CVS 1998 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Corporation

fifteen

38

fourteen

Commitments & Contingencies

In connection with certain business dispositions completed

between 1991 and 1997, the Company continues to

guarantee lease obligations for approximately 1,600 former

stores. The Company is indemnified for these obligations by

the respective purchasers. Assuming that each respective

purchaser became insolvent, an event which the Company

believes to be highly unlikely, management estimates that it

could settle these obligations for approximately $1.1 billion

as of December 31, 1998.

Notes to Consolidated Financial Statements (continued)

In the opinion of management, the ultimate disposition of

these guarantees will not have a material adverse effect on

the Company’s consolidated financial condition, results of

operations or future cash flows.

The Company is also a defendant in various lawsuits arising

in the ordinary course of business. In the opinion of

management and the Company’s outside counsel, the

ultimate disposition of these lawsuits, exclusive of potential

insurance recoveries, will not have a material adverse effect

on the Company’s consolidated financial condition, results

of operations or future cash flows.

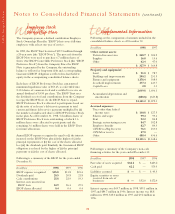

Quarterly Financial Information (Unaudited)

In millions, except per share amounts 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Net sales:

1998 $3,601.5 $3,755.9 $3,725.1 $4,191.1

1997 3,397.8 3,406.8 3,328.7 3,616.3

Gross margin:

1998 $1,006.9 $1,020.5 $ 995.3 $1,106.5

1997 967.9 873.0 905.6 971.8

Earnings (loss) from continuing operations

before extraordinary item:

1998 $ 132.0 $ 16.2 $ 102.4 $ 145.8

1997 92.1 (221.4) 82.2 123.6

Net earnings (loss):

1998 $ 132.0 $ 16.2 $ 102.4 $ 145.8

1997 92.2 (221.1) 82.2 123.6

Earnings (loss) per common share from continuing operations

before extraordinary item:

1998: Basic $ 0.34 $ 0.03 $ 0.25 $ 0.37

Diluted 0.33 0.03 0.25 0.36

1997: Basic 0.24 (0.60) 0.21 0.31

Diluted 0.23 (0.60) 0.20 0.31

Net earnings (loss) per common share:

1998: Basic $ 0.34 $ 0.03 $ 0.25 $ 0.37

Diluted 0.33 0.03 0.25 0.36

1997: Basic 0.24 (0.60) 0.21 0.31

Diluted 0.23 (0.60) 0.20 0.31

Market price per common share (New York Stock Exchange):

1998: High $ 377/16 $39

5/8 $46

1/2 $5511/16

Low 311/16 333/8 363/8 421/16

1997: High 24 267/8 30 35

Low 191/2 221/8 257/16 275/16

Dividends declared per common share:

1998 $ 0.0550 $ 0.0550 $ 0.0575 $0.0575

1997 0.0550 0.0550 0.0550 0.0550

Number of registered common shareholders at year-end:

1998 10,500