CVS 1998 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

CVS Corporation

•During 1996, Revco recorded a $12.8 million charge

when Rite Aid Corporation announced that it

had withdrawn its tender offer to acquire Revco.

This event took place before we merged with Revco.

If you exclude the effect of these nonrecurring charges,

comparable total operating expenses as a percentage of net

sales were 20.9% in 1998, 21.9% in 1997 and 22.8% in 1996.

What have we done to improve our comparable total

operating expenses as a percentage of net sales?

•We eliminated most of Arbor’s existing corporate

overhead in 1998 and most of Revco’s in 1997.

•Our strong sales performance has consistently

allowed our net sales to grow at a faster pace

than total operating expenses.

•Our information technology initiatives have led to

greater productivity, which has resulted in lower

operating costs and improved sales. Our major IT

initiatives include: Supply Chain Management,

Rx2000 Pharmacy Delivery Project, and Rapid

.

As a result of combining the operations of CVS, Arbor and

Revco, we were able to achieve substantial annual operating

cost savings in 1998 and 1997. Although we are extremely

proud of this accomplishment, we strongly advise you not to

rely on the resulting operating expense improvement trend

to predict our future performance.

Operating profit increased $510.8 million to $772.2 mil-

lion in 1998. This compares to $261.4 million in 1997 and

$591.9 million in 1996. If you exclude the effect of the

nonrecurring charges we recorded in gross margin and in

total operating expenses, our comparable operating profit

increased $161.4 million (or 20.7%) to $940.5 million in

1998. This compares to $779.1 million in 1997 and $604.7

million in 1996. Comparable operating profit as a percentage

of net sales was 6.2% in 1998, 5.7% in 1997 and 5.1% in 1996.

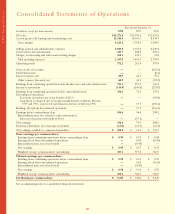

Other expense (income), net consisted of the following

for the years ended December 31:

In millions 1998 1997 1996

Gain on sale of securities $—$—$(121.4)

Dividend income ——(5.6)

Interest expense 69.7 59.1 84.7

Interest income (8.8) (15.0) (9.2)

Other expense (income), net $60.9 $ 44.1 $ (51.5)

We cannot, however, guarantee that future store

relocations will deliver the same results as those

historically achieved. Please read the “Cautionary

Statement Concerning Forward-Looking Statements”

section below.

Gross margin as a percentage of net sales was 27.0% in

1998. This compares to 27.0% in 1997 and 27.9% in 1996.

As you review our gross margin performance, please

remember to consider the impact of the $10.0 million

charge we recorded in 1998 to reflect markdowns on

noncompatible Arbor merchandise and the $75.0 million

charge we recorded in 1997 to reflect markdowns on

noncompatible Revco merchandise. If you exclude the

effect of these nonrecurring charges, our comparable gross

margin as a percentage of net sales was 27.1% in 1998,

27.6% in 1997 and 27.9% in 1996.

Why has our comparable gross margin rate been declining?

•Pharmacy sales are growing at a faster pace than front

store sales. On average, our gross margin on

pharmacy sales is lower than our gross margin on

front store sales.

•Sales to customers covered by third party insurance

programs have continued to increase and, thus, have

become a larger part of our total pharmacy business.

Our gross margin on third party sales has continued

to decline largely due to the efforts of managed care

organizations and other pharmacy benefit managers

to reduce prescription drug costs. To address this

trend, we have dropped a number of third party

programs that fell below our minimum profitability

standards. In the event this trend continues and we

elect to drop additional programs and/or decide not

to participate in future programs that fall below our

minimum profitability standards, we may not be able

to sustain our current rate of sales growth.

Total operating expenses were 22.0% of net sales in 1998.

This compares to 25.1% in 1997 and 22.9% in 1996. As you

review our performance in this area, please remember to

consider the impact of the following nonrecurring charges:

•During 1998, we recorded the $158.3 million charge

associated with the Arbor merger.

•During 1997, we recorded the $411.7 million charge

associated with the Revco merger. We also recorded a

$31.0 million charge for certain costs associated with

the restructuring of Big B. Please read Note 3 to

the consolidated financial statements for other

important information about this charge.

Management’s Discussion and Analysis of Financial