Brother International 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

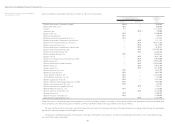

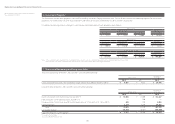

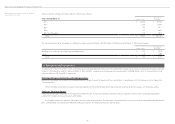

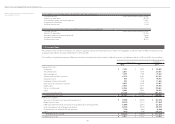

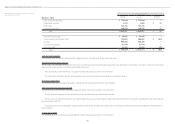

The liability for employees’ retirement benefits at March 31, 2012 and 2011 consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2012 2011 2012

Projected benefit obligation ¥ (51,533) ¥ (50,134) $ (628,451)

Fair value of plan assets 42,878 42,447 522,902

Unrecognized actuarial loss 11,875 11,621 144,818

Unrecognized prior service benefit 1,570 1,158 19,146

Net assets 4,790 5,092 58,415

Prepaid pension cost 11,771 12,620 143,549

Liability for employees’ retirement benefits ¥ (6,981) ¥ (7,528) $ (85,134)

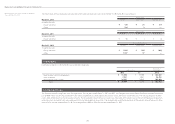

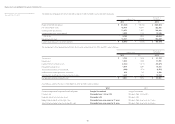

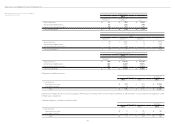

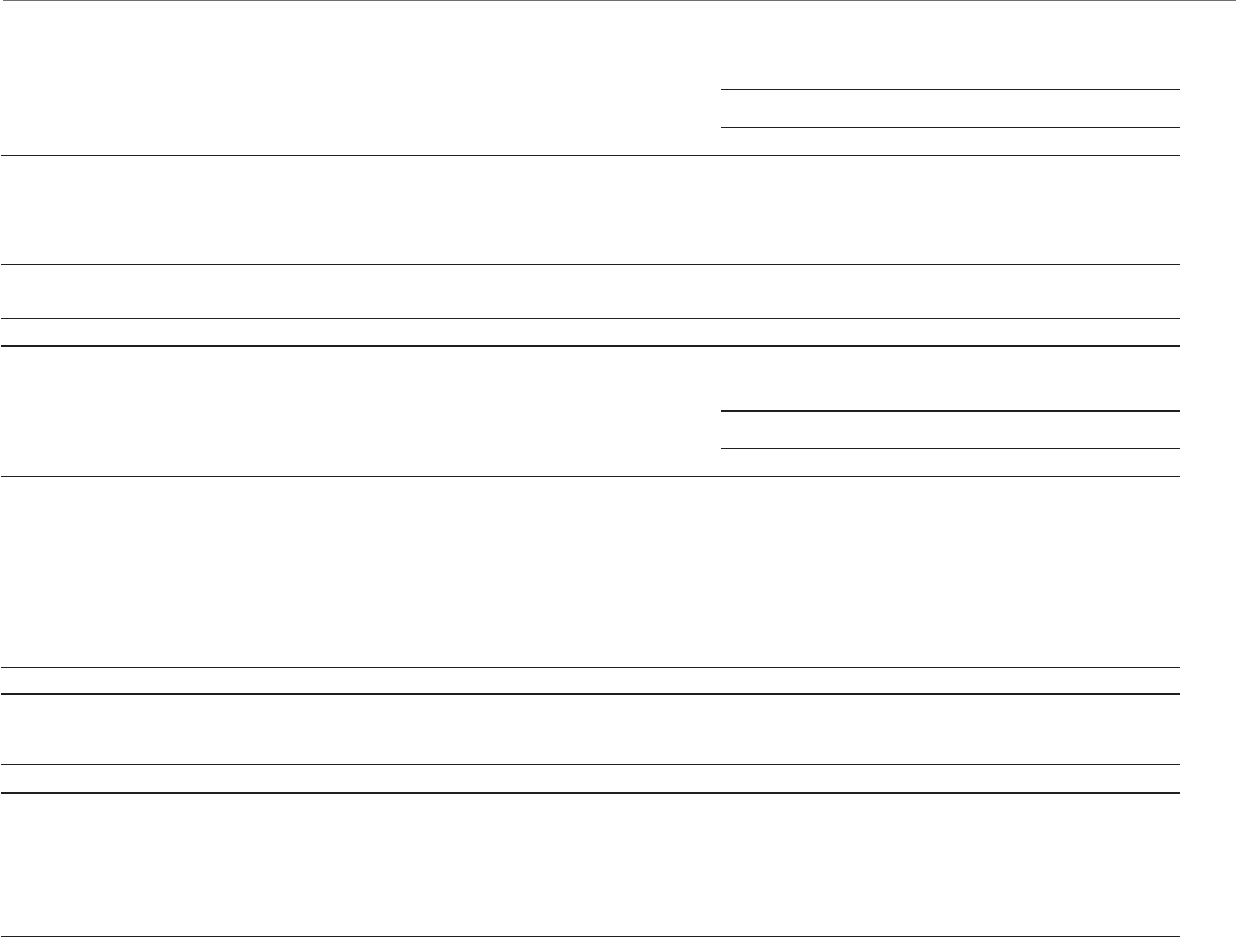

The components of net periodic benefit costs for the years ended March 31, 2012 and 2011 were as follows:

Millions of Yen

Thousands of

U.S. Dollars

2012 2011 2012

Service cost ¥ 1,733 ¥ 1,638 $ 21,134

Interest cost 1,463 1,434 17,841

Expected return on plan assets (1,531) (1,517) (18,671)

Recognized actuarial loss 1,618 2,201 19,732

Amortization of prior service benefit (404) (274) (4,927)

Additional retirement payments and others 213 147 2,598

Contribution to defined contribution pension plans 1,569 1,413 19,134

Net periodic retirement benefits cost ¥ 4,661 ¥ 5,042 $ 56,841

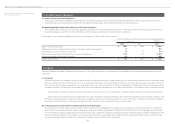

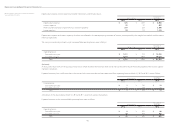

Assumptions used for the years ended March 31, 2012 and 2011 were as follows:

2012 2011

Periodic recognition of projected benefit obligation Straight-line method Straight-line method

Discount rate Principally from 1.5% to 2.0% Principally from 1.5% to 2.0%

Expected rate of return on plan assets Principally 3.0% Principally 3.0%

Recognition period of actuarial gain / loss Principally from seven years to 17 years Principally from seven years to 17 years

Amortization period of prior service benefit / cost Principally from seven years to 16 years Principally from seven years to 16 years

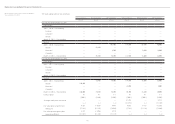

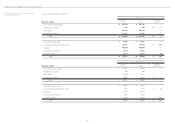

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2012