Abercrombie & Fitch 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

6

CHAIRMAN’S LETTER

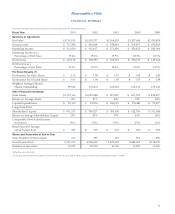

Although fiscal 2003 was a huge challenge for our organization, we once again achieved record

sales and profit for the year. This past fourth quarter marked our 46th consecutive quarter of

profit improvement.

Financial highlights during fiscal 2003 include sales of $1.708 billion, net income of $205

million and an operating margin of 19.4%. In addition, we repurchased a total of 4.4 million

shares at a total cost of $115 million. Even with this large buyback expenditure, the opening of

107 new stores and a home office expansion, we continued to increase our cash balance, reaching

over $500 million at year-end. Based on this level of financial strength, the Board of Directors

approved the initiation of a $0.50 per share annual cash dividend. The Board of Directors and

management of Abercrombie & Fitch are committed to increasing shareholder value, and the

dividend confirms this focus while still enabling our company to pursue all of our planned

growth initiatives.

I am proud to say we achieved these results without compromising the integrity of our

brands. Enhancing our brands and increasing the bottom line have always been our primary

focus and to exceed $200 million in net income for the year despite a tough sales trend reflects

the strength of our business.

While we are pleased with our financial results, driving volume is our single biggest focus

in fiscal 2004. We must however, achieve this goal in a manner that is consistent with the proper

positioning of our brands. Our objective is to be the dominant aspirational brand for each of

our targeted age groups and our focus must be on separating ourselves from the competition in

terms of fashion and quality. In order to better differentiate our brands from the competition

we have strengthened our design and merchandising groups. By adding depth to these areas of

the business, I believe that we are better positioned to identify and interpret emerging fashion

trends for each of our brands.

We also adjusted our marketing strategy during fiscal 2003. Going forward, we will reinforce