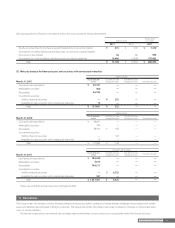

Brother International 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2011 and 2010

40 Brother Annual Report 2011

All revenues in the above table at March 31, 2011 and 2010 arose from sublease transactions.

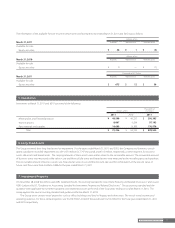

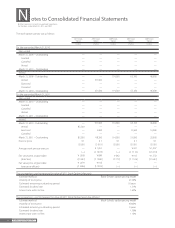

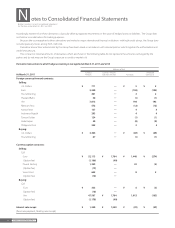

Expected revenues under noncancellable operating leases were as follows:

Millions of Yen

Thousands of

U.S. Dollars

2011 2010 2011

Operating leases:

Due within one year ¥ 201 ¥97$ 2,421

Due after one year 264 180 3,181

Total ¥ 465 ¥ 277 $ 5,602

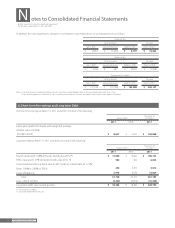

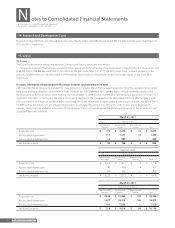

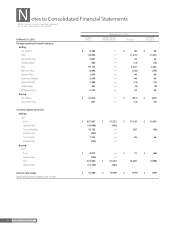

16. Financial Instruments and Related Disclosures

On March 10, 2008, the ASBJ revised ASBJ Statement No.10, “Accounting Standard for Financial Instruments” and issued ASBJ Guidance No.19,

“Guidance on Accounting Standard for Financial Instruments and Related Disclosures.” This accounting standard and the guidance are applicable

to financial instruments and related disclosures at the end of the fiscal years ending on or after March 31, 2010. The Group applied the revised

accounting standard and the new guidance effective March 31, 2010.

(1) Group policy for financial instruments

The Group uses financial instruments, mainly long-term debt including bank loans and bonds, based on its capital financing plan. Cash surpluses,

if any, are invested in low risk financial assets. Short-term bank loans are used to fund its ongoing operations. Derivatives are used, not for specula-

tive purposes, but to manage exposure to financial risks as described in (2) below.

(2) Nature and extent of risks arising from financial instruments

Receivables such as trade notes and trade accounts are exposed to customer credit risk. Although receivables in foreign currencies are exposed to

the market risk of fluctuation in foreign currency exchange rates, the position, net of payables in foreign currencies, is hedged by using forward

foreign currency contracts and currency option contracts.

Marketable and investment securities, mainly equity instruments of customers and suppliers of the Group, are exposed to the risk of market

price fluctuations.

Payment terms of payables, such as trade notes and trade accounts, are less than one year. Payables in foreign currencies are exposed to the

market risk of fluctuation in foreign currency exchange rates.

Bank loans are mainly used to fund ongoing operations. For the year ended March 31, 2011, the long-term portion of bank loans is borrowed

with fixed interest rate. For the year ended March 31, 2010, the long-term portion of bank loans was borrowed with variable interest rates and was

exposed to market risks from changes in variable interest rates, however, a part of those risks was mitigated by using derivatives of interest-rate

swaps.

The maturities of bonds are a year after the balance sheet date at maximum and are mainly used to fund plant and equipment investment.

Derivatives mainly include forward foreign currency contracts, currency option contracts, which are used to manage exposure to market risks

from changes in foreign currency exchange rates of receivables and payables, respectively. In addition, interest-rate swaps were also used to

manage exposure to market risks from changes in interest rates of bank loans for the year ended March 31, 2010. Please see Note 17 for more

detail about derivatives.

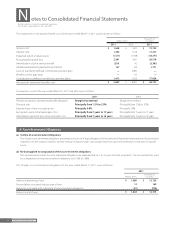

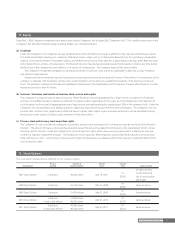

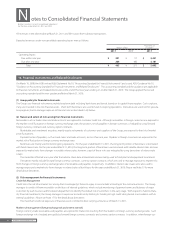

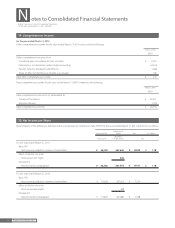

(3) Risk management for financial instruments

Credit Risk Management

Credit risk is the risk of economic loss arising from counterparty’s failure to repay or service debt according to the contractual terms. The Group

manages its credit risk from receivables on the basis of internal guidelines, which include monitoring of payment terms and balances of major

customers by each business administration department to identify the default risk of customers in the early stage. With respect to held-to-matu-

rity financial investments, the Group manages its exposure to credit risk by limiting its funding to high credit rating bonds in accordance with its

internal guidelines. Please see Note 17 for the detail about derivatives.

The maximum credit risk exposure of financial assets is limited to their carrying amounts as of March 31, 2011.

Market risk management (foreign exchange risk and interest rate risk)

Foreign currency trade receivables and payables are exposed to market risk resulting from fluctuations in foreign currency exchange rates. Such

foreign exchange risk is hedged principally by forward foreign currency contracts and currency option contracts. In addition, when foreign cur-

Notes to Consolidated Financial Statements