Brother International 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

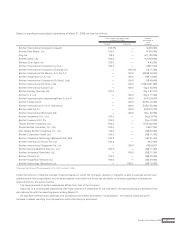

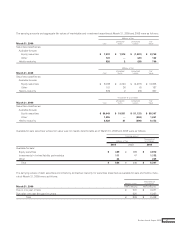

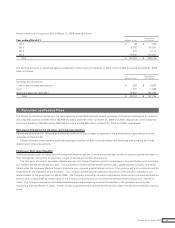

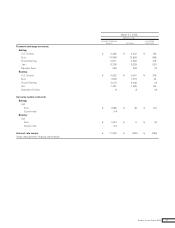

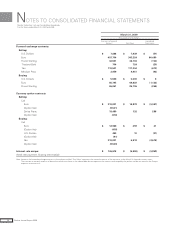

Annual maturities of long-term debt at March 31, 2009 were as follows:

Year ending March 31 Millions of Yen

Thousands of

U.S. Dollars

2010 ¥ 49$ 500

2011 5,003 51,051

2012 501 5,112

2013 15,000 153,061

Total ¥ 20,553 $ 209,724

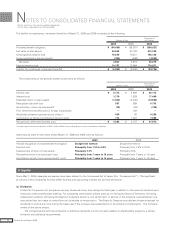

The carrying amounts of assets pledged as collateral for other long-term liabilities of ¥261 million (2,663 thousand) at March 31, 2009

were as follows:

Millions of Yen

Thousands of

U.S. Dollars

Buildings and structures,

net of accumulated depreciation ¥ 258 $ 2,633

Land 123 1,255

Notes and accounts receivable 18,953 193,398

Total ¥ 19,334 $ 197,286

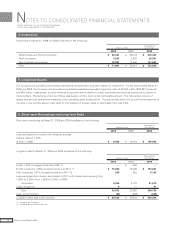

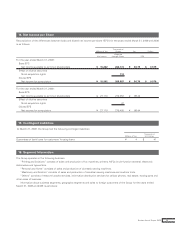

7. Retirement and Pension Plans

The liability for retirement benefits in the accompanying consolidated balance sheets consisted of retirement allowances for directors

and corporate auditors of ¥285 million ($2,908 thousand) and ¥192 million at March 31, 2009 and 2008, respectively, and employees’

retirement benefits of ¥5,860 million ($59,796 thousand) and ¥6,546 million at March 31, 2009 and 2008, respectively.

Retirement Allowances for Directors and Corporate Auditors

Retirement allowances for directors and corporate auditors are paid subject to approval of the shareholders in accordance with the

Japanese Companies Act.

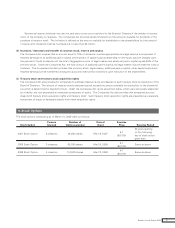

Certain domestic consolidated subsidiaries recorded a liability for their unfunded retirement allowance plan covering all of their

directors and corporate auditors.

Employees’ Retirement Benefits

Under the pension plan, employees terminating their employment are, in most circumstances, entitled to pension payments based on

their average pay during their employment, length of service and certain other factors.

The Company and certain domestic subsidiaries have two types of pension plans for employees: a non-contributory and a contribu-

tory funded defined benefit pension plan. The contributory funded defined benefit pension plan, applied by the Company and estab-

lished under the Japanese Welfare Pension Insurance Law, covered a substitutional portion of the government and a corporate portion

established at the discretion of the Company. The Company transferred the substitutional portion of the pension obligations and

related assets to the government in March 2006. The Company and certain domestic subsidiaries implemented a defined contribution

pension plan in fiscal 2005 by which a part of the former contributory and non-contributory defined benefit pension plan was termi-

nated. The Company and certain domestic subsidiaries applied accounting treatments specified in the guidance issued by the

Accounting Standard Board of Japan. Certain foreign subsidiaries have defined benefit pension plans and defined contribution pension

plans.

29Brother Annual Report 2009