Brother International 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

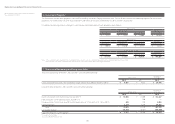

(Lessee)

Under the previous accounting standard, finance leases that deem to transfer ownership of the leased property to the lessee were to be capitalized. However, other finance

leases were permitted to be accounted for as operating lease transactions if certain “as if capitalized” information is disclosed in the note to the lessee’s financial statements.

The revised accounting standard requires that all finance lease transactions should be capitalized to recognize lease assets and lease obligations in the balance sheet. In

addition, the accounting standard permits leases which existed at the transition date and do not transfer ownership of the leased property to the lessee to be accounted

for as operating lease transactions.

(Lessor)

Under the previous accounting standard, finance leases that deem to transfer ownership of the leased property to the lessee were to be treated as sales. However, other

finance leases were permitted to be accounted for as operating lease transactions if certain “as if sold” information is disclosed in the note to the lessor’s financial state-

ments. The revised accounting standard requires that all finance leases that deem to transfer ownership of the leased property to the lessee should be recognized as lease

receivables, and all finance leases that deem not to transfer ownership of the leased property to the lessee should be recognized as investments in lease.

The Group applied the revised accounting standard effective April 1, 2008. In addition, the Group accounted for leases which existed at the transition date and do not

transfer ownership of the leased property to the lessee as operating lease transactions.

All other leases are accounted for as operating leases.

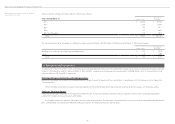

(19) Construction Contracts

In December 2007, the ASBJ issued ASBJ Statement No.15, “Accounting Standard for Construction Contracts” and ASBJ Guidance No.18, “Guidance on Accounting Standard

for Construction Contracts.”

Under this new accounting standard, the construction revenue and construction costs should be recognized by the percentage-of-completion method, if the outcome

of a construction contract can be estimated reliably. When total construction revenue, total construction costs and the stage of completion of the contract at the balance

sheet date can be reliably measured, the outcome of a construction contract can be estimated reliably. If the outcome of a construction contract cannot be reliably esti-

mated, the completed-contract method shall be applied. When it is probable that the total construction costs will exceed total construction revenue, an estimated loss on

the contract should be immediately recognized by providing for loss on construction contracts.

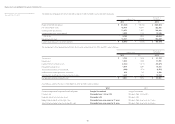

(20) Income Taxes

The provision for current income taxes is computed based on the pretax income included in the consolidated statements of income. The asset and liability approach is

used to recognize deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of

assets and liabilities. Deferred taxes are measured by applying currently enacted tax laws to the temporary differences.

(21) Foreign Currency Transactions

All short-term and long-term monetary receivables and payables denominated in foreign currencies are translated into Japanese yen at the exchange rates at the consoli-

dated balance sheet date. The foreign exchange gains and losses from translation are recognized in the consolidated statements of income to the extent that they are not

hedged by forward exchange contracts.

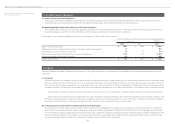

(22) Foreign Currency Financial Statements

The balance sheet accounts of the consolidated foreign subsidiaries are translated into Japanese yen at the current exchange rate as of the balance sheet date except for

equity, which is translated at the historical rate.

Differences arising from such translation are shown as “Foreign currency translation adjustments” in a separate component of the equity and included in minority

interests.

Revenue and expense accounts of consolidated foreign subsidiaries are translated into Japanese yen at the average exchange rate during the year.

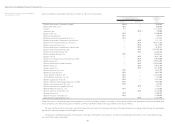

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2012