CVS 1998 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1998 Financial Report

27

Store opening and closing costs ~ New store opening

costs are charged directly to expense when incurred. When

the Company closes a store, the estimated unrecoverable

costs, including the remaining lease obligation, are charged

to expense in the year of the closing.

Advertising costs ~ External costs incurred to produce

media advertising are expensed when the advertising takes

place.

Income taxes ~ Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to

differences between the carrying amount of assets and

liabilities for financial reporting purposes and the amounts

used for income tax purposes as well as for the deferred tax

effects of tax credit carryforwards. Deferred tax assets and

liabilities are measured using enacted tax rates expected to

apply to taxable income in the years in which those

temporary differences are expected to be recovered or

settled.

Stock-based compensation ~ During 1996, the

Company adopted Statement of Financial Accounting

Standards (“SFAS”) No. 123, “Accounting for Stock-Based

Compensation.” Under SFAS No. 123, companies can elect

to account for stock-based compensation using a fair value

based method or continue to measure compensation

expense using the intrinsic value method prescribed in

Accounting Principles Board Opinion (“APB”) No. 25,

“Accounting for Stock Issued to Employees.” The Company

has elected to continue to account for its stock-based com-

pensation plans under APB No. 25. See Note 7 for further

information about the Company’s stock incentive plans.

Insurance ~ The Company is self-insured up to certain

limits for general liability, workers compensation and

automobile liability claims. The Company accrues for

projected losses in the year the claim is incurred based on

actuarial assumptions followed in the insurance industry and

the Company’s past experience.

Use of estimates ~ The preparation of financial

statements in conformity with generally accepted accounting

principles requires management to make estimates and

assumptions that affect the reported amounts in the

consolidated financial statements and accompanying notes.

Actual results could differ from those estimates.

Reclassifications ~ Certain reclassifications have been

made to the consolidated financial statements of prior years

to conform to the current year presentation.

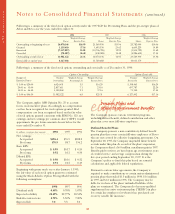

Earnings per common share ~ During the fourth

quarter of 1997, the Company adopted SFAS No. 128,

“Earnings Per Share” and restated previously reported

earnings per common share. Basic earnings per common

share is computed by dividing: (i) net earnings, after

deducting the after-tax dividends on the ESOP Preference

Stock, by (ii) the weighted average number of common

shares outstanding during the year (the “Basic Shares”).

Diluted earnings per common share normally assumes that

the ESOP Preference Stock is converted into common stock

and all dilutive stock options are exercised. Diluted earnings

per common share is computed by dividing: (i) net earnings,

after accounting for the difference between the current

dividends on the ESOP Preference Stock and the common

stock and after making adjustments for certain non-

discretionary expenses that are based on net earnings such as

incentive bonuses and profit sharing by (ii) Basic Shares plus

the additional shares that would be issued assuming that all

dilutive stock options are exercised and the ESOP Preference

Stock is converted into common stock. In 1997, the assumed

conversion of the ESOP Preference Stock would have

increased diluted earnings per common share and, therefore,

was not considered.

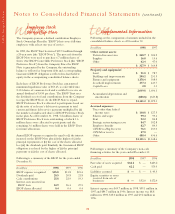

New accounting pronouncements ~ During 1998, the

Company adopted: (i) SFAS No. 130, “Reporting

Comprehensive Income,” which established standards for

the reporting and display of comprehensive income and its

components, (ii) SFAS No. 131, “Disclosures about

Segments of an Enterprise and Related Information,” which

requires companies to report financial information based on

how management internally organizes data to make

operating decisions and assess performance and (iii) SFAS

No. 132, “Employers’ Disclosures about Pensions and Other

Postretirement Benefits,” which revises the disclosure

requirements for pensions and other postretirement benefit

plans. Adoption of the above disclosure standards did not

affect the Company’s financial results. Comprehensive

income does not differ from the consolidated net earnings

presented in the accompanying consolidated statements of

operations.