Brother International 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

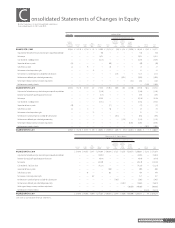

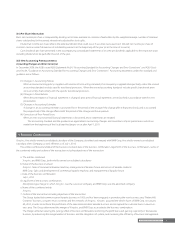

Brother Industries, Ltd. and Consolidated Subsidiaries

Years ended March 31, 2011 and 2010

21

Brother Annual Report 2011

Thousands Millions of Yen

Accumulated other comprehensive income (loss)

Number of

Shares of

Common Stock

Outstanding

Common

Stock

Capital

Surplus

Stock

Acquisition

Rights

Retained

Earnings

Treasury

Stock

Unrealized

Gain (Loss) on

Available-for-

sale

Securities

Deferred

Gain (Loss)

Under

Hedge

Accounting

Foreign

Currency

Translation

Adjustments Total

Minority

Interests

Total

Equity

BALANCE, APRIL 1, 2009 267,649 ¥ 19,210 ¥ 16,134 ¥ 195 ¥ 197,083 ¥ (11,672) ¥ (30) ¥ 3,114 ¥ (27,048) ¥ 196,986 ¥ 2,385 ¥ 199,371

Adjustment of retained earnings due to change in scope of consolidation — — — — 310 — — — — 310 — 310

Net income — — — — 19,629 — — — — 19,629 — 19,629

Cash dividends, ¥ 20.00 per share — — — — (5,375) — — — — (5,375) — (5,375)

Acquisition of treasury stock (39) — — — — (40) — — — (40) — (40)

Sale of treasury stock 24 — 15 — — 10 — — — 25 — 25

Net increase in stock acquisition rights — — — 92 — — — — — 92 — 92

Net increase in unrealized gain on available-for-sale securities — — — — — — 3,128 — — 3,128 — 3,128

Net decrease in deferred gain under hedge accounting — — — — — — — (2,013) — (2,013) — (2,013)

Net change in foreign currency translation adjustments — — — — — — — — (232) (232) — (232)

Net decrease in minority interests — — — — — — — — — — (1,363) (1,363)

BALANCE, MARCH 31, 2010 267,634 19,210 16,149 287 211,647 (11,702) 3,098 1,101 (27,280) 212,510 1,022 213,532

Adjustment of retained earnings due to change in scope of consolidation — — — — (1,246) — — — — (1,246) — (1,246)

Decrease due to split-off type of corporate divestiture — — — — (375) — — — — (375) — (375)

Net income — — — — 26,238 — — — — 26,238 — 26,238

Cash dividends, ¥ 22.00 per share — — — — (5,912) — — — — (5,912) — (5,912)

Acquisition of treasury stock (20) — — — — (17) — — — (17) — (17)

Sale of treasury stock 34 — 8 — — 30 — — — 38 — 38

Net increase in stock acquisition rights — — — 52 — — — — — 52 — 52

Net decrease in unrealized gain on available-for-sale securities — — — — — — (653) — — (653) — (653)

Net decrease in deferred gain under hedge accounting — — — — — — — (1,192) — (1,192) — (1,192)

Net change in foreign currency translation adjustments — — — — — — — — (8,981) (8,981) — (8,981)

Net decrease in minority interests — — — — — — — — — — (1,015) (1,015)

BALANCE, MARCH 31, 2011 267,648 ¥ 19,210 ¥ 16,157 ¥ 339 ¥ 230,352 ¥ (11,689) ¥ 2,445 ¥ (91) ¥ (36,261) ¥ 220,462 ¥ 7 ¥ 220,469

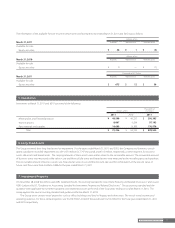

Thousands of U.S. Dollars (Note 1)

Accumulated other comprehensive income (loss)

Common

Stock

Capital

Surplus

Stock

Acquisition

Rights

Retained

Earnings

Treasury

Stock

Unrealized

Gain (Loss) on

Available-for-

sale

Securities

Deferred

Gain (Loss)

Under

Hedge

Accounting

Foreign

Currency

Translation

Adjustments Total

Minority

Interests

Total

Equity

BALANCE, MARCH 31, 2010 $ 231,446 $ 194,567 $ 3,457 $ 2,549,964 $ (140,988) $ 37,325 $ 13,265 $ (328,675) $ 2,560,361 $ 12,313 $ 2,572,674

Adjustment of retained earnings due to change in scope of consolidation — — — (15,012) — — — — (15,012) — (15,012)

Decrease due to split-off type of corporate divestiture — — — (4,518) — — — — (4,518) — (4,518)

Net income — — — 316,120 — — — — 316,120 — 316,120

Cash dividends, $ 0.27 per share — — — (71,229) — — — — (71,229) — (71,229)

Acquisition of treasury stock — — — — (205) — — — (205) — (205)

Sale of treasury stock — 96 — — 362 — — — 458 — 458

Net increase in stock acquisition rights — — 627 — — — — — 627 — 627

Net decrease in unrealized gain on available-for-sale securities — — — — — (7,867) — — (7,867) — (7,867)

Net decrease in deferred gain under hedge accounting — — — — — — (14,361) — (14,361) — (14,361)

Net change in foreign currency translation adjustments ——— — ——

— (108,205) (108,205) — (108,205)

Net decrease in minority interests ——— — ——

——— (12,229) (12,229)

BALANCE, MARCH 31, 2011 $ 231,446 $ 194,663 $ 4,084 $ 2,775,325 $ (140,831) $ 29,458 $ (1,096) $ (436,880) $ 2,656,169 $ 84 $ 2,656,253

See notes to consolidated financial statements.

Consolidated Statements of Changes in Equity