Brother International 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Brother Annual Report 2011

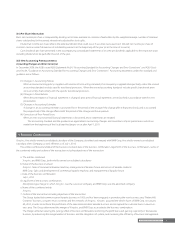

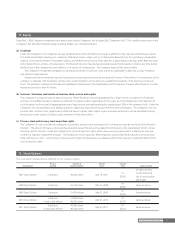

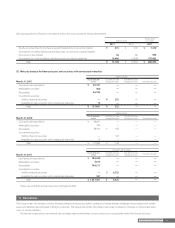

Annual maturities of long-term debt at March 31, 2011 were as follows:

Year ending March 31 Millions of Yen

Thousands of

U.S. Dollars

2012 ¥ 3,422 $ 41,229

2013 16,565 199,578

2014 684 8,241

2015 447 5,386

2016 and thereafter 610 7,349

Total ¥ 21,728 $ 261,783

The carrying amounts of assets pledged as collateral for other long-term liabilities of ¥157 million ($1,892 thousand) at March 31, 2011 were

as follows:

Millions of Yen

Thousands of

U.S. Dollars

Buildings and structures,

net of accumulated depreciation ¥ 228 $ 2,747

Land 123 1,482

Total ¥ 351 $ 4,229

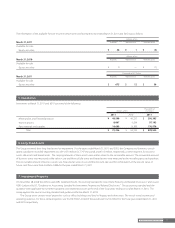

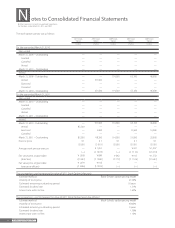

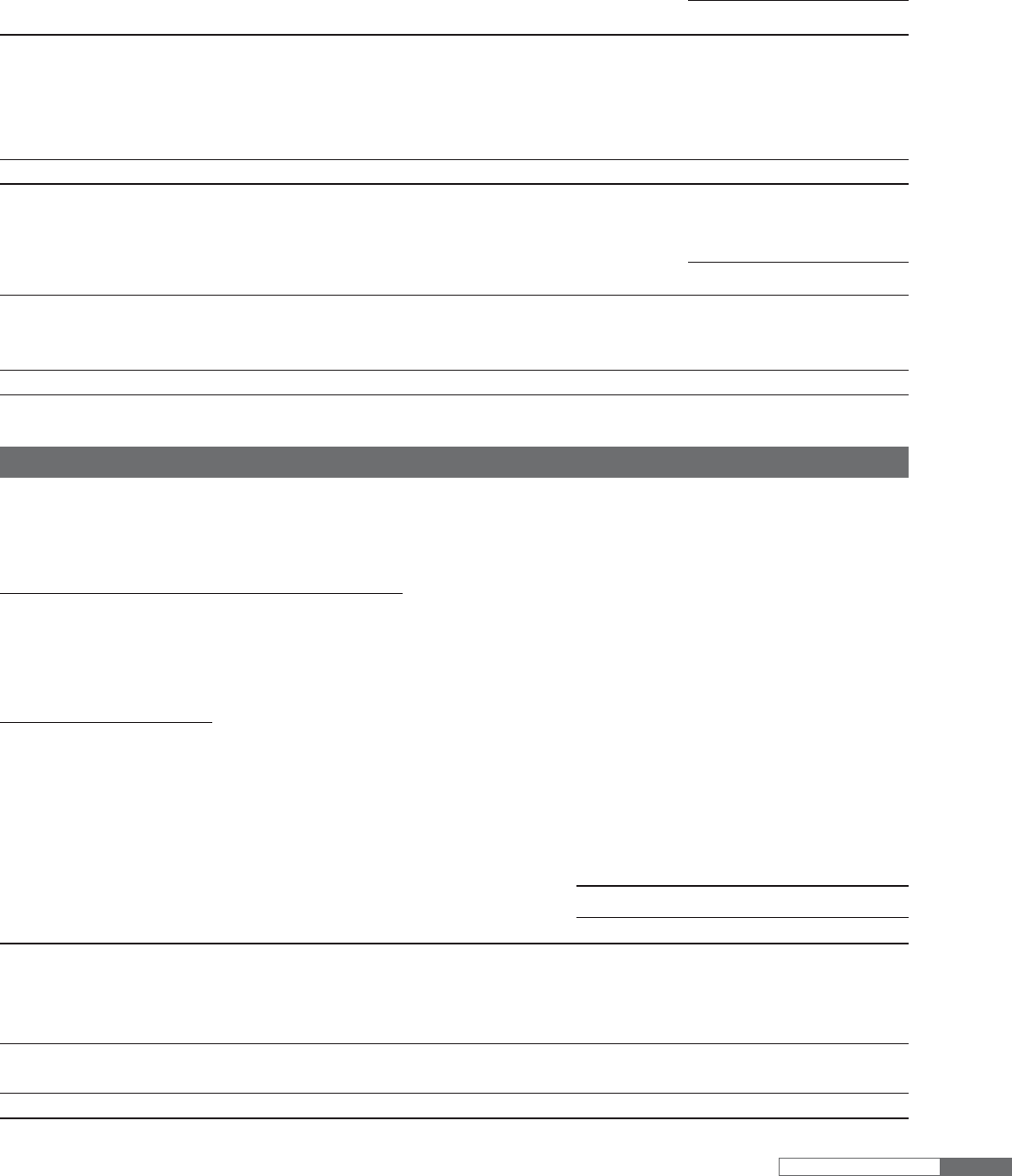

9. Retirement and Pension Plans

The liability for retirement benefits in the accompanying consolidated balance sheets consisted of retirement allowances for directors and corpo-

rate auditors of ¥121 million ($1,458 thousand) and ¥156 million at March 31, 2011 and 2010, respectively, and employees’ retirement benefits of

¥7,528 million ($90,699 thousand) and ¥7,032 million at March 31, 2011 and 2010, respectively.

Retirement Allowances for Directors and Corporate Auditors

Retirement allowances for directors and corporate auditors are paid subject to approval of the shareholders in accordance with the Companies Act

of Japan.

Certain domestic consolidated subsidiaries recorded liabilities for their unfunded retirement allowance plan covering all of their directors and

corporate auditors.

Employees’ Retirement Benefits

Under the pension plan, employees terminating their employment are, in most circumstances, entitled to pension payments based on their aver-

age pay during their employment, length of service and certain other factors.

The Company and certain domestic subsidiaries had two types of pension plans for employees: a non-contributory and a contributory funded

defined benefit pension plan. The Company and certain domestic subsidiaries applied accounting treatments specified in the guidance as

described in Note 2(14). Certain foreign subsidiaries have defined benefit pension plans and defined contribution pension plans.

The liability for employees’ retirement benefits at March 31, 2011 and 2010 consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2011 2010 2011

Projected bene t obligation ¥ (50,134) ¥ (52,374) $ (604,024)

Fair value of plan assets 42,447 44,610 511,410

Unrecognized actuarial loss 11,621 14,395 140,012

Unrecognized prior service bene t 1,158 (257) 13,951

Net asset 5,092 6,374 61,349

Prepaid pension cost 12,620 13,406 152,048

Liability for employees’ retirement bene ts ¥ (7,528) ¥ (7,032) $ (90,699)