Brother International 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Overview

Looking back at the state of the economy during the period under review, emerging economies,

particularly China, stayed strong on the back of increasing domestic demand, while developed

economies followed a recovery trend as a whole, despite a slowdown due to fiscal concerns in the

euro zone. In Japan, in spite of signs of moderate economic recovery, the yen’s continued appreciation

throughout the year, coupled with the massive damage from the Great East Japan Earthquake that

occurred on March 11, 2011, has given rise to uncertainties about the future.

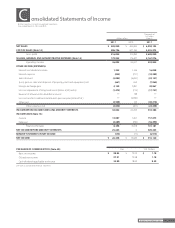

Under these circumstances, the Brother Group’s consolidated net sales increased 12.7% over the

previous year to ¥502,830 million primarily because of substantially higher sales of machine tools and

industrial sewing machines following sharp market recovery, despite the negative effect of the stronger

yen. Although there was the negative effect of exchange rates and cost increase of raw materials,

substantially higher sales and improving sales composition pushed up operating income by 35.5% year-

on-year to ¥36,092 million. Net income chalked up a year-on-year increase of 33.7% to ¥26,238 million.

Performance by Business Segment

For details about performance by business segment, please see “Review of Operations,” Pages 10-11.

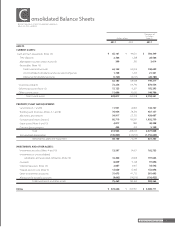

Fund Procurement, Liquidity and Cash Flows

The Brother Group’s financial policies ensure flexible and efficient funding and maintain an appropriate

level of liquidity for current and future operating activities. In accordance with these policies, we have

created a cash management system to optimize the group-wide use of cash held by individual

companies. We also maintain open lines of credit with several banking institutions to complement

existing liquidity on hand. Through these measures, we have established a system to correct the

uneven distribution of funds and minimize the overall borrowing needs of the Group.

Liquidity Management

The Group’s liquidity on hand consists of cash and cash equivalents and the unused portion of open

commitment lines of credit. As of March 31, 2011, cash and cash equivalents totaled ¥65,101 million.

We maintain commitment lines of credit with several financial institutions for a combined amount of

¥30,000 million, and the entire amount in open lines of credit was unused as of March 31, 2011. This

total plus cash and cash equivalents was ¥95,101 million at fiscal year-end. Taking into consideration

seasonal funding requirements, debt payable within one year and business environment risks, we

believe that we have sufficient liquidity on hand to support our operations through a whole year.

Fund Procurement

As a basic rule, we procure working capital and other short-term funding in debt payable within one

year that is funded with local currency. The basic policy on long-term funding for manufacturing

facilities is that funds should come from internal reserves, long-term fixed-rate borrowings and

corporate bonds. As of March 31, 2011, short-term borrowings stood at ¥8,637 million, primarily

denominated in yen. The balance of long-term debt (including current portion of long-term debt

within one year) was ¥21,728 million, all procured in fixed-rate debt procured in yen. Outstanding

corporate bonds stood at ¥15,500 million.

We have obtained credit ratings from Rating and Investment Information, Inc. (R&I). As of March 31,

2011, R&I assigned the Group’s long-term bonds and issuer credit “A” ratings and its commercial paper

an “a-1” rating. We consider consistent ratings important in maintaining our access to credit and

capital markets.

The Brother Group believes that its liquidity on hand, including open commitment lines of credit,

and sound corporate finance structure, on top of its ability to generate cash flows from operating

activities, make it possible to secure working capital as well as funds for capital investment and R&D

investment to maintain the Group’s growth.

Cash Flows

Cash flows from operating activities

Cash flows from operating activities provided net cash and cash equivalents amounting to ¥49,489

million, ¥859 million less than ¥50,348 million in the previous year. This was primarily because of

increases in inventories and income taxes-paid despite an increase in income before income taxes and

minority interests.

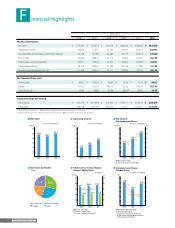

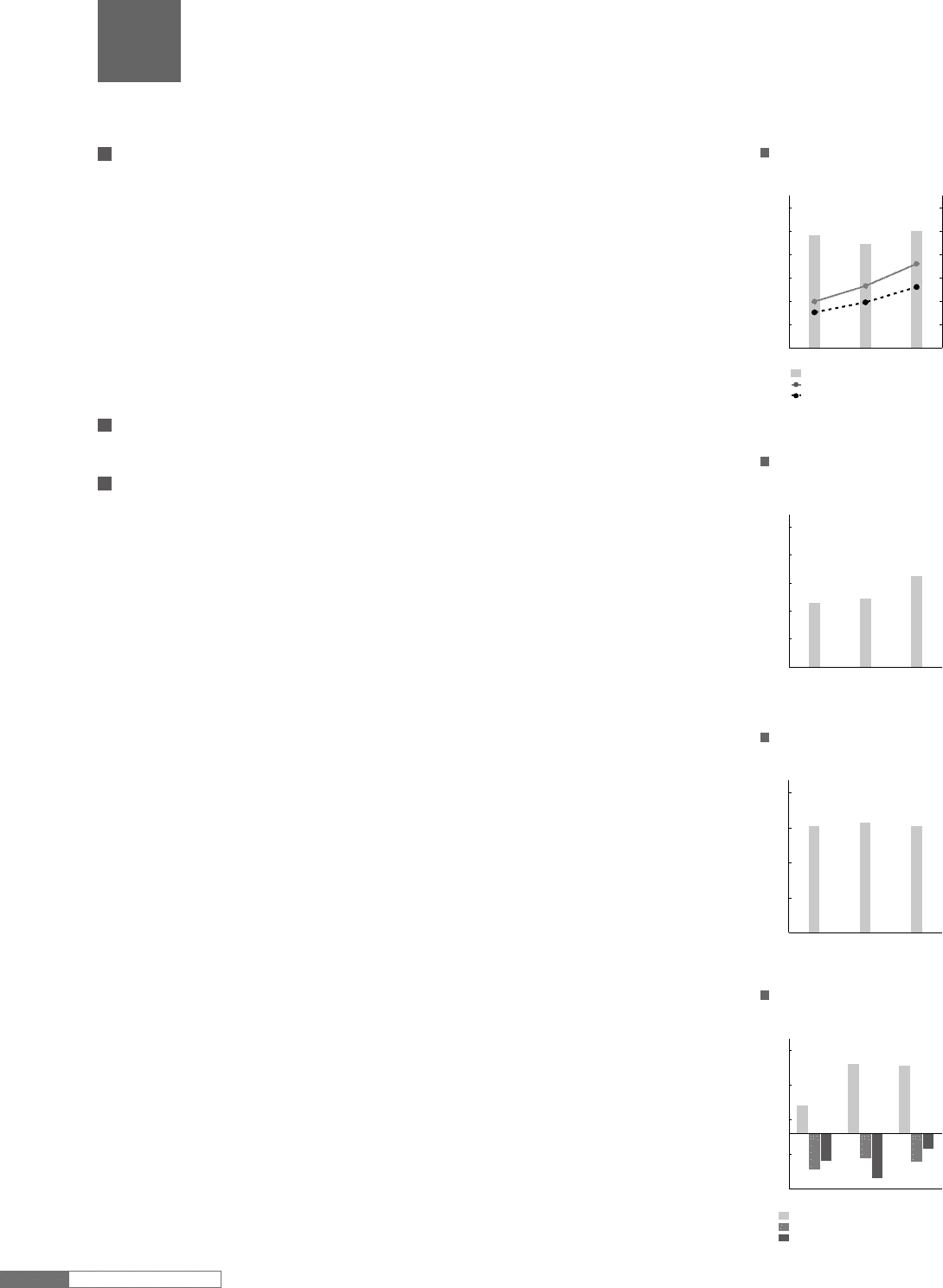

Net sales (left)

Operating income (right)

Net income (right)

Operating Results

(¥ billion) (¥ billion)

482.2 446.3

502.8

0

100

200

300

400

500

600

201120102009 0

10

20

30

40

50

60

19.9

26.6

36.1

15.3

19.6

26.2

Fiscal years ended March 31

Cash and Cash Equivalents,

End of Year

(¥ billion)

65.1

46.1 49.0

As of March 31

0

20

40

60

80

100

201120102009

Cash Flows from Operating Activities

Cash Flows from Investing Activities

Cash Flows from Financing Activities

-11.0

-26.2

-18.1 -20.0

-19.5

-32.2

-40

-15

10

35

60 49.5

20.5

50.3

Cash Flows

Fiscal years ended March 31

201120102009

(¥ billion)

Interest-bearing Debt

30.4 31.5 30.4

As of March 31

0

10

20

30

40

201120102009

(¥ billion)

anagement’s Discussion and Analysis

M

14 Brother Annual Report 2011