Brother International 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

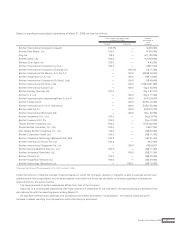

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

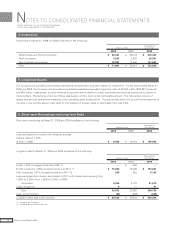

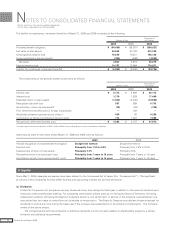

(2) Investments in Unconsolidated Subsidiaries and Associated Companies

Investments in 2 unconsolidated subsidiaries (2 in 2008) and 6 associated companies (6 in 2008) are accounted for by the equity

method.

Investments in the remaining unconsolidated subsidiaries and associated companies are stated at cost. If these companies had

been consolidated or accounted for by the equity method, the effect on the consolidated financial statements would not have been

material.

Accordingly, income from the unconsolidated subsidiaries and associated companies is recognized when the Group receives

dividends. Unrealized inter-company profits, if any, have not been eliminated in the consolidated financial statements.

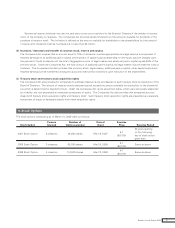

(3) Unification of Accounting Policies Applied to Foreign Subsidiaries for the Consolidated Financial Statements

On May 17, 2006, the Accounting Standards Board of Japan (the “ASBJ”) issued ASBJ Practical Issues Task Force (PITF) No.18,

“Practical Solution on Unification of Accounting Policies Applied to Foreign Subsidiaries for the Consolidated Financial Statements.”

The new task force prescribes: (1) the accounting policies and procedures applied to a parent company and its subsidiaries for similar

transactions and events under similar circumstances should in principle be unified for the preparation of the consolidated financial

statements, (2) financial statements prepared by foreign subsidiaries in accordance with either International Financial Reporting Stan-

dards or the generally accepted accounting principles in the United States tentatively may be used for the consolidation process, (3)

however, the following items should be adjusted in the consolidation process so that net income is accounted for in accordance with

Japanese GAAP unless they are not material: 1) amortization of goodwill; 2) scheduled amortization of actuarial gain or loss of pen-

sions that has been directly recorded in the equity; 3) expensing capitalized development costs of R&D; 4) cancellation of the fair value

model of accounting for property, plant, and equipment and investment properties and incorporation of the cost model of accounting;

5) recording the prior years’ effects of changes in accounting policies in the income statement where retrospective adjustments to

financial statements have been incorporated; and 6) exclusion of minority interests from net income, if included.

Effective April 1, 2008, the Group adopted the new task force. The effect of the adoption was not material.

(4) Cash Equivalents

Cash equivalents are short-term investments that are readily convertible into cash and that are exposed to insignificant risk of changes

in value.

Cash equivalents include time deposits, certificates of deposits, money management funds and free financial funds, all of which

mature or become due within three months of the date of acquisition.

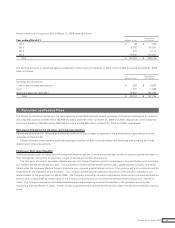

(5) Inventories

Inventories are stated at the lower of cost or market. Cost is determined by the average method by the Company and consolidated

manufacturing subsidiaries. The consolidated sales subsidiaries determine cost by using the average method or the first-in, first-out

method.

In July 2006, the ASBJ issued ASBJ Statement No.9, “Accounting Standard for Measurement of Inventories.” This standard

requires that inventories held for sale in the ordinary course of business be measured at the lower of cost or net selling value, which is

defined as the selling price less additional estimated manufacturing costs and estimated direct selling expenses. The replacement

cost may be used in place of the net selling value, if appropriate. The standard also requires that inventories held for trading purposes

be measured at the market price. The standard was effective for fiscal years beginning on or after April 1, 2008 with early adoption

permitted.

The Group applied this new accounting standard for measurement of inventories effective April 1, 2008. There was no impact on

the consolidated statement of income for the year ended March 31, 2009.

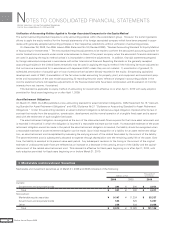

(6) Marketable and Investment Securities

Marketable and investment securities are classified and accounted for, depending on management’s intent, as follows:

i ) trading securities, which are held for the purpose of earning capital gains in the near term, are reported at fair value, and the related

unrealized gains and losses are included in earnings,

ii ) held-to-maturity debt securities, which management has the positive intent and ability to hold to maturity, are reported at amortized

cost, and

iii) available-for-sale securities with market values, which are not classified as either of the aforementioned securities, are reported at

fair value, with unrealized gains and losses, net of applicable taxes, reported as a separate component of equity. Non-marketable

available-for-sale securities are stated at cost determined by the moving average method.

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2009 and 2008

22 Brother Annual Report 2009