Brother International 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

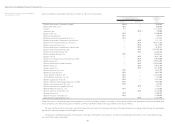

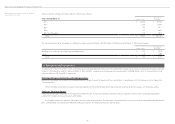

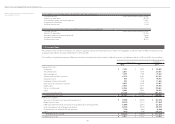

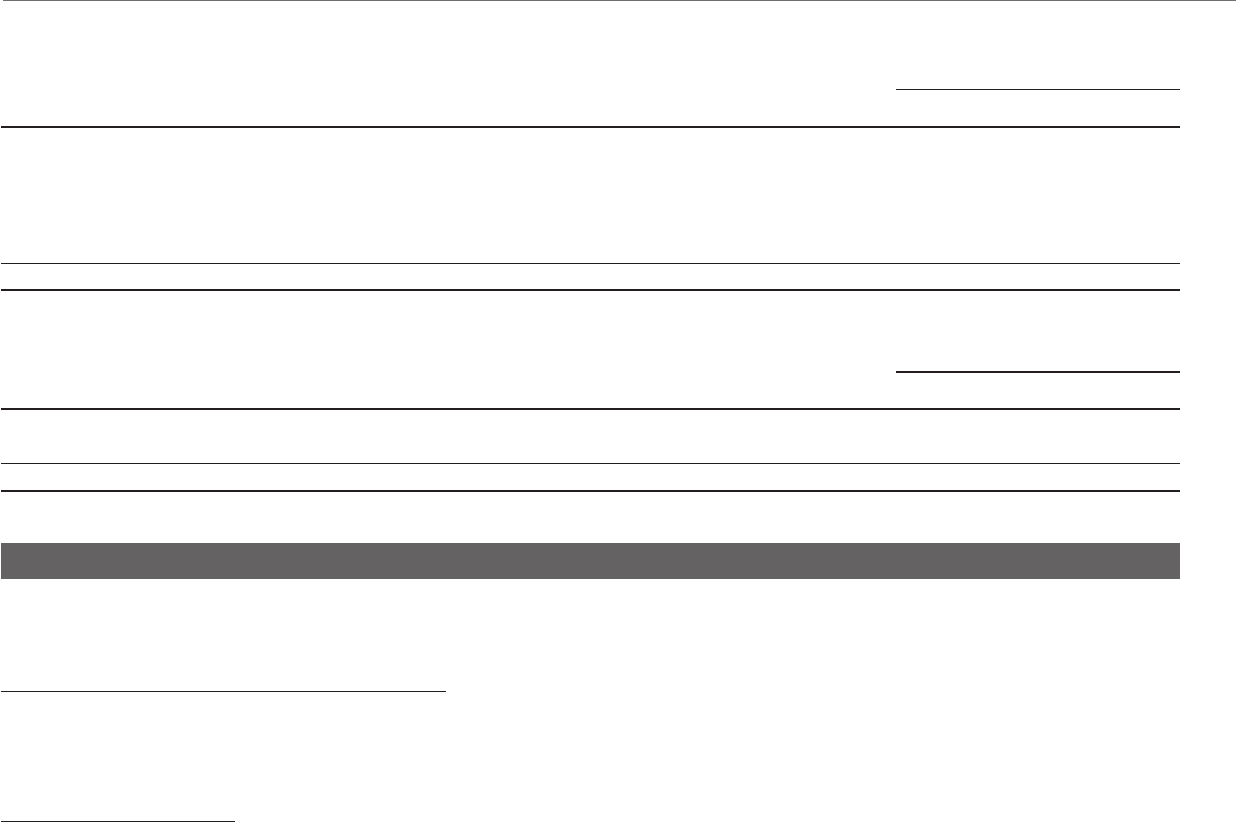

Year ended March 31, 2012 Annual maturities of long-term debt at March 31, 2012 were as follows:

Years ending M arch 31 Millions of Yen

Thousands of

U.S. Dollars

2013 ¥ 16,363 $ 199,549

2014 1,202 14,659

2015 313 3,817

2016 221 2,695

2017 and thereafter 575 7,012

Total ¥ 18,674 $ 227,732

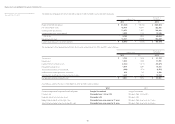

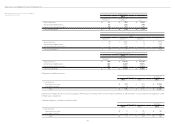

The carrying amounts of assets pledged as collateral for other long-term liabilities of ¥104 million ($1,268 thousand) at March 31, 2012 were as follows:

Millions of Yen

Thousands of

U.S. Dollars

Buildings and structures, net of accumulated depreciation ¥ 214 $ 2,610

Land 123 1,500

Total ¥ 337 $ 4,110

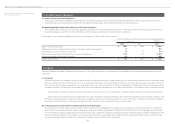

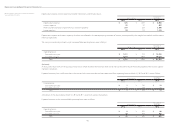

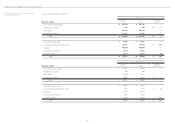

8. Retirement and Pension Plans

The liability for retirement benefits in the accompanying consolidated balance sheets consisted of retirement allowances for directors and corporate auditors of ¥106

million ($1,293 thousand) and ¥121 million at March 31, 2012 and 2011, respectively, and employees’ retirement benefits of ¥6,980 million ($85,122 thousand) and ¥7,528

million at March 31, 2012 and 2011, respectively.

Retirement Allowances for Directors and Corporate Auditors

Retirement allowances for directors and corporate auditors are paid subject to approval of the shareholders in accordance with the Companies Act of Japan (the

“Companies Act”).

Certain domestic consolidated subsidiaries recorded liabilities for their unfunded retirement allowance plan covering all of their directors and corporate auditors.

Employees’ Retirement Benefits

Under the pension plan, employees terminating their employment are, in most circumstances, entitled to pension payments based on their average pay during their

employment, length of service and certain other factors.

The Company and certain domestic subsidiaries have two types of pension plans for employees: a non-contributory and a contributory funded defined benefit pension

plan. Certain foreign subsidiaries have defined benefit pension plans and defined contribution pension plans.