Brother International 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For other than temporary declines in fair value, marketable and investment securities are reduced to net realizable value by a charge to

income.

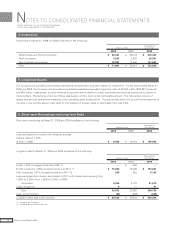

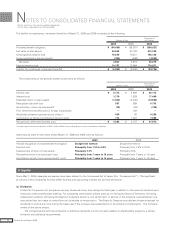

(7) Property, Plant and Equipment

Property, plant and equipment are stated at cost. Depreciation is computed by the declining-balance method.

Effective April 1, 2008, the Company and several domestic consolidated subsidiaries shortened the useful lives of certain machin-

ery after reviewing the expected useful lives following a change in statutory useful life of machinery under the revised corporate tax

law of 2008.

The effect of this treatment was to decrease income before income taxes and minority interests for the year ended March 31,

2009 by ¥426 million ($4,347 thousand).

The range of useful lives was principally from 3 to 50 years for buildings and structures, from 4 to 12 years for machinery and

vehicles and from 2 to 20 years for furniture and fixtures in the year ended March 31, 2009.

Depreciation of leased assets under finance leases is computed by the straight-line method over the lease period.

(8) Long-lived Assets

The Company and its domestic subsidiaries review their long-lived assets for impairment whenever events or changes in circumstance

indicate the carrying amount of an asset or asset group may not be recoverable. An impairment loss would be recognized if the carry-

ing amount of an asset or asset group exceeds the sum of the undiscounted future cash flows expected to result from the continued

use and eventual disposition of the asset or asset group. The impairment loss would be measured as the amount by which the carry-

ing amount of the asset exceeds its recoverable amount, which is the higher of the discounted cash flows from the continued use and

eventual disposition of the asset or the net selling price at disposition.

(9) Bond Issuance Cost

Bond issuance costs are charged to income as incurred.

(10) Research and Development Costs

Research and development costs are charged to income as incurred.

(11) Other Investments and Assets

Intangible assets and goodwill are carried at cost less accumulated amortization, which is calculated by the straight-line method.

Goodwill is amortized over its recoverable period, unless deemed immaterial and charged to income.

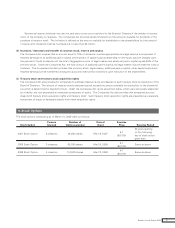

(12) Leases

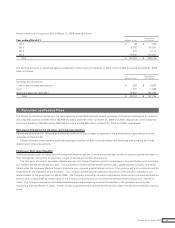

On March 30, 2007, the ASBJ issued ASBJ Statement No.13, “Accounting Standard for Lease Transactions,” which revised the previous

accounting standard for lease transactions issued on June 17, 1993.

(Lessee)

Under the previous accounting standard, finance leases that deem to transfer ownership of the leased property to the lessee were to

be capitalized, however, other finance leases were permitted to be accounted for as operating lease transactions if certain “as if

capitalized” information is disclosed in the note to the lessee’s financial statements. The revised accounting standard requires that all

finance lease transactions should be capitalized.

(Lessor)

Under the previous accounting standard, finance leases that deem to transfer ownership of the leased property to the lessee were to

be treated as sales. However, other finance leases were permitted to be accounted for as operating lease transactions if certain “as if

sold” information is disclosed in the note to the lessor’s financial statements. The revised accounting standard requires that all

finance leases that deem to transfer ownership of the leased property to the lessee should be recognized as lease receivables, and all

finance leases that deem not to transfer ownership of the leased property to the lessee should be recognized as investments in lease.

In addition, the accounting standard permits leases which existed at the transition date and do not transfer ownership of the

leased property to the lessee to be accounted for as operating lease transactions.

Effective April 1, 2008, the Group adopted the revised accounting standard for lease transactions. In addition, the Group

accounted for leases which existed at the transition date and do not transfer ownership of the leased property to the lessee as operat-

ing lease transactions. The effect of the adoption was not material.

23Brother Annual Report 2009