Brother International 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Brother Annual Report 2011

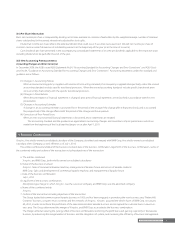

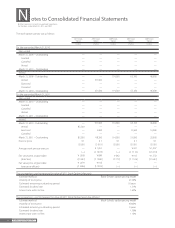

(24) Per Share Information

Basic net income per share is computed by dividing net income available to common shareholders by the weighted average number of common

shares outstanding for the period, retroactively adjusted for stock splits.

Diluted net income per share reflects the potential dilution that could occur if securities were exercised. Diluted net income per share of

common stock assumes full exercise of outstanding warrants at the beginning of the year (or at the time of issuance).

Cash dividends per share presented in the accompanying consolidated statements of income are dividends applicable to the respective years

including dividends to be paid after the end of the year.

(25) New Accounting Pronouncements

Accounting Changes and Error Correction

In December 2009, the ASBJ issued ASBJ Statement No.24, “Accounting Standard for Accounting Changes and Error Corrections” and ASBJ Guid-

ance No.24, “Guidance on Accounting Standard for Accounting Changes and Error Corrections.” Accounting treatments under this standard and

guidance are as follows:

(1) Changes in Accounting Policies

When a new accounting policy is applied with revision of accounting standards, the new policy is applied retrospectively unless the revised

accounting standards include specific transitional provisions. When the revised accounting standards include specific transitional provi-

sions, an entity shall comply with the specific transitional provisions.

(2) Changes in Presentations

When the presentation of financial statements is changed, prior period financial statements are reclassified in accordance with the new

presentation.

(3) Changes in Accounting Estimates

A change in an accounting estimate is accounted for in the period of the change if the change affects that period only, and is accounted

for prospectively if the change affects both the period of the change and future periods.

(4) Corrections of Prior Period Errors

When an error in prior period financial statements is discovered, those statements are restated.

This accounting standard and the guidance are applicable to accounting changes and corrections of prior period errors which are

made from the beginning of the fiscal year that begins on or after April 1, 2011.

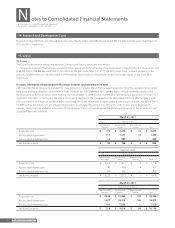

3. Business Combinations

Xing Inc., the wholly-owned consolidated subsidiary of the Company, absorbed and merged with BMB Corp., the wholly-owned consolidated

subsidiary of the Company, as well, effective as of July 1, 2010.

The entities combined and detail of the business involved, date of the business combination, legal form of the business combination, name of

the combined entity and outline of the transaction including objectives of the transaction

a. The entities combined

Xing Inc. and BMB Corp., both wholly-owned consolidated subsidiaries

b. Detail of the business involved

Xing Inc.: Sales of commercial karaoke machine, management of karaoke house and service of karaoke contents

BMB Corp.: Sales and development of commercial karaoke machine, and management of karaoke house

c. Date of the business combination

July 1, 2010

d. Legal form of the business combination

Absorption-type merger in which Xing Inc. was the successor company and BMB Corp. was the absorbed company

e. Name of the combined entity

Xing Inc.

f . Outline of the transaction including objectives of the transaction

The Group started telecommunication karaoke business in 1992 and has been engaged in promoting the new business area, “Network &

Contents” business, using the music contents and the networks of Xing Inc. Xing Inc. acquired the whole shares of BMB Corp. on January

20, 2010, in order to reinforce the profit basis of the telecommunication karaoke business and to expand the customer basis in new busi-

ness area. The Group determined the merger of Xing Inc. and BMB Corp. to accelerate the business combination.

The merger aimed at realizing the synergy effect of business combination, reinforcing the profit basis, and gaining superiority in the karaoke

business, by advancing the reorganization of business and the integration of system, and increasing the efficiency of business management.