Brother International 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

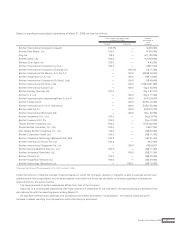

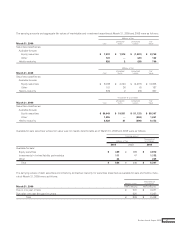

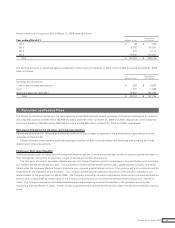

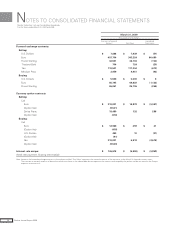

The liability for employees’ retirement benefits at March 31, 2009 and 2008 consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2009 2008 2009

Projected benefit obligation ¥ (54,490) ¥ (58,387) $ (556,021)

Fair value of plan assets 40,552 51,783 413,796

Unrecognized actuarial loss 19,220 10,531 196,122

Unrecognized prior service benefit (355) (409) (3,622)

Net asset 4,927 3,518 50,275

Prepaid pension cost 10,787 10,064 110,071

Liability for employees’ retirement benefits ¥ (5,860) ¥ (6,546) $ (59,796)

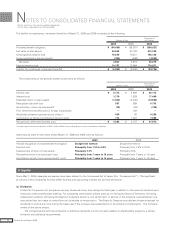

The components of net periodic benefit costs were as follows:

Millions of Yen

Thousands of

U.S. Dollars

2009 2008 2009

Service cost ¥ 2,173 ¥ 2,808 $ 22,173

Interest cost 1,710 1,529 17,449

Expected return on plan assets (1,822) (2,043) (18,592)

Recognized actuarial loss 897 589 9,153

Amortization of prior service benefit (78) (58) (796)

Prior retirement benefits cost in foreign subsidiaries — 192 —

Additional retirement payments and others * 430 83 4,388

Contribution to defined contribution pension plans 774 1,037 7,898

Net periodic retirement benefits cost ¥ 4,084 ¥ 4,137 $ 41,673

*Includes special termination benefits of ¥327 million ($3,337 thousand) paid by a certain consolidated subsidiary.

Assumptions used for the years ended March 31, 2009 and 2008 were as follows:

2009 2008

Periodic recognition of projected benefit obligation Straight-line method Straight-line method

Discount rate Principally from 1.5% to 2.0% Principally from 1.5% to 2.0%

Expected rate of return on plan assets Principally 3.0% Principally 3.0%

Recognition period of actuarial gain / loss Principally from 7 years to 16 years Principally from 7 years to 15 years

Amortization period of prior service benefit / cost Principally from 7 years to 14 years Principally from 7 years to 14 years

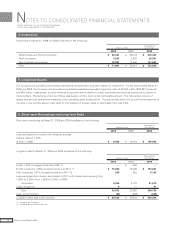

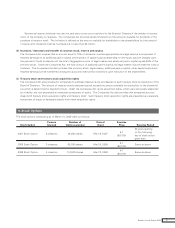

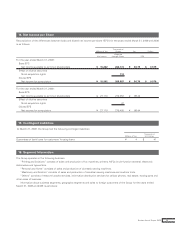

8. Equity

Since May 1, 2006, Japanese companies have been subject to the Companies Act of Japan (the “Companies Act”). The significant

provisions in the Companies Act that affect financial and accounting matters are summarized below:

(a) Dividends

Under the Companies Act, companies can pay dividends at any time during the fiscal year in addition to the year-end dividend upon

resolution at the shareholders meeting. For companies meet certain criteria such as; (1) having the Board of Directors, (2) having

independent auditors, (3) having the Board of Corporate Auditors, and (4) the term of service of the directors is prescribed as one

year rather than two years of normal term by its articles of incorporation. The Board of Directors may declare dividends (except for

dividends in kind) at any time during the fiscal year if the company has prescribed so in its articles of incorporation. The Company

meets all the above criteria.

The Companies Act permits companies to distribute dividends-in-kind (non-cash assets) to shareholders subject to a certain

limitation and additional requirements.

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2009 and 2008

30 Brother Annual Report 2009