Brother International 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

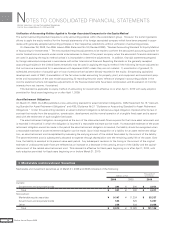

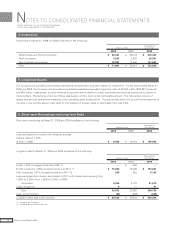

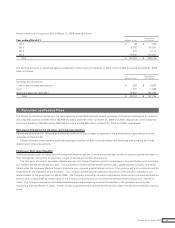

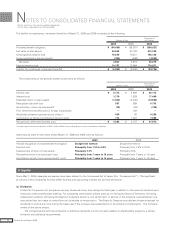

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(13) Warranty Reserve

The Group provided a warranty reserve for repair service to cover all repair expenses based on the past warranty experience.

Warranty reserve included in accrued expenses was ¥4,848 million ($49,469 thousand) and ¥7,229 million at March 31, 2009 and

2008, respectively.

(14) Income Taxes

The provision for current income taxes is computed based on the pretax income included in the consolidated statements of income.

The asset and liability approach is used to recognize deferred tax assets and liabilities for the expected future tax consequences of

temporary differences between the carrying amounts and the tax bases of assets and liabilities. Deferred taxes are measured by

applying currently enacted tax laws to the temporary differences.

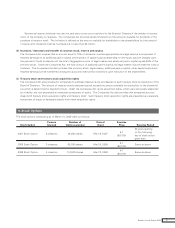

(15) Bonuses to Directors and Corporate Auditors

Bonuses to directors and corporate auditors are accrued at the year end to which such bonuses are attributable.

(16) Liability for Retirement Benefits

(i) Employees’ Retirement Benefits — The Company has a contributory funded pension plan and a defined contribution pension plan

covering substantially all of its employees. Certain consolidated subsidiaries have non-contributory funded pension plans or

unfunded retirement benefit plans. Also, certain foreign subsidiaries have defined benefit pension plans and defined contribution

pension plans.

The Company and certain consolidated subsidiaries account for the liability for retirement benefits based on projected benefit

obligations and plan assets at the balance sheet date. Certain small subsidiaries apply the simplified method to state the liability at

the amount which would be paid if employees retired, less plan assets at the balance sheet date.

(ii) Retirement Benefits for Directors and Corporate Auditors — Certain domestic consolidated subsidiaries provided retirement

allowances for directors and corporate auditors. Retirement allowances for directors and corporate auditors were recorded to state

the liability which would be paid at the amount if they retired at each balance sheet date. The retirement benefits for directors and

corporate auditors are paid upon the approval of the shareholders.

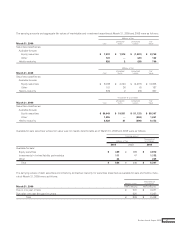

(17) Business Combination

In October 2003, the Business Accounting Council (“BAC”) issued a Statement of Opinion, “Accounting for Business Combinations,”

and on December 27, 2005, the Accounting Standards Board of Japan (“ASBJ”) issued ASBJ Statement No.7, “Accounting Standard for

Business Divestitures,” and ASBJ Guidance No.10, “Guidance for Accounting Standard for Business Combinations and Business

Divestitures.” The Group adopted the new accounting pronouncements effective April 1, 2006.

The accounting standard for business combinations allows companies to apply the pooling of interests method of accounting only

when certain specific criteria are met such that the business combination is essentially regarded as a uniting-of-interests.

For business combinations that do not meet the uniting-of-interests criteria, the business combination is considered to be an

acquisition and the purchase method of accounting is required. This standard also prescribes the accounting for combinations for

entities under common control and for joint ventures.

(18) Stock Options

The ASBJ Statement No.8, “Accounting Standard for Stock Options” and related guidance are applicable to stock options granted on

and after May 1, 2006. This standard requires companies to recognize compensation expense for employee stock options based on

the fair value at the date of grant and over the vesting period as consideration for receiving goods or services. The standard also

requires companies to account for stock options granted to non-employees based on the fair value of either the stock option or the

goods or services received. In the consolidated balance sheet, stock options are presented as stock acquisition rights as a separate

component of equity until exercised. The standard covers equity-settled, share-based payment transactions, but does not cover cash-

settled, share-based payment transactions. In addition, the standard allows unlisted companies to measure options at their intrinsic

value if they cannot reliably estimate fair value.

The Company applied this accounting standard for stock options to those granted on and after May 1, 2006.

(19) Foreign Currency Transactions

All short-term and long-term monetary receivables and payables denominated in foreign currencies are translated into Japanese yen

at the exchange rates at the balance sheet date. The foreign exchange gains and losses from translation are recognized in the

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2009 and 2008

24 Brother Annual Report 2009