Brother International 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

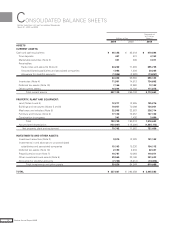

Liquidity Management

The Group’s liquidity in hand consists of cash and cash equivalents and the unused portion of open

commitment lines of credit. As of March 31, 2009, cash and cash equivalents totaled ¥46,128 million.

In addition, the Group maintains commitment lines of credit with several financial institutions. The

unused portion of the Group’s total ¥30,000 million in open lines of credit was ¥28,886 million. This

total plus cash and cash equivalents was ¥75,014 million at fiscal year-end. Taking into consideration

changes in seasonal funding requirements, debt payable within one year and business risks, the

Group believes it has sufficient liquidity to support operations for one year.

Fund Procurement

As a rule, working capital and other short-term funding is debt payable within one year that is funded

with local currency. The basic policy for long-term funding for manufacturing facilities is that funds

should come from internal reserves from long-term debt and corporate bonds.

As of March 31, 2009, short-term borrowings was ¥9,858 million, primarily denominated in yen.

Long-term debt (including long-term debt payable within one year) totaled ¥5,044 million, with

fixed-rate debt denominated in yen. Corporate bonds totaled ¥15,500 million.

As of March 31, 2009, Rating and Investment Information, Inc., assigned the Group’s long-term

bonds and issuer credit “A” ratings and its commercial paper an “a-1” rating. We consider consis-

tent ratings important in maintaining access to credit and capital markets.

The Brother Group believes that it has sufficient cash for working capital, capital investment and

R&D investment to maintain growth through cash flows from operating activities; liquidity on hand,

including open lines of credit; and a sound corporate financial structure.

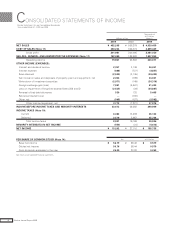

Cash Flows

In the period under review, net cash provided by operating activities was ¥20,520 million. Net

cash used in investing activities was ¥26,218 million. Net cash used in financing activities was

¥19,522 million. As a result, cash and cash equivalents as of March 31, 2009, amounted to

¥46,128 million, down ¥37,091 million from one year earlier.

Below were the major factors that contributed to cash flows during the period under review:

Cash flows from operating activities

Among cash inflows, income before income taxes and minority interests provided ¥23,613 million,

and depreciation and amortization provided ¥23,094 million. In addition to adjustments for non-

financial gains and losses, an increase in inventories provided ¥8,717 million. A decrease in trade

notes and accounts payable used ¥5,143 million, and income taxes paid used ¥10,126 million.

As a result, net cash provided by operating activities was ¥20,520 million.

Cash flows from investing activities

Major uses of cash included the disbursement for purchases of property, plant and equipment of

¥20,835 million, ¥7,122 million in disbursement for purchases of intangible assets, ¥2,818 million in

disbursement for purchases of investment securities and a disbursement for purchase of business of

¥1,202 million. Sources of cash included proceeds from sales of property, plant and equipment of

¥5,632 million. The result was ¥26,218 million in net cash used in investing activities.

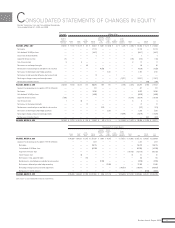

Cash flows from financing activities

The acquisition of treasury stock required ¥10,011 million in cash. Cash dividends paid including

minority interest portion used ¥6,801 million, and the net decrease in short-term borrowings used

¥2,272 million. Owing to these factors, net cash used in financing activities was ¥19,522 million.

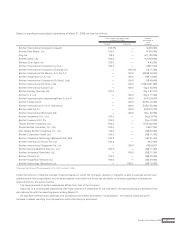

Cash and Cash Equivalents,

End of Year

(¥ billion)

70.4

83.2

46.1

Fiscal years ended March 31

0

20

40

60

80

100

200920082007

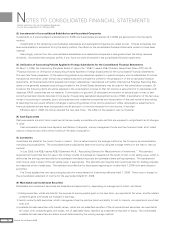

Cash Flows from Operating Activities

Cash Flows from Investing Activities

Cash Flows from Financing Activities

-35.9

-29.3 -26.2

-6.7 -7.0

-19.5

Fiscal years ended March 31

200920082007

Cash Flows

(¥ billion)

-40

-15

10

35

60

47.8

58.2

20.5

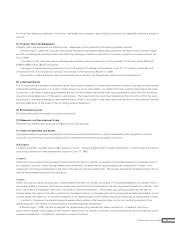

Interest-bearing Debt

(¥ billion)

33.6

35.3

30.4

Fiscal years ended March 31

200920082007

0

10

20

30

40

13Brother Annual Report 2009