Utilized Balance at

In millions Charge to Date Transfer 12/31/98(1) Charges to Date Transfer 12/31/98(1)

Merger transaction costs $ 15.0 $ (15.9) $ 0.9 $ — $ 35.0 $ (32.4) $(2.6) $ —

Restructuring costs:

Employee severence

and benefits 27.1 (13.8) 0.3 13.6 89.8 (77.4) — 12.4

Exit costs:

Noncancelable lease

obligations and duplicate

facilities 67.5 (25.8) (1.9) 39.8 211.6 (147.9) — 63.7

Fixed asset write-offs 41.2 (41.2) — — 87.3 (87.3) — —

Contract cancellation costs 4.8 (1.2) — 3.6 7.4 (7.4) — —

Other 2.7 (3.4) 0.7 — 11.6 (14.2) 2.6 —

$ 158.3 $ (101.3) $ — $ 57.0 $ 442.7 $ (366.6) $ — $ 76.1

(1) The Company believes that the reserve balances at December 31, 1998 are adequate to cover the remaining liabilities associated with these charges.

Merger &

Restructuring Charges

In accordance with Emerging Issues Task Force (“EITF”)

Issue No. 94-3, “Liability Recognition for Certain Employee

Termination Benefits and Other Costs to Exit an Activity

(Including Certain Costs Incurred in a Restructuring)” and

SFAS No. 121, “Accounting for the Impairment of Long-

Lived Assets and for Long-Lived Assets to Be Disposed Of,”

the Company recorded the following charges in connection

with the Mergers.

In connection with the CVS/Arbor Merger, the Company

recorded a $158.3 million charge to operating expenses

during the second quarter of 1998 for direct and other

merger-related costs pertaining to the merger transaction

and certain restructuring activities (the “CVS/Arbor

Charge”). Asset write-offs included in this charge totaled

$41.2 million. The balance of the charge, $117.1 million,

will require cash outlays of which $60.1 million had been

incurred as of December 31, 1998. The remaining cash

outlays primarily include noncancelable lease commitments

and severance. The Company also recorded a $10.0 million

charge to cost of goods sold during the second quarter of

1998 to reflect markdowns on noncompatible Arbor

merchandise (the “Arbor Inventory Markdown”).

In connection with the CVS/Revco Merger, the Company

recorded a $411.7 million charge to operating expenses

during the second quarter of 1997 for direct and other

merger-related costs pertaining to the merger transaction

and certain restructuring activities (the “CVS/Revco

Charge”). Asset write-offs included in this charge totaled

$82.2 million. The balance of the charge, $329.5 million,