Brother International 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

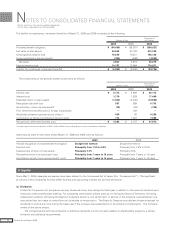

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2009 and 2008

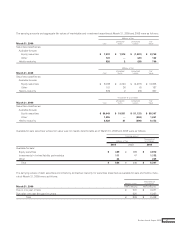

The stock option activity was as follows:

2009 Stock

Option

2008 Stock

Option

2007 Stock

Option

(shares) (shares) (shares)

For the year ended March 31, 2008

Non-vested

March 31, 2007 – Outstanding — — —

Granted —— —

Canceled —— —

Vested —— —

March 31, 2008 – Outstanding — — —

Vested

March 31, 2007 - Outstanding — — 46,000

Vested — 65,100 —

Exercised —— —

Canceled —— —

March 31, 2008 – Outstanding — 65,100 46,000

For the year ended March 31, 2009

Non-vested

March 31, 2008 – Outstanding — — —

Granted —— —

Canceled —— —

Vested —— —

March 31, 2009 – Outstanding — — —

Vested

March 31, 2008 - Outstanding — 65,100 46,000

Vested 114,500 — —

Exercised —— —

Canceled —— —

March 31, 2009 – Outstanding 114,500 65,100 46,000

Exercise price ¥ 1 ¥ 1 ¥ 1

($ 0.010) ($ 0.010) ($ 0.010)

Average stock price at exercise ¥ — ¥ — ¥ —

($ —) ($ —) ($ —)

Fair value price at grant date ¥ 642 ¥ 915 ¥ 1,350

($ 6.551) ($ 9.337) ($ 13.776)

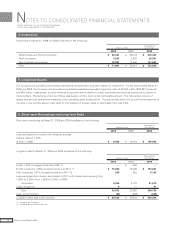

The assumptions used to measure fair value of 2008 Stock Option

Estimate method: Black-Scholes option pricing model

Volatility of stock price: 38.62%

Estimated remaining outstanding period: 9 years

Estimated dividend rate: 1.24%

Interest rate with risk free: 1.09%

The assumptions used to measure fair value of 2009 Stock Option

Estimate method: Black-Scholes option pricing model

Volatility of stock price: 43.17%

Estimated remaining outstanding period: 10 years

Estimated dividend rate: 1.34%

Interest rate with risk free: 1.29%

32 Brother Annual Report 2009