Abercrombie & Fitch 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

shares vest over four years. Options covering the remaining 20,000

shares vest on the first anniversary of the grant date. All options

have a maximum term of ten years.

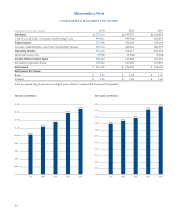

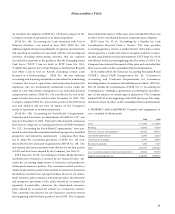

Options Outstanding Options Exercisable

at January 31, 2004 at January 31, 2004

Wei ghted–

Average Weighted– Weighted–

Range of Remaining Average Average

Exercise Number Contractual Exercise Number Exercisable

Prices Outstanding Life Price Exercisable Price

$8-$23 2,691,000 4.3 $13.50 1,618,000 $13.86

$23-$38 7,039,000 6.9 $26.50 3,094,000 $26.17

$38-$51 5,131,000 5.4 $43.54 1,479,000 $43.25

$8-$51 14,861,000 5.9 $30.03 6,191,000 $27.04

A summary of option activity for 2003, 2002 and 2001 follows:

Number of Weighted–Average

2003 Shares Option Price

Outstanding at beginning of year 16,059,000 $28.31

Granted 636,000 27.89

Exercised (1,586,000) 12.39

Canceled (248,000) 27.04

Outstanding at end of year 14,861,000 $30.03

Options exercisable at year-end 6,191,000 $27.04

2002

Outstanding at beginning of year 12,961,000 $28.65

Granted 3,583,000 26.53

Exercised (93,000) 16.44

Canceled (392,000) 26.31

Outstanding at end of year 16,059,000 $28.31

Options exercisable at year-end 4,556,000 $19.10

2001

Outstanding at beginning of year 12,994,000 $28.01

Granted 648,000 29.38

Exercised (521,000) 15.00

Canceled (160,000) 24.09

Outstanding at end of year 12,961,000 $28.65

Options exercisable at year-end 3,065,000 $18.49

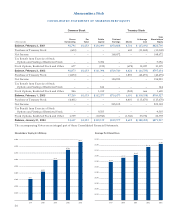

A total of 78,000, 1,046,000 and 19,000 restricted shares were grant-

ed in 2003, 2002 and 2001, respectively, with a total market value at

grant date of $2.1 million, $28.0 million and $.6 million, respectively.

Of the restricted shares granted in 2002, 1,000,000 shares were

awarded to the Company’s Chairman, which become vested on

December 31, 2008 provided the Chairman remains continuously

employed by the Company through such date. The remaining

restricted share grants generally vest either on a graduated scale over

four years or 100% at the end of a fixed vesting period, principally

five years. The market value of restricted shares is being amortized

as compensation expense over the vesting period, generally four

to five years. Compensation expenses related to restricted share

awards amounted to $5.3 million, $2.3 million and $3.9 million in

2003, 2002 and 2001, respectively.

11. RETIREMENT BENEF IT S The Company maintains a qualified

defined contribution retirement plan and a nonqualified supple-

mental retirement plan. Participation in the qualified plan is available

to all associates who have completed 1,000 or more hours of service

with the Company during certain 12-month periods and attained

the age of 21. Participation in the nonqualified plan is subject to

service and compensation requirements. The Company’s contribu-

tions to these plans are based on a percentage of associates’ eligible

annual compensation. The cost of these plans was $6.4 million in

2003, $5.6 million in 2002 and $3.9 million in 2001.

Effective February 2, 2003, the Company established a

Supplemental Executive Retirement Plan (the “SERP”) to pro-

vide additional retirement income to its Chairman. Subject to

service requirements, the Chairman will receive a monthly prorat-

ed share of his final average compensation (as defined in the

SERP) for life. The SERP has been actuarially valued by an inde-

pendent third party and the expense associated with the SERP is

being accrued over the stated term of the Amended and Restated

Employment Agreement, dated as of January 30, 2003, between

the Company and its Chairman.

12. CONTINGENCIES The Company is involved in a number of

legal proceedings that arise out of, and are incidental to, the conduct

of its business.

In 2003, five actions were filed under various states’ laws on behalf

of purported classes of employees and former employees of the

Company alleging that the Company required its associates to wear

and pay for a “uniform” in violation of applicable law. Two of the

actions have been ordered coordinated. In each case, the plaintiff,

on behalf of his or her purported class, seeks injunctive relief and

unspecified amounts of economic and liquidated damages. For cer-

tain of the cases, the parties are in the process of discovery. In other

cases, answers have been filed. In one case, the Company has filed

a motion to dismiss and that motion is pending.

In 2003, an action was filed in which the plaintiff alleges that the

“uniform,” when purchased, drove associates’ wages below the fed-

32