CVS 1998 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

1998 Financial Report

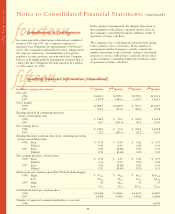

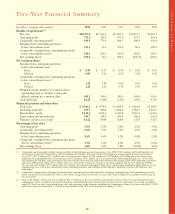

In millions, except per share amounts 1998 1997 1996 1995 1994

Results of operations:(3)

Net sales $15,273.6 $13,749.6 $11,831.6 $10,513.1 $9,469.1

Operating profit 772.2 261.4 591.9 271.7 416.8

Comparable operating profit(1) 940.5 779.1 604.7 486.8 416.8

Earnings from continuing operations

before extraordinary item 396.4 76.5 372.4 83.4 185.9

Comparable earnings from continuing operations

before extraordinary item(2) 510.1 419.2 306.8 210.2 185.9

Net earnings (loss) 396.4 76.9 208.2 (547.1) 400.2

Per common share:

Earnings from continuing operations

before extraordinary item:

Basic $ 0.99 $ 0.17 $ 0.98 $ 0.18 $ 0.47

Diluted 0.98 0.16 0.95 0.18 0.47

Comparable earnings from continuing operations

before extraordinary item:(2)

Basic 1.28 1.08 0.80 0.53 0.47

Diluted 1.26 1.05 0.78 0.53 0.47

Weighted average number of common shares

outstanding used to calculate comparable

diluted earnings per common share 405.2 396.0 383.6 364.8 361.6

Cash dividends 0.225 0.220 0.220 0.760 0.760

Financial position and other data:

Total assets $ 6,763.2 $ 5,978.9 $ 6,014.9 $ 6,614.4 $7,202.9

Total long-term debt 275.7 290.4 1,204.8 1,056.3 1,012.3

Shareholders’ equity 3,110.6 2,614.6 2,413.8 2,567.4 3,341.4

Depreciation and amortization 249.7 238.2 205.4 186.4 169.5

Number of stores at year-end 4,122 4,094 4,204 3,715 3,617

Percentage of net sales:

Operating profit 5.1% 1.9% 5.0% 2.6% 4.4%

Comparable operating profit(1) 6.2% 5.7% 5.1% 4.6% 4.4%

Earnings from continuing operations

before extraordinary item 2.6% 0.6% 3.1% 0.8% 2.0%

Comparable earnings from continuing operations

before extraordinary item(2) 3.3% 3.0% 2.6% 2.0% 2.0%

Net earnings (loss) 2.6% 0.6% 1.8% (5.2%) 4.2%

(1) Comparable operating profit excludes the pre-tax effect of the following nonrecurring charges: (i) in 1998, $158.3 million ($107.8 million after-tax)

related to the merger of CVS and Arbor and $10.0 million ($5.9 million after-tax) related to the markdown of noncompatible Arbor merchandise,

(ii) in 1997, $411.7 million ($273.7 million after-tax) related to the merger of CVS and Revco, $75.0 million ($49.9 million after-tax) related to the

markdown of noncompatible Revco merchandise and $31.0 million ($19.1 million after-tax) related to the restructuring of Big B, Inc., (iii) in 1996,

$12.8 million ($6.5 million after-tax) related to the write-off of costs incurred in connection with the failed merger of Rite Aid Corporation and Revco

and (iv) in 1995, $165.5 million ($97.7 million after-tax) related to the Company’s strategic restructuring program and the early adoption of SFAS

No. 121 and $49.5 million ($29.1 million after-tax) related to the Company changing its policy from capitalizing internally developed software costs to

expensing the costs as incurred, outsourcing certain technology functions and retaining certain employees until their respective job functions were

transitioned.

(2) Comparable earnings from continuing operations before extraordinary item and comparable earnings per common share from continuing operations

before extraordinary item exclude the after-tax effect of the charges discussed in Note (1) above and a $121.4 million ($72.1 million after-tax) gain on

sale of securities.

(3) Prior to the Mergers, Arbor’s fiscal year ended on July 31 and Revco’s fiscal year ended on the Saturday closest to May 31. In recording the business

combinations, Arbor’s and Revco’s historical stand-alone consolidated financial statements have been restated to a December 31 year-end, to conform

with CVS’ fiscal year-end. As permitted by the rules and regulations of the Securities and Exchange Commission, Arbor’s fiscal year ended July 31, 1995

and Revco’s fiscal year ended June 3, 1995 have been combined with CVS’ fiscal year ended December 31, 1994.

Five-Year Financial Summary