Brother International 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

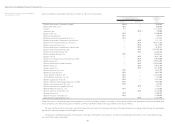

Cash flows from financing activities

Net cash used in financing activities totaled ¥14,118 million, ¥3,168 million more than ¥10,950 million used in the previous year. Interest-bearing debt resulted in

¥7,166 million in disbursements, ¥2,637 million more than in the previous year. Cash dividends paid used ¥6,450 million, ¥538 million more than in the previous year.

As a result of these activities, as well as the exchange rate fluctuations affecting the yen conversion value of cash and cash equivalents of overseas consolidated sub-

sidiaries, cash and cash equivalents as of March 31, 2012, amounted to ¥58,732 million, a decrease of ¥6,369 million over a year earlier.

Outlook for Fiscal 2012

We expect the business environment in fiscal 2012 to remain uncertain, despite the sense of a gradual recovery in the Americas, due to the slowdown seen in eco-

nomic growth in emerging countries such as China and Europe, where the impact of sovereign debt concerns persists.

Despite these conditions, the Brother Group has forecasted an increase in net sales year-on-year for fiscal 2012 thanks to continuing robust demand for the com-

pany’s products. Operating income will likely remain on par with the previous fiscal year due to the negative effect of exchange rates and rising depreciation expenses

from an increase in capital investments. Net income is expected to increase year-on-year thanks to an increase in foreign exchange profits and a decrease in corporate

income tax and other taxes owing to deferred tax accounting.

Business and Other Risk

The following items may impact Group businesses, operating performance and financial conditions. Forward-looking statements reflect the Group’s judgment as of

March 31, 2012.

(1) Market Competition

In printing and other operations, the Brother Group cultivates business in many markets where it faces stiff competition. Competitors could allocate more management

resources to their business than the Group does, new competitors could enter the market and competition could intensify as a result of alliances or collaboration

among competitors. As a result, the Group may be unable to maintain its current market share, adversely affecting Group performance.

(2) Acquisition of Human Resources

The Brother Group works to secure needed human resources for each function related to global expansion in projects, development, design, manufacturing, sales and

services. However, competition for human resources is rising. In the event that ongoing recruitment and employment of skilled human resources becomes more dif-

ficult, the Group may become unable to invest sufficient resources in research and development, which could lead to lowered competitiveness and stable supply of

products caused by a workforce shortage. These factors could in turn affect Group performance adversely.

(3) Intellectual Property Rights

We conduct business operations by concluding license agreements with other companies on patents and other intellectual property rights as necessary. The balance

of royalty revenues and payments based on such license agreements could cause fluctuations in the Group’s operating performance and also become constraints on

business operations depending on the terms of such agreements. Furthermore, there are limits to the degree to which proprietary technology acquired through

research and development can be protected, and the potential exists for third parties to infringe upon our intellectual property rights and manufacture and sell counter-

feit products. Other companies may file lawsuits against the Group with regard to intellectual property rights, which could affect the Group’s performance. The Group

provides appropriate rewards to in-house inventors based on the Invention Incentive Scheme. Despite this, there is the possibility of litigation with inventors over

compensation.

(4) Product Quality Control

To provide high-quality, attractive products, the Group has established a production management system with rigorous product quality control standards. However, not

all products are free from defects, and there is no guarantee that no problems will arise as a result of product safety or quality issues. In the event that significant prob-

lems arise, substantial costs may be incurred, brand image and reputation may deteriorate, and customer willingness to purchase Group products may fall, adversely

affecting Group’s performance.

(5) Exchange and Interest Rates

The Brother Group conducts a high percentage of its manufacturing and sales overseas, and exchange rate fluctuations could affect foreign currency transactions. To

reduce this risk and improve the link between foreign currency transaction receipts and payments, the Group utilizes forward exchange contracts and other instruments

to reduce short-term risk. However, currency appreciation in China, Southeast Asia or other regions where the Group operates major manufacturing facilities could

cause procurement and production costs to rise, and mid- to long-term exchange rate fluctuations could affect its financial condition.

Cash Flows from Operating Activities

Cash Flows from Investing Activities

Cash Flows from Financing Activities

-18.1 -20.0

-30.8

-32.2

-11.0 -14.1

-40

-15

10

35

60

50.3 49.5

39.3

Cash Flows

(¥ billion)

Fiscal years ended March 31

201220112010

Management’s Discussion and Analysis