Abercrombie & Fitch 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

quarter in the 2001 fiscal year. The increase in the operating

income rate was due to a higher gross income rate partially offset

by a higher general, administrative and store operating expense rate.

In the 2002 fiscal year, the operating income was $312.6 million

compared to $271.5 million in the 2001 fiscal year. The operating

income rates for same time periods were 19.6% versus 19.9%. The

decline was attributable to a higher general, administrative and store

operating expense rate due to the inability to leverage fixed costs on

a comp store decrease. The increased expense rate was partially off-

set by a gross income rate increase.

INTEREST INCOME AND INCOME TAXES Fourth quarter and

year-to-date net interest income for the 2003 fiscal year were $1.1

million and $3.7 million, respectively, as compared with net interest

income of $1.3 million and $3.8 million, respectively, for the com-

parable periods in the 2002 fiscal year. The decline in the 2003 fiscal

year fourth quarter net interest income was due to lower interest

rates. The Company continued to invest in tax-free securities.

Fourth quarter and year-to-date net interest income were $1.3

million and $3.8 million, respectively, in the 2002 fiscal year as

compared with net interest income of $1.2 million and $5.1 mil-

lion, respectively, for the comparable periods in the 2001 fiscal

year. The decrease in net interest income in the year-to-date peri-

od was a result of the Company’s strategy, at the beginning of the

2002 fiscal year, to invest cash in tax-free securities due to the

decline in short-term market interest rates. The investment in

tax-free securities lowered the Company’s effective tax rate.

Previously, the Company primarily invested in the commercial

paper market.

The effective tax rates for the fourth quarter and year-to-date

periods of the 2003 fiscal year were 39.3% and 38.8%, respectively,

as compared to 38.5% and 38.4%, respectively, for the comparable

periods in the 2002 fiscal year.

FINANCIAL CONDITION Continued growth in net income and

cash on hand has afforded the Company financial strength and

flexibility. A more detailed discussion of liquidity, capital resources

and capital requirements follows.

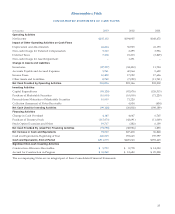

LIQUIDITY AND CAPITAL RESOURCES Cash provided by oper-

ating activities provides the resources to support operations, including

projected growth, seasonal requirements and capital expenditures.

Furthermore, the Company expects that cash from operating activ-

ities will fund the dividend announced in February 2004. The

Board of Directors will review and approve the appropriateness of

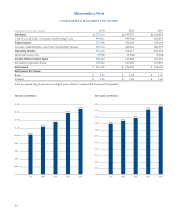

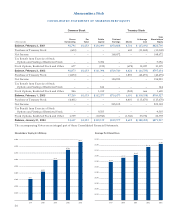

future dividend amounts. A summary of the Company’s working

capital (current assets less current liabilities) position and capitaliza-

tion follows (in thousands):

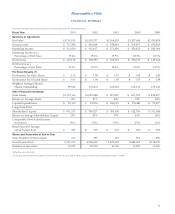

2003 2002 2001

Working capital $472,653 $384,094 $241,616

Capitalization:

Shareholders’ equity $871,257 $749,527 $595,434

The Company considers the following to be measures of

liquidity and capital resources:

2003 2002 2001

Current ratio (current assets divided

by current liabilities) 2.69 2.57 2.48

Net cash provided by

operating activities (in thousands) $281,896 $293,146 $233,202

The decrease in cash provided by operating activities in the 2003

fiscal year from the 2002 fiscal year was primarily driven by an

increase in inventories not offset by commensurate increases in net

income, accounts payable and accrued expenses. Inventories

increased from the net addition of 103 stores representing an increase

of 663,000 gross square feet in 2003. Inventories at fiscal year-end

were 3% higher on a gross square foot basis than at the end of the

2002 fiscal year.

The increase in cash from operating activities from the 2002

fiscal year from the 2001 fiscal year was primarily from increases in

net income, accounts payable and accrued expenses, and income

taxes payable. Accounts payable increased in the 2002 fiscal year

due to both the increased level of inventory and timing of pay-

ments. Accrued expenses increased in the 2002 fiscal year prima-

rily due to higher store expenses, consistent with the increase in store

openings. The increase in income taxes payable was driven by high-

er pre-tax income and timing of payments.

The Company’s operations are seasonal in nature and typically

peak during the back-to-school and Christmas selling periods.

Accordingly, cash requirements for inventory expenditures are

highest during these periods.

Cash outflows during the 2003 fiscal year related to investing

activities were primarily for capital expenditures (see the discussion

in the “Capital Expenditures” section below) related to new stores

(net of construction allowances) with approximately $35 million

invested in the completion of the home office expansion, improve-

ments in the distribution center and information technology expen-

ditures for a new point-of-sale system. This system was completely

rolled-out to all stores during the third quarter of the 2003 fiscal year.

Abercrombie &Fitch

17