Brother International 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

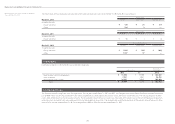

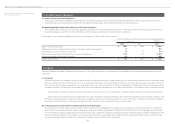

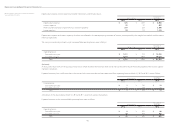

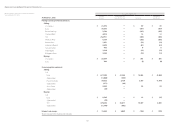

Year ended March 31, 2012 A reconciliation between the normal effective statutory tax rates and the actual effective tax rates reflected in the accompanying consolidated statements of income for the

years ended March 31, 2012 and 2011 was as follows:

2012 2011

Normal effective statutory tax rate 40.50% 40.10%

Expenses not deductible for income tax purposes 2.56 6.40

Revenues not recognized for income tax purposes (0.45) (1.24)

Lower income tax rates applicable to income in certain foreign countries (8.80) (7.36)

Tax credit for R&D expenses (1.26) (4.10)

Tax sparing credit (0.49) (0.23)

Net change in valuation allowance 8.10 (10.32)

Undistributed earnings of foreign subsidiaries 2.30 1.76

Other – net 0.29 (0.35)

Actual effective tax rate 42.75% 24.66%

On December 2, 2011, new tax reform laws were enacted in Japan, which decreased effective statutory tax rate effective for the fiscal year on and after April 1, 2012. The

effect of this change was immaterial to the Group.

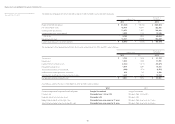

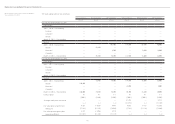

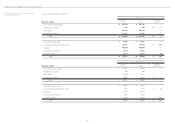

13. R&D Costs

R&D costs charged to income were ¥39,232 million ($478,439 thousand) and ¥36,253 million for the years ended March 31, 2012 and 2011, respectively.

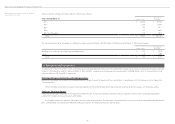

14. Leases

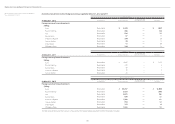

(As lessee)

The Group leases certain buildings and structures, furniture and fixtures, machinery and vehicles.

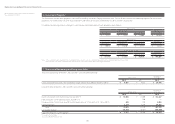

Total rental expense of finance leases, except for those cases in which the ownership of the leased assets is transferred to the lessee, amounted to ¥1,044 million ($12,732

thousand) and ¥4,054 million for the years ended March 31, 2012 and 2011, respectively. Sublease payments, in the amount of ¥369 million ($4,500 thousand) and ¥2,248

million, were included in the amounts for the years ended March 31, 2012 and 2011, respectively.

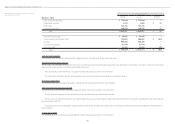

Pro forma information of leased property whose lease inception was before March 31, 2008

ASBJ Statement No.13, “Accounting Standard for Lease Transactions” requires that all finance lease transactions be capitalized to recognize lease assets and lease obligations

in the balance sheet. However, ASBJ Statement No.13 permits leases without ownership transfer of the leased property to the lessee whose lease inception was before

March 31, 2008 to continue to be accounted for as operating lease transactions if certain “as if capitalized” information is disclosed in the note to the financial statements.

The Group applied the ASBJ Statement No.13 effective April 1, 2008 and accounted for such leases as operating lease transactions. Pro forma information of leased prop-

erty whose lease inception was before March 31, 2008 was as follows: