Abercrombie & Fitch 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

concepts are operating at very similar margins, both in IMU and

merchandise margin.

The increase in buying and occupancy costs, as a percent of net

sales, reflected the inability to leverage fixed costs, such as rent,

depreciation and other real estate related charges, with a comp

store decrease.

The markdown rate, as a percentage of net sales, exceeded last year

for the quarter due to the weaker than expected pre-Christmas busi-

ness resulting in aggressive markdowns in the back half of January.

The Company conservatively managed its inventory and despite

negative comps ended the fourth quarter of the 2003 fiscal year with

inventories, at cost, up 3% per gross square foot versus the fourth

quarter of the 2002 fiscal year.

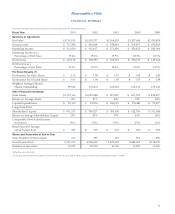

FISCAL 2003 For the 2003 fiscal year, gross income increased to

$717.4 million from $656.0 million in the 2002 fiscal year. The

gross income rate in the 2003 fiscal year was 42.0% versus 41.1% in

the 2002 fiscal year. The increase was driven by improvements in

IMU that were partially offset by increased buying and occupancy

costs as a percentage of net sales.

Buying and occupancy costs increased over last year, as a per-

centage of net sales, due to the inability to leverage fixed expenses

with lower sales volume per average store.

FOURTH QUARTER 2002 Gross income for the fourth quarter of

the 2002 fiscal year was $243.0 million compared to $208.5 million

in the same period in the 2001 fiscal year. The gross income rate

for the fourth quarter of the 2002 fiscal year was 45.5%, up 80

basis points from the 2001 fiscal year rate of 44.7%. The increase

in the gross income rate resulted largely from an increase in IMU,

partially offset by an increase in buying and occupancy costs, as a

percent of net sales.

Continued progress in sourcing was an important factor in

improving IMU in all three concepts. The Company continued to

make progress increasing IMU in Hollister, where IMU improved

over 700 basis points in the fourth quarter of the 2002 fiscal year ver-

sus the fourth quarter of the 2001 fiscal year. Additionally, the

Company’s less aggressive approach to promotions during the fourth

quarter of the 2002 fiscal year resulted in selling at higher average

retail prices compared to the fourth quarter of the 2001 fiscal year.

The increase in buying and occupancy costs, as a percent of

net sales, reflected the inability to leverage fixed costs, such as

rent, depreciation and other real estate related charges, with a

comp store decrease.

The Company ended the fourth quarter of the 2002 fiscal

year with inventories, at cost, up 12% per gross square foot versus the

fourth quarter of the 2001 fiscal year.

FISCAL 2002 Gross income for the 2002 fiscal year was $656.0 mil-

lion compared to $558.0 million in the 2001 fiscal year. The gross

income rate was 41.1% in the 2002 fiscal year versus 40.9% in the

2001 fiscal year. The increase was driven by improvements in IMU

that were almost fully offset by increased buying and occupancy

costs, as a percentage of net sales.

Gross income was also protected as a result of strong inventory

management through most of the first half of the 2002 fiscal year.

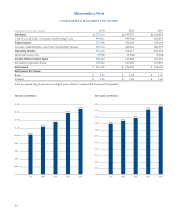

GENERAL, ADMINIST RATIVE AND STORE OPERATING

EXPENSES: FOURTH QUARTER 2003 General, administrative

and store operating expenses during fourth quarter of the 2003

fiscal year were $106.7 million compared to $93.4 million during

the same period in the 2002 fiscal year. The fourth quarter of the

2003 fiscal year general, administrative and store operating

expense rate (general, administrative and store operating expens-

es divided by net sales) was 19.0% compared to 17.5% in the

fourth quarter of the 2002 fiscal year. The increase in rate versus

the 2002 fiscal year reflects a loss of leverage due to the double-

digit drop in comps partially offset by lower bonuses and efficien-

cies in store operations, distribution center operations and the

direct to consumer business.

During the fourth quarter of the 2003 fiscal year, store pay-

roll hours were reduced by 2% per average Abercrombie & Fitch

adult store and wages, in all three concepts, were held relatively

flat. Store hours are managed on a weekly basis in order to match

hours with sales volume. Overall, store expenses grew at approx-

imately the same rate as the Company’s square footage growth

during the fourth quarter.

The distribution center achieved record level productivity during

the fourth quarter of the 2003 fiscal year. Productivity, as measured

in units processed per labor hour, was 18% higher than the fourth

quarter of the 2002 fiscal year. This increase was on top of a 39%

increase last year and a 50% increase two years ago.

Costs related to the distribution center, excluding direct ship-

ping costs related to the e-commerce and catalogue sales, included in

general, administrative and store operating expenses were $5.5 mil-

lion for the fourth quarter of the 2003 fiscal year compared to $4.9

million for the fourth quarter of the 2002 fiscal year.

FISCAL 2003 Full year general, administrative and store operating

expenses were $385.8 million in the 2003 fiscal year versus $343.4 mil-

Abercrombie &Fitch

15