CVS 1998 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1998 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

CVS Corporation

two

Business Combinations

Merger Transactions

On March 31, 1998, CVS completed a merger with Arbor

Drugs, Inc. (“Arbor”), pursuant to which 37.8 million shares

of CVS common stock were exchanged for all the outstanding

common stock of Arbor (the “CVS/Arbor Merger”). Each

outstanding share of Arbor common stock was exchanged for

0.6364 shares of CVS common stock. In addition, outstanding

Arbor stock options were converted at the same exchange

ratio into options to purchase 5.3 million shares of CVS

common stock.

On May 29, 1997, CVS completed a merger with Revco D.S.,

Inc. (“Revco”), pursuant to which 120.6 million shares of

CVS common stock were exchanged for all the outstanding

common stock of Revco (the “CVS/Revco Merger”). Each

outstanding share of Revco common stock was exchanged for

1.7684 shares of CVS common stock. In addition, outstanding

Revco stock options were converted at the same exchange

ratio into options to purchase 6.6 million shares of CVS

common stock.

The CVS/Arbor Merger and CVS/Revco Merger (collectively,

the “Mergers”) constituted tax-free reorganizations and have

been accounted for as pooling of interests under Accounting

Principles Board Opinion No. 16, “Accounting for Business

Combinations.” Accordingly, all prior period financial

statements presented have been restated to include the

combined results of operations, financial position and cash

flows of Arbor and Revco as if they had always been owned

by CVS.

Prior to the Mergers, Arbor’s fiscal year ended on July 31

and Revco’s fiscal year ended on the Saturday closest to May

31. These fiscal year-ends have been restated to a December

31 year-end to conform to CVS’ fiscal year-end. Arbor’s and

Revco’s cost of sales and inventories have been restated from

the last-in, first-out method to the first-in, first-out method

to conform to CVS’ accounting method for inventories. The

impact of the restatement was to increase earnings from

continuing operations by $0.5 million in 1998, $1.2 million

in 1997 and $15.5 million in 1996.

There were no material transactions between CVS, Arbor

and Revco prior to the Mergers. Certain reclassifications

have been made to Arbor’s and Revco’s historical stand-

alone financial statements to conform to CVS’ presentation.

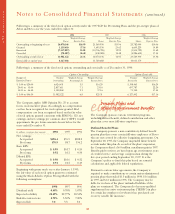

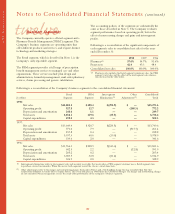

Following are the results of operations for the separate

companies prior to the Mergers and the combined amounts

presented in the consolidated financial statements:

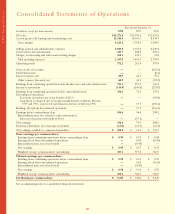

Three Months Ended Years Ended

March 28, March 29, December 31,

In millions 1998 1997 1997 1996

Net sales:

CVS $3,333.6 $1,515.0 $12,738.2 $ 5,528.1

Arbor 267.9 237.0 1,011.4 886.8

Revco — 1,645.8 — 5,416.7

$3,601.5 $3,397.8 $13,749.6 $11,831.6

Earnings from

continuing operations:

CVS $ 121.3 $ 58.5 $ 37.3 $ 239.6

Arbor 10.7 9.4 39.2 31.6

Revco — 24.2 — 101.2

$ 132.0 $ 92.1 $ 76.5 $ 372.4

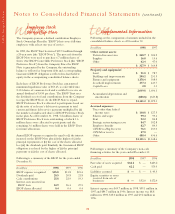

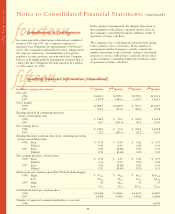

Purchase Transactions

On December 23, 1996, the Company completed the cash

purchase of Big B, Inc. (“Big B”) by acquiring all the outstanding

shares of Big B common stock. The aggregate transaction value,

including the assumption of $49.3 million of Big B debt, was

$423.2 million. The Big B acquisition was accounted for as a

purchase business combination. The resulting excess of purchase

price over net assets acquired, $248.9 million, is being amortized

on a straight-line basis over 40 years. For financial reporting

purposes, Big B’s results of operations have been included in the

consolidated financial statements since November 16, 1996.

The Company also acquired other retail drugstore businesses

that were accounted for as purchase business combinations.

These acquisitions did not have a material effect on the consoli-

dated financial statements either individually or in the aggregate.

The results of operations of these companies have been

included in the consolidated financial statements since their

respective dates of acquisition.

Notes to Consolidated Financial Statements (continued)