Brother International 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

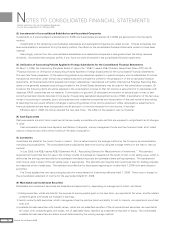

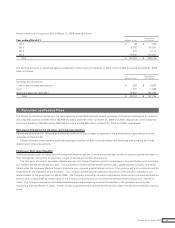

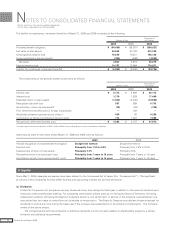

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Unification of Accounting Policies Applied to Foreign Associated Companies for the Equity Method

The current accounting standard requires to unify accounting policies within the consolidation group. However, the current guidance

allows to apply the equity method for the financial statements of its foreign associated company which have been prepared in accor-

dance with generally accepted accounting principles in their respective jurisdictions without unification of accounting policies.

On December 26, 2008, the ASBJ issued ASBJ Statement No.16 (Revised 2008), “Revised Accounting Standard for Equity Method

of Accounting for Investments.” The new standard requires adjustments to be made to conform the associate’s accounting policies for

similar transactions and events under similar circumstances to those of the parent company when the associate’s financial statements

are used in applying the equity method unless it is impractible to determine adjustments. In addition, financial statements prepared

by foreign associated companies in accordance with either International Financial Reporting Standards or the generally accepted

accounting principles in the United States tentatively may be used in applying the equity method if the following items are adjusted so

that net income is accounted for in accordance with Japanese GAAP unless they are not material: 1) amortization of goodwill; 2)

scheduled amortization of actuarial gain or loss of pensions that has been directly recorded in the equity; 3) expensing capitalized

development costs of R&D; 4) cancellation of the fair value model accounting for property, plant, and equipment and investment prop-

erties and incorporation of the cost model accounting; 5) recording the prior years’ effects of changes in accounting policies in the

income statement where retrospective adjustments to the financial statements have been incorporated; and 6) exclusion of minority

interests from net income, if contained.

This standard is applicable to equity method of accounting for investments effective on or after April 1, 2010 with early adoption

permitted for fiscal years beginning on or after April 1, 2009.

Asset Retirement Obligations

On March 31, 2008, the ASBJ published a new accounting standard for asset retirement obligations, ASBJ Statement No.18 “Account-

ing Standard for Asset Retirement Obligations” and ASBJ Guidance No.21 “Guidance on Accounting Standard for Asset Retirement

Obligations.” Under this accounting standard, an asset retirement obligation is defined as a legal obligation imposed either by law or

contract that results from the acquisition, construction, development and the normal operation of a tangible fixed asset and is associ-

ated with the retirement of such tangible fixed asset.

The asset retirement obligation is recognized as the sum of the discounted cash flows required for the future asset retirement and

is recorded in the period in which the obligation is incurred if a reasonable estimate can be made. If a reasonable estimate of the asset

retirement obligation cannot be made in the period the asset retirement obligation is incurred, the liability should be recognized when

a reasonable estimate of asset retirement obligation can be made. Upon initial recognition of a liability for an asset retirement obliga-

tion, an asset retirement cost is capitalized by increasing the carrying amount of the related fixed asset by the amount of the liability.

The asset retirement cost is subsequently allocated to expense through depreciation over the remaining useful life of the asset. Over

time, the liability is accreted to its present value each period. Any subsequent revisions to the timing or the amount of the original

estimate of undiscounted cash flows are reflected as an increase or a decrease in the carrying amount of the liability and the capital-

ized amount of the related asset retirement cost. This standard is effective for fiscal years beginning on or after April 1, 2010, with

early adoption permitted for fiscal years beginning on or before March 31, 2010.

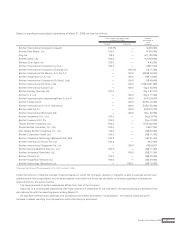

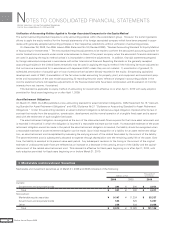

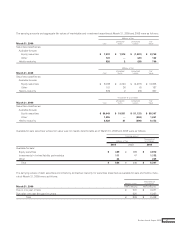

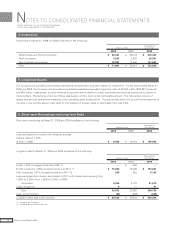

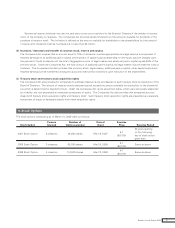

3. Marketable and Investment Securities

Marketable and investment securities as of March 31, 2009 and 2008 consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2009 2008 2009

Current:

Government and corporate bonds ¥ 301 ¥ 300 $ 3,071

Total ¥ 301 ¥ 300 $ 3,071

Non-current:

Marketable equity securities ¥ 9,147 ¥ 11,324 $ 93,337

Government and corporate bonds 525 525 5,357

Other 238 234 2,428

Total ¥ 9,910 ¥ 12,083 $ 101,122

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2009 and 2008

26 Brother Annual Report 2009